- United States

- /

- Banks

- /

- NasdaqCM:BFC

Undiscovered Gems in the US to Explore This February 2025

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has experienced a robust 22% rise over the last 12 months, with earnings anticipated to grow by 15% annually in the coming years. In this dynamic environment, identifying stocks that are not yet widely recognized but have strong growth potential can be key to capitalizing on future opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 125.65% | 12.07% | 2.64% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Cashmere Valley Bank | 15.51% | 5.80% | 3.51% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Bank First (NasdaqCM:BFC)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank First Corporation operates as a holding company for Bank First, N.A., with a market capitalization of $1.03 billion.

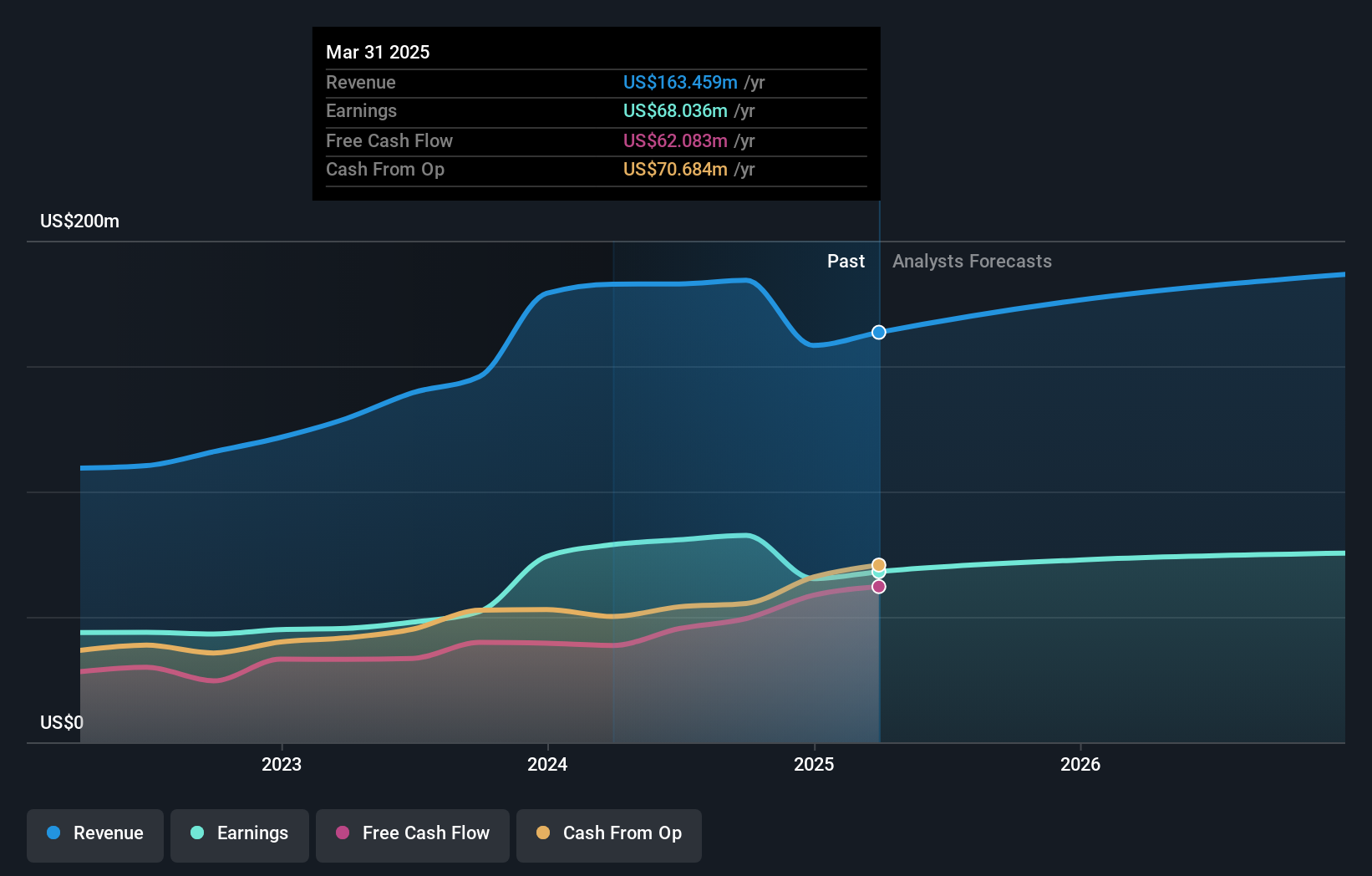

Operations: Bank First generates revenue primarily from offering a full range of consumer and commercial financial institution services, amounting to $158.25 million.

With total assets of US$4.5 billion and equity of US$639.7 million, Bank First stands out with its robust balance sheet. The bank's deposits total US$3.7 billion against loans of US$3.5 billion, showcasing a strong deposit base primarily from low-risk sources at 95%. Despite negative earnings growth last year (-11.5%), it trades at 17% below estimated fair value and forecasts a promising 6.92% annual earnings growth rate ahead. Recent events include maintaining dividends with a notable increase over the prior year and no share repurchases in the latest quarter, reflecting strategic financial management amidst executive changes.

- Delve into the full analysis health report here for a deeper understanding of Bank First.

Explore historical data to track Bank First's performance over time in our Past section.

Fidelity D & D Bancorp (NasdaqGM:FDBC)

Simply Wall St Value Rating: ★★★★★★

Overview: Fidelity D & D Bancorp, Inc. is the bank holding company for The Fidelity Deposit and Discount Bank, offering a variety of banking, trust, and financial services to individuals, small businesses, and corporate clients with a market cap of $264.60 million.

Operations: The primary revenue stream for Fidelity D & D Bancorp, Inc. comes from its banking, trust, and financial services segment, generating $79.41 million. The company has a market cap of $264.60 million.

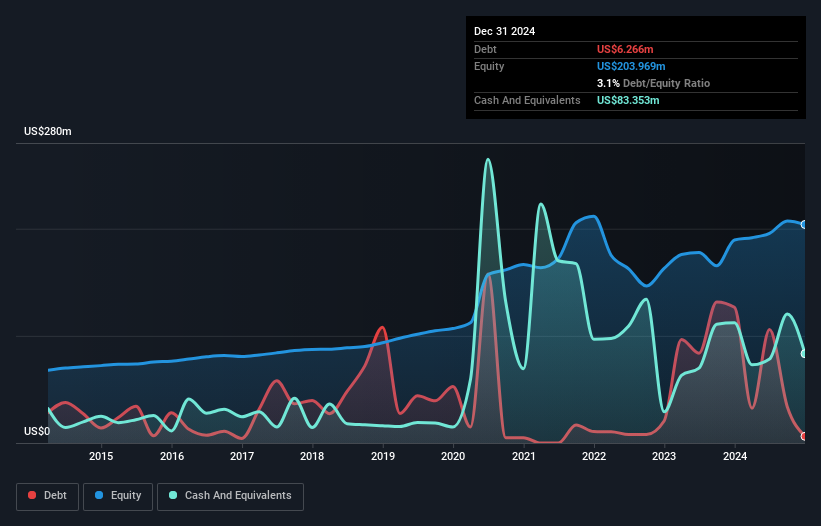

Fidelity D & D Bancorp, with total assets of US$2.6 billion and equity of US$204 million, stands out for its robust financial health. The company boasts a net interest margin of 2.7% and holds customer deposits totaling US$2.3 billion as its primary funding source, reflecting low-risk liabilities at 98%. Its bad loans are well-managed at just 0.4% of total loans, supported by a sufficient allowance ratio of 275%. Earnings growth over the past year hit an impressive 14.2%, surpassing the industry average by a significant margin, highlighting high-quality earnings potential in this sector niche.

Materialise (NasdaqGS:MTLS)

Simply Wall St Value Rating: ★★★★★★

Overview: Materialise NV is a company that offers additive manufacturing and medical software, along with 3D printing services across the Americas, Europe and Africa, and the Asia-Pacific, with a market cap of approximately $523.93 million.

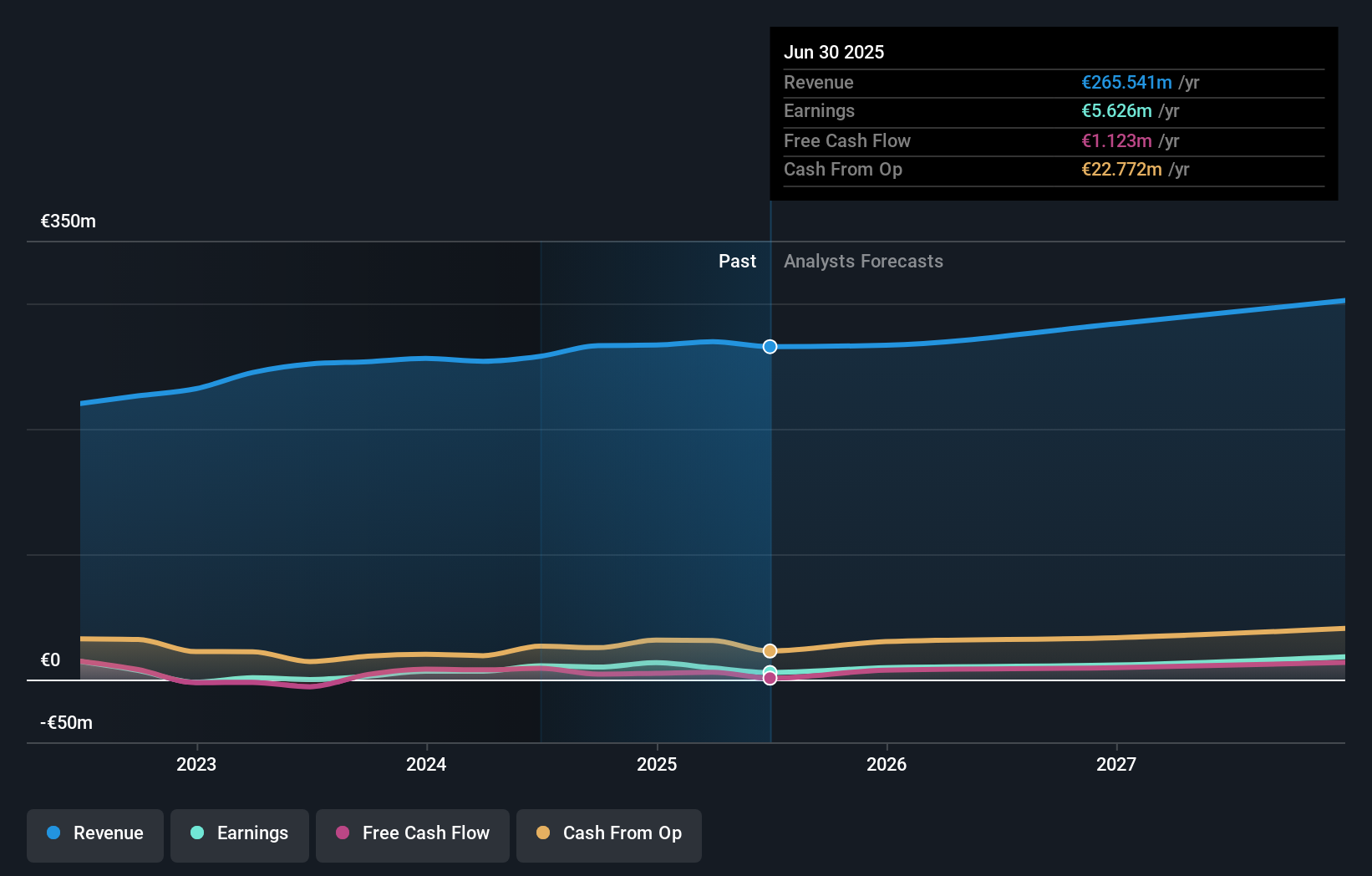

Operations: Materialise generates revenue through its three primary segments: Medical (€112.37 million), Software (€44.03 million), and Manufacturing (€109.99 million). The company's revenue streams are diversified across these segments, reflecting its focus on both software solutions and manufacturing services in the additive manufacturing industry.

Materialise, a notable player in the 3D printing industry, has shown impressive financial resilience. Over the past five years, its debt-to-equity ratio dropped from 90.4% to 18.3%, indicating improved financial health. The company boasts more cash than total debt and remains profitable with positive free cash flow of €9.05M as of June 2024. Despite a substantial one-off loss of €9.4M impacting recent results, earnings surged by 274% last year, outpacing the software industry's growth rate of 27%. With projected annual earnings growth at nearly 22%, Materialise seems poised for continued expansion in its sector.

- Take a closer look at Materialise's potential here in our health report.

Review our historical performance report to gain insights into Materialise's's past performance.

Taking Advantage

- Click through to start exploring the rest of the 279 US Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank First might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BFC

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives