- United States

- /

- Banks

- /

- NasdaqGS:FFIN

First Financial Bankshares (FFIN): Net Profit Margin Rebound Reinforces Premium Valuation Narrative

Reviewed by Simply Wall St

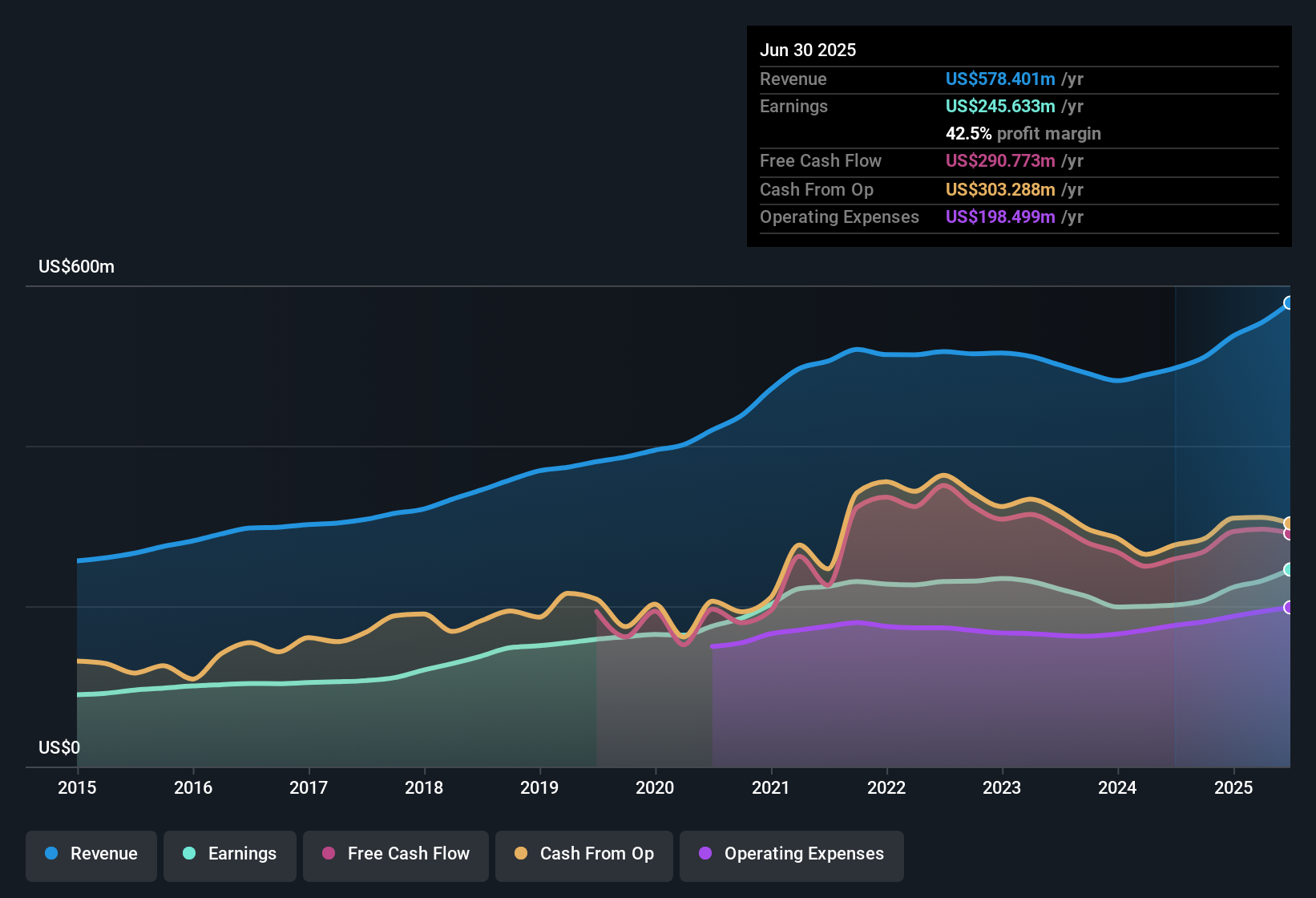

First Financial Bankshares (FFIN) posted encouraging numbers this period, with net profit margins climbing to 41.7%, up from 40.6% a year ago. EPS benefited from this strength, as earnings grew 17.1% in the last year and have averaged 1.2% annual growth over the past five years. Looking ahead, analysts see rewards in the form of ongoing profit and revenue growth, even though expansion is projected to trail the broader US market’s pace.

See our full analysis for First Financial Bankshares.Now, let’s see how this latest performance stacks up alongside the market narratives that typically shape the outlook for First Financial Bankshares.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Growth Trails Sector Leaders

- First Financial Bankshares is expected to grow earnings at 9.58% per year going forward, lagging behind the broader US market's estimated 15.5% annual growth.

- While the company continues to post steady profit gains and high-quality earnings, prevailing market analysis highlights that its cautious management approach appeals to investors seeking stability rather than outsized growth.

- Sector averages suggest faster-moving competitors may capture more upside if current trends hold, even as FFIN attracts those valuing reliability.

- The company’s projected earnings growth, although positive, points to less aggressive expansion than seen across the industry at large.

Premium Valuation Despite Slower Expansion

- Shares trade at a Price-To-Earnings Ratio of 18.2x, notably higher than both the peer average (12.7x) and the US Banks industry average (11.2x), even though growth expectations are more modest.

- The market’s willingness to pay a premium valuation for FFIN, according to industry commentary, reflects confidence that its defensive strengths will be rewarded in turbulent environments. This contrasts with peers that may offer more growth but also greater exposure to sector swings.

- High-quality earnings and attractive dividends help justify this premium in the current climate of market caution.

- However, some investors question if this pricing can persist without a shift in the underlying growth narrative.

Trading at a Discount to DCF Fair Value

- At the current share price of $31.12, First Financial Bankshares is priced well below its DCF fair value of $42.62, signaling potential undervaluation based on modeled future cash flows.

- Analysts point out that this fair value gap could create an opportunity for value-focused investors, particularly if the company continues its track record of profit expansion and steady management.

- The ongoing profit and revenue growth, even if slower than the sector, supports a case for eventual re-rating closer to modeled value.

- The absence of flagged risks further strengthens the investment case for those attracted to reliable fundamentals at a discount.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Financial Bankshares's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

First Financial Bankshares' slower earnings growth and modest expansion means it trails higher-growth peers that may offer greater upside potential.

If you want to focus on established companies expected to deliver stronger future earnings, check out high growth potential stocks screener (59 results) and target tomorrow’s leaders today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFIN

First Financial Bankshares

Through its subsidiaries, provides banking services in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives