- United States

- /

- Banks

- /

- NasdaqGM:FGBI

First Guaranty Bancshares (NASDAQ:FGBI) Is Paying Out Less In Dividends Than Last Year

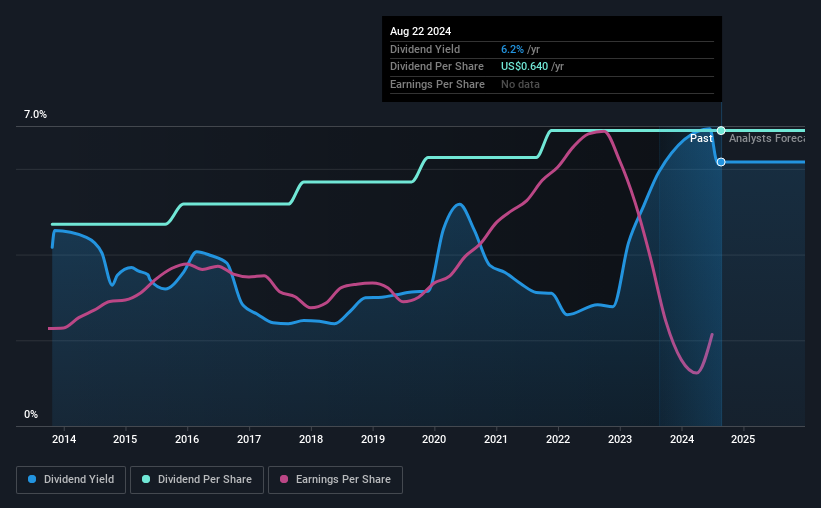

First Guaranty Bancshares, Inc. (NASDAQ:FGBI) is reducing its dividend to $0.08 on the 30th of Septemberwhich is 50% less than last year's comparable payment of $0.16. The dividend yield of 6.2% is still a nice boost to shareholder returns, despite the cut.

Check out our latest analysis for First Guaranty Bancshares

First Guaranty Bancshares' Earnings Will Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much.

First Guaranty Bancshares has a long history of paying out dividends, with its current track record at a minimum of 10 years. Past distributions do not necessarily guarantee future ones, but First Guaranty Bancshares' payout ratio of 75% is a good sign as this means that earnings decently cover dividends.

EPS is set to fall by 7.2% over the next 12 months. However, if the dividend continues along recent trends, we estimate the future payout ratio could reach 77%, meaning that most of the company's earnings are being paid out to shareholders.

First Guaranty Bancshares Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. Since 2014, the dividend has gone from $0.437 total annually to $0.64. This implies that the company grew its distributions at a yearly rate of about 3.9% over that duration. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth Is Doubtful

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though First Guaranty Bancshares' EPS has declined at around 6.7% a year. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments First Guaranty Bancshares has been making. We don't think First Guaranty Bancshares is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, First Guaranty Bancshares has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FGBI

First Guaranty Bancshares

Operates as the holding company for First Guaranty Bank that provides commercial banking services in Louisiana and Texas.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026