- United States

- /

- Banks

- /

- NasdaqGS:FFBC

First Financial Bancorp (FFBC): Margin Expansion Defies Cautious Narratives as Profitability Surges

Reviewed by Simply Wall St

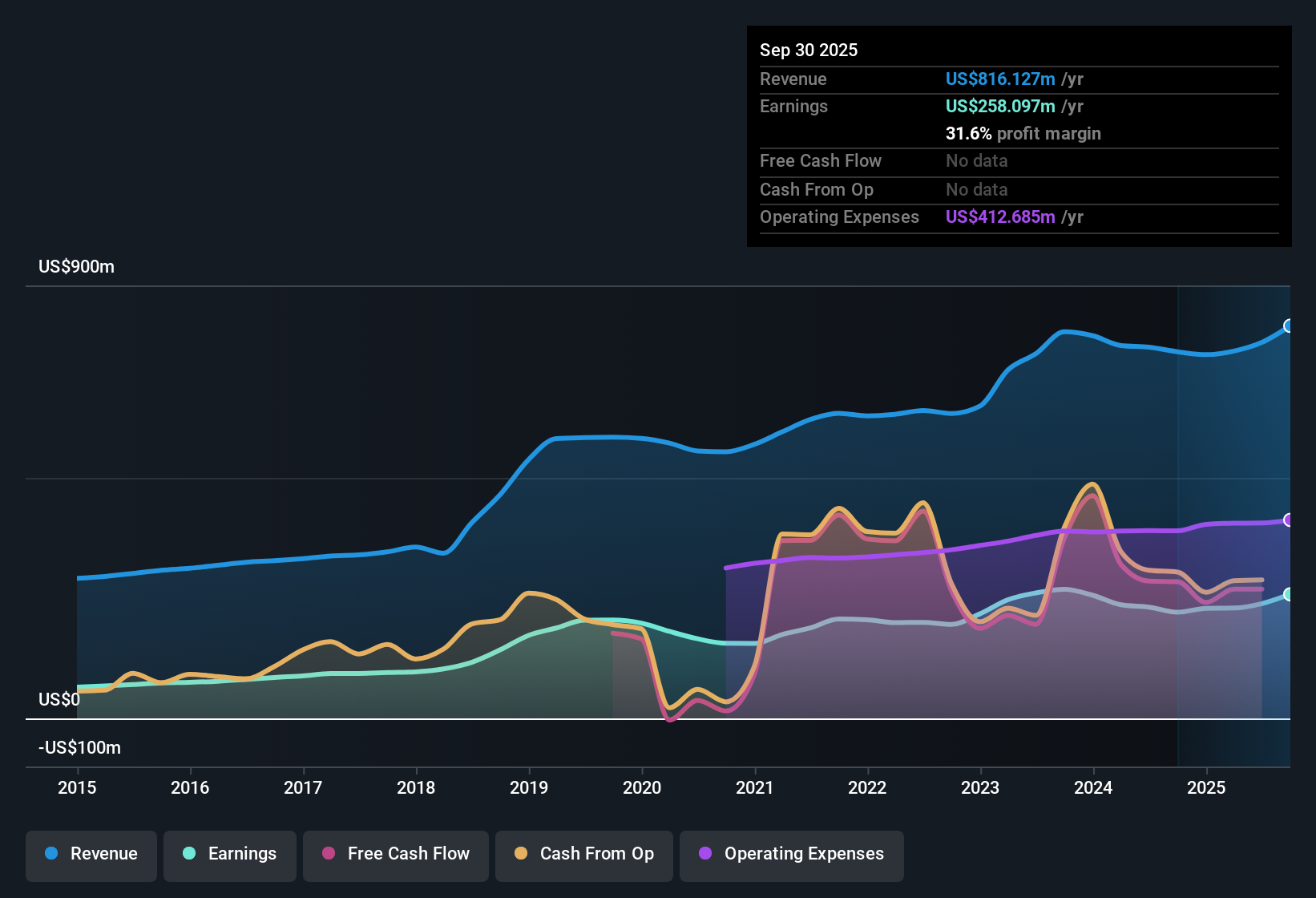

First Financial Bancorp (FFBC) is forecasting earnings growth of 24.89% per year and revenue growth of 15.7% per year, both outpacing the broader US market. Net profit margins currently stand at 31.6%, up from last year’s 29%, indicating improved profitability. Over the past year, earnings have grown at 17%, handily beating the five-year average growth rate of 7.7% per year. The company is drawing attention for high-quality earnings and strong growth expectations over the next three years.

See our full analysis for First Financial Bancorp.The next section puts these standout results head-to-head with the community narrative, revealing where consensus holds and where the numbers may prompt a rethink.

See what the community is saying about First Financial Bancorp

Digital Efficiencies Boost Margins and Reach

- Net profit margins have climbed to 31.6%, up from last year’s 29%, as 80% of the company’s digital transformation initiatives are now in place. This has driven cost efficiencies and helped expand their customer base without adding branches.

- According to analysts' consensus view, efficiency gains from automation and technology investments are expected to keep lowering expenses and increasing profitability.

- Analysts highlight that operational reviews and process redesigns are already yielding improved net margins and lower noninterest expenses. This reinforces the idea that digital improvement is genuinely benefiting bottom-line results.

- Consensus also notes the bank’s focus on technology is expected to widen their reach to new customer segments, which could support future growth even if physical expansion slows.

- Bulls and bears can both find signals here, but consensus is that the operational shift to digital is evident in the numbers.

📊 Read the full First Financial Bancorp Consensus Narrative.

Market Share Grows with Strategic Expansion

- The acquisition of Westfield Bank positions First Financial Bancorp for greater market share. Analysts expect revenue to grow by 23.2% annually over the next three years, which is among the highest rates for regional peers.

- Analysts' consensus view points out that this deal, along with demographic-driven moves into new fee-based services like leasing and bankcards, should support stronger revenue and earnings growth.

- Consensus highlights that expansion into new geographies and service lines diversifies revenue streams, reducing reliance on interest income and helping smooth out earnings.

- They note the deal offers leverage for integration efficiencies and opens up opportunities for earnings stability, especially as loan and core deposit pipelines accelerate in tandem with economic growth in core regions.

Valuation Discounts Raise Long-Term Appeal

- At a price-to-earnings ratio of 8.9x, First Financial Bancorp trades below both the industry average of 11.2x and its peer average of 19x. Its current share price of $24.09 is also well below the $30.17 analyst target and the $61.42 DCF fair value.

- Analysts' consensus view finds these valuation metrics compelling. The current discount could offer upside if projected earnings and revenue gains materialize.

- The consensus perspective is that, while risks such as commercial real estate exposure and regulatory pressures persist, the bank’s growth and margin expansion are not yet reflected in the share price.

- Consensus adds that dividends remain attractive and no major insider selling has been reported, contributing to positive market expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Financial Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the figures? Put your perspective into words and shape your personal narrative in just minutes with Do it your way.

A great starting point for your First Financial Bancorp research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While First Financial Bancorp is growing quickly, concerns linger about its exposure to commercial real estate and ongoing regulatory pressures that could affect earnings stability.

If you want more consistent performance regardless of market turbulence, use our stable growth stocks screener (2095 results) to discover companies that have delivered reliable growth across both good and challenging times.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FFBC

First Financial Bancorp

Operates as the bank holding company for First Financial Bank that provides commercial banking and related services to individuals and businesses in Ohio, Indiana, Kentucky, and Illinois.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)