- United States

- /

- Banks

- /

- NasdaqGM:FDBC

Fidelity D & D Bancorp (FDBC) Profit Margin Jumps to 27.9%, Surpassing Skepticism Over Earnings Quality

Reviewed by Simply Wall St

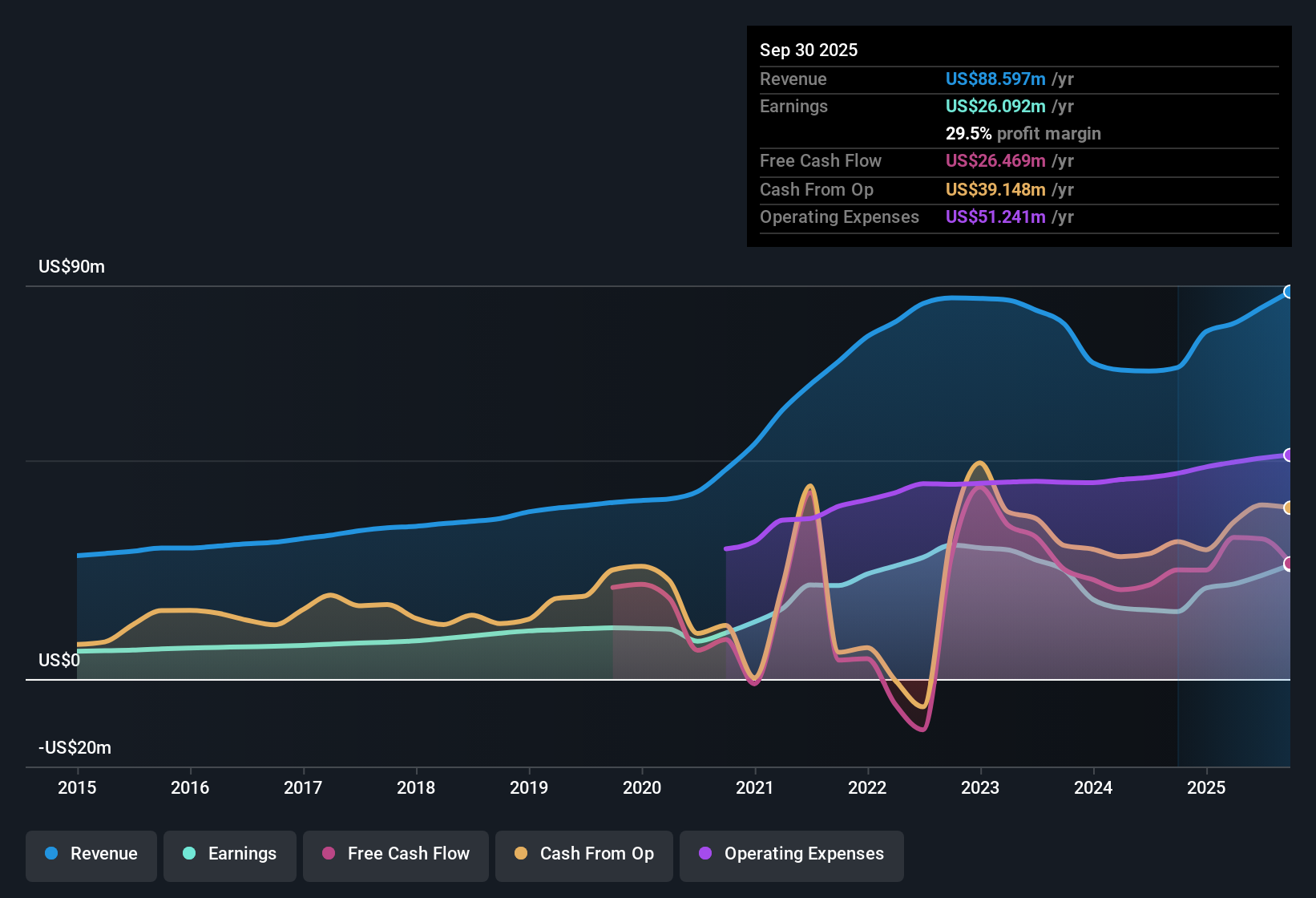

Fidelity D & D Bancorp (FDBC) posted a standout year, with earnings growing by 50.1%, far ahead of its 2.5% annual growth rate over the last five years. Net profit margin hit 27.9%, up from 22.4% a year ago, and the company’s 10.9x Price-to-Earnings ratio comes in below both industry and peer averages. The current share price of $44.79 trades at a notable discount to the estimated fair value of $79.71, giving investors plenty to think about in terms of upside potential.

See our full analysis for Fidelity D & D Bancorp.Next, we will look at how these results stack up against the dominant narratives around Fidelity D & D Bancorp and see which expectations are confirmed or upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Push to 27.9%

- Net profit margin climbed to 27.9%, up from 22.4% in the previous year. This highlights increased operational efficiency, even as many banks contend with rising costs.

- What stands out is that, despite sector-wide pressure on lending profitability, Fidelity D & D’s improvement in margins supports the view that regional banks with conservative balance sheets can outperform their peers during volatile periods.

- Sector context points to ongoing concerns about net interest margin compression and higher funding costs; however, FDBC’s margin trend signals prudent management and relative outperformance.

- While broader banking trends have led many lenders to report declining profitability, the margin increase at FDBC emphasizes its resilience compared to industry averages.

Share Price Trails DCF Fair Value

- The current share price of $44.79 trades at a significant discount to the DCF fair value of $79.71, making the stock appear undervalued by about 44% versus calculated intrinsic worth.

- This substantial gap appeals to investors attracted to discounted opportunities, especially since valuation metrics such as the Price-to-Earnings ratio (10.9x) are below both the US banks industry average and peer average.

- While regional bank stocks frequently remain stable during uncertain periods, a discount of this size may support cautious optimism for investors considering potential upside if the fundamentals remain strong.

- Recent profit acceleration and improved margins challenge perceptions that the company is “cheap for a reason,” as operational progress appears to be a major factor in the undervaluation narrative.

Profit Growth Far Outpaces Five-Year Trend

- Earnings rose by 50.1% in the latest year, far surpassing the previous five-year average growth rate of 2.5% per year and indicating a potential turning point in performance trajectory.

- Analysis notes that such a significant annual growth rate is rare among regional peers, suggesting Fidelity D & D may be benefiting from stable deposits and a prudent lending approach.

- Although the sector faces ongoing questions about the quality of future loan books and exposure to commercial real estate, the rapid pace of profit growth so far indicates earnings momentum that stands apart from the broader industry.

- Management’s focus on conservative risk management may be providing the stability needed for this level of growth without pursuing riskier lending strategies.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Fidelity D & D Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite rapid recent growth, Fidelity D & D Bancorp’s profits have been volatile, raising questions about the sustainability of such momentum going forward.

If you want steadier compounding and less performance whiplash, check out companies delivering consistent results through ups and downs with stable growth stocks screener (2094 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:FDBC

Fidelity D & D Bancorp

Operates as the bank holding company for The Fidelity Deposit and Discount Bank that provides a range of banking, trust, and financial services to individuals, small businesses, and corporate customers.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion