- United States

- /

- Banks

- /

- NasdaqGS:FFIN

What the Recent 3.4% Rise Means for First Financial Bankshares Valuation

Reviewed by Bailey Pemberton

- Ever wondered if First Financial Bankshares could be a hidden bargain or if it's priced just right? You are not alone, as investors are always on the lookout for that next undervalued gem.

- In the past week, the stock ticked up 3.4%, but those gains follow a year where shares have fallen by 24.2%, highlighting both volatility and shifting sentiment around its growth prospects.

- This share price movement is happening against a backdrop of regional banks drawing attention for their strategic moves and market resilience. This has added fresh context to recent shifts in sector performance. Notably, the banking industry’s evolving regulatory environment and continued focus on digital transformation have also been in the headlines and are influencing investor outlook.

- Currently, First Financial Bankshares holds a valuation score of 2 out of 6, suggesting a few signals of undervaluation, but leaving room for further scrutiny. We will break down exactly how this score is determined using a variety of valuation methods, and stick around, because there might be a smarter way to assess what the numbers really mean.

First Financial Bankshares scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: First Financial Bankshares Excess Returns Analysis

The Excess Returns valuation method looks at how much profit a company generates above its cost of equity, focusing on return on invested capital and future growth expectations rather than just cash flow. This model offers insight into how effectively First Financial Bankshares puts shareholder money to work compared to other investments.

For First Financial Bankshares, the most recent data shows a Book Value of $12.87 per share and a Stable Earnings Per Share (EPS) of $2.01 per share. These forecasts are grounded in weighted future Return on Equity estimates from five analysts. The company’s Cost of Equity stands at $1.00 per share, and the resulting Excess Return comes in at $1.01 per share. Notably, the average Return on Equity is a strong 14.01%. The projected Stable Book Value increases to $14.38 per share based on weighted input from four analysts.

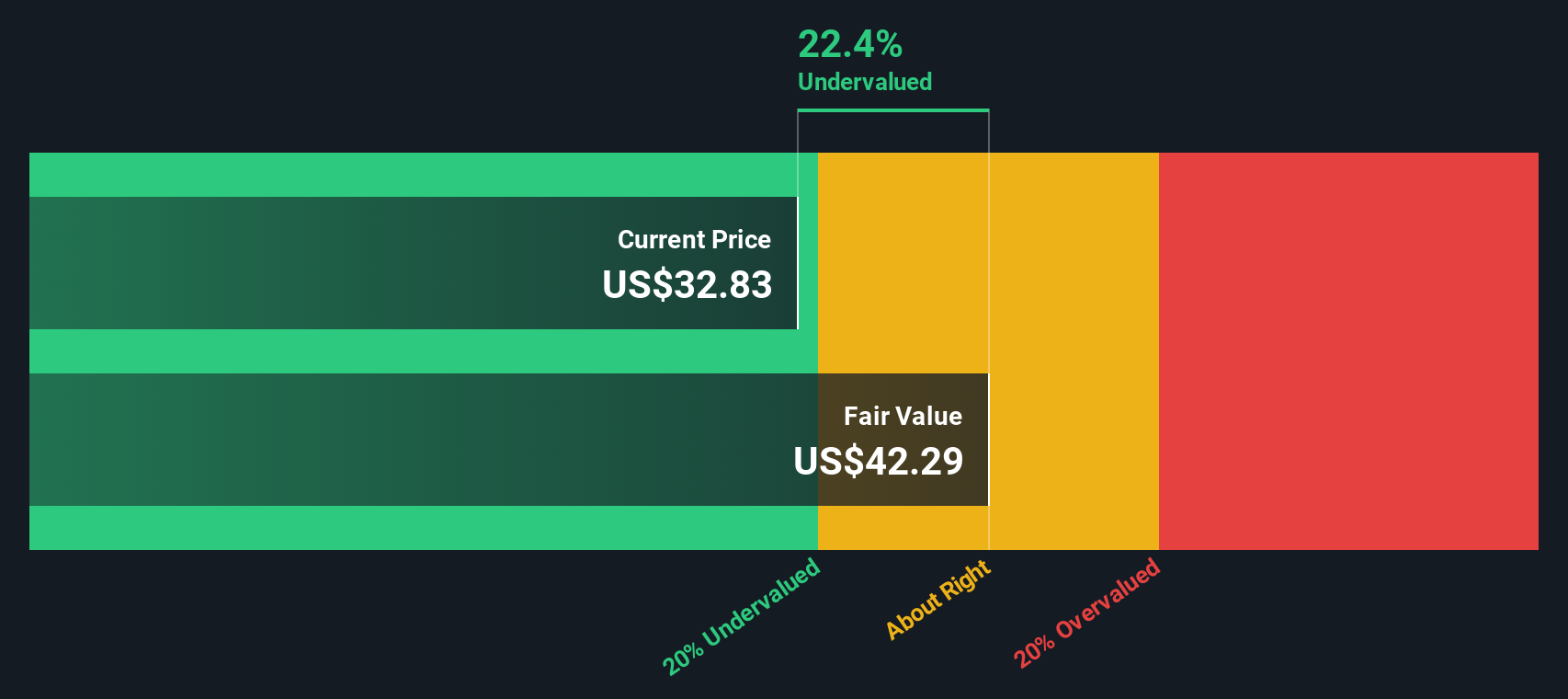

Together, these numbers suggest that First Financial Bankshares is currently generating solid returns relative to its capital base. According to the Excess Returns model, the intrinsic value estimate implies the stock is trading at a 25.3% discount, indicating it may be 25.3% undervalued compared to its fair value if these returns persist.

Result: UNDERVALUED

Our Excess Returns analysis suggests First Financial Bankshares is undervalued by 25.3%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: First Financial Bankshares Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable banking companies because it provides a simple way to relate a company’s share price to its per-share earnings. This makes it especially useful for gauging investor expectations and comparing valuations across companies with steady profit streams.

It is important to remember that growth prospects and company risk play a significant role in determining what is a “normal” or “fair” PE ratio for a given company. Higher expected growth or lower risk typically support a higher PE. In contrast, slower growth or greater uncertainty lead to lower multiples being justified.

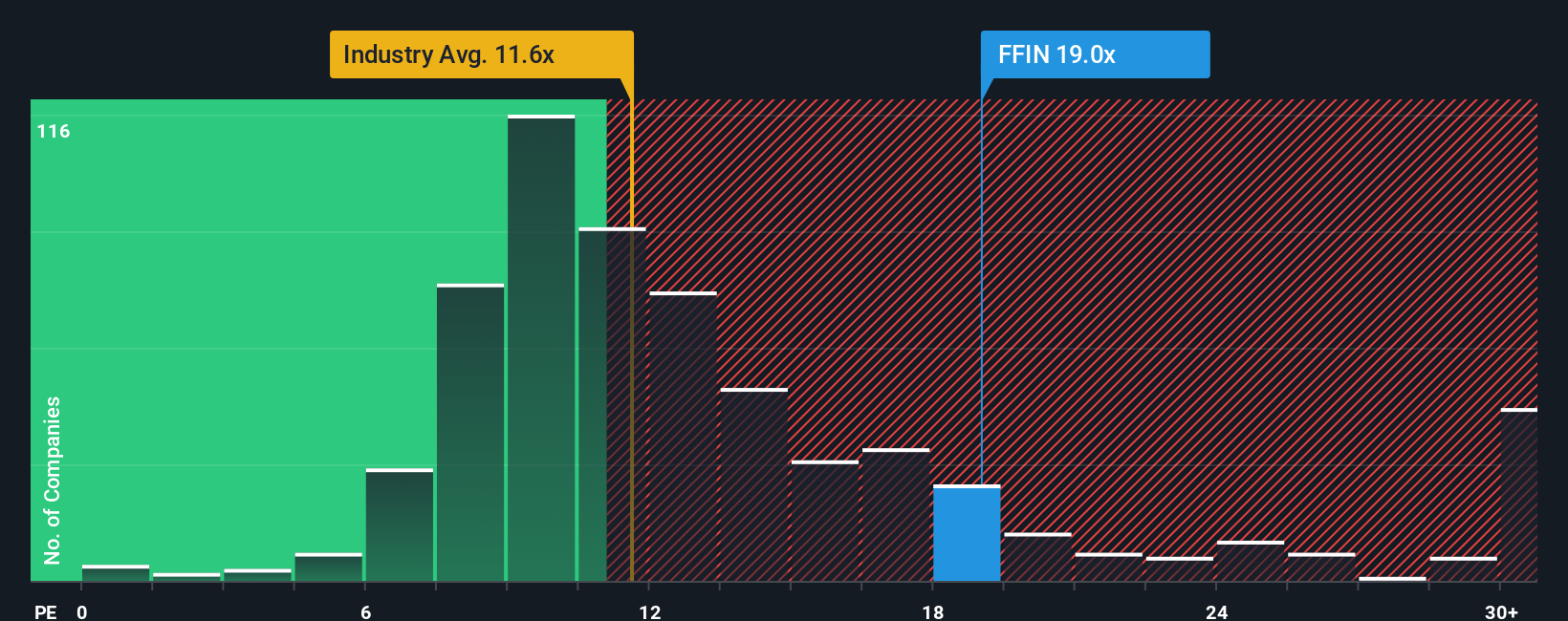

Currently, First Financial Bankshares trades at a PE ratio of 18.3x, which stands well above the average for both its industry (11.4x) and its peer group (12.0x). While such a premium might raise questions, context is key. Simply Wall St’s proprietary “Fair Ratio” is designed to estimate a suitable PE by considering multiple company-specific factors beyond just raw earnings. It accounts for First Financial Bankshares’ growth prospects, its profit margin, the profile of the banking industry, market capitalization, and the specific risks it faces.

The Fair Ratio for First Financial Bankshares is 11.7x. This is significantly lower than the company’s current PE multiple, which suggests that at current prices the stock appears to be overvalued on a PE basis, even when taking its unique qualities into account. Using the Fair Ratio, rather than simply comparing with industry or peer averages, gives a more robust picture of whether the premium is justified.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Financial Bankshares Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story about a company’s future, where you connect your view of First Financial Bankshares with key forecasts such as future revenue, earnings, and margins, and arrive at your own fair value estimate. This approach links what you believe about the company, including its business, risks, and future, directly to a clear, numbers-backed forecast. It moves beyond static multiples or analyst averages.

Narratives are designed to be easy and accessible, available to millions of investors on Simply Wall St’s Community page. They help you decide when to buy or sell by showing whether your Fair Value, based on your assumptions, aligns with or diverges from the current market price. The best part is that Narratives are updated dynamically whenever new information, such as news or earnings announcements, comes in, helping you stay current.

For example, some investors see First Financial Bankshares as poised for recovery and assign it a high fair value, while others are more cautious and estimate a much lower value. These different Narratives are all based on each investor’s unique perspective. This tool empowers you to invest with conviction, using your own insight and the latest data.

Do you think there's more to the story for First Financial Bankshares? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success