- United States

- /

- Banks

- /

- NasdaqGS:FCNC.A

First Citizens BancShares (FCNC.A): Assessing Value After Significant Share Buyback Completion

Reviewed by Simply Wall St

If you have been watching First Citizens BancShares (FCNC.A), the company’s latest move deserves your attention. The bank just wrapped up a major part of its buyback program, purchasing 486,324 shares for over $916 million in four months. This brings total repurchases under the current plan to more than 1.6 million shares, or 11.5% of the company’s outstanding stock. This signals management’s strong conviction in the business and its long-term prospects. For investors, buybacks like these often hint at underlying value, as they both reduce the share count and can serve as a confidence booster from leadership.

The timing of this milestone is notable: over the past year, First Citizens BancShares’ stock is down about 2%, lagging broader markets despite steady underlying revenue growth. The stock fell 8% in the past month, erasing earlier gains, but remains up 5% over the past three months. While annual net income is slightly down year over year, the long-term numbers show solid growth, increasing over 135% in three years and nearly 400% in five. Recent volatility may reflect shifting perceptions around risk and future growth for regional banks, but momentum has not fully faded.

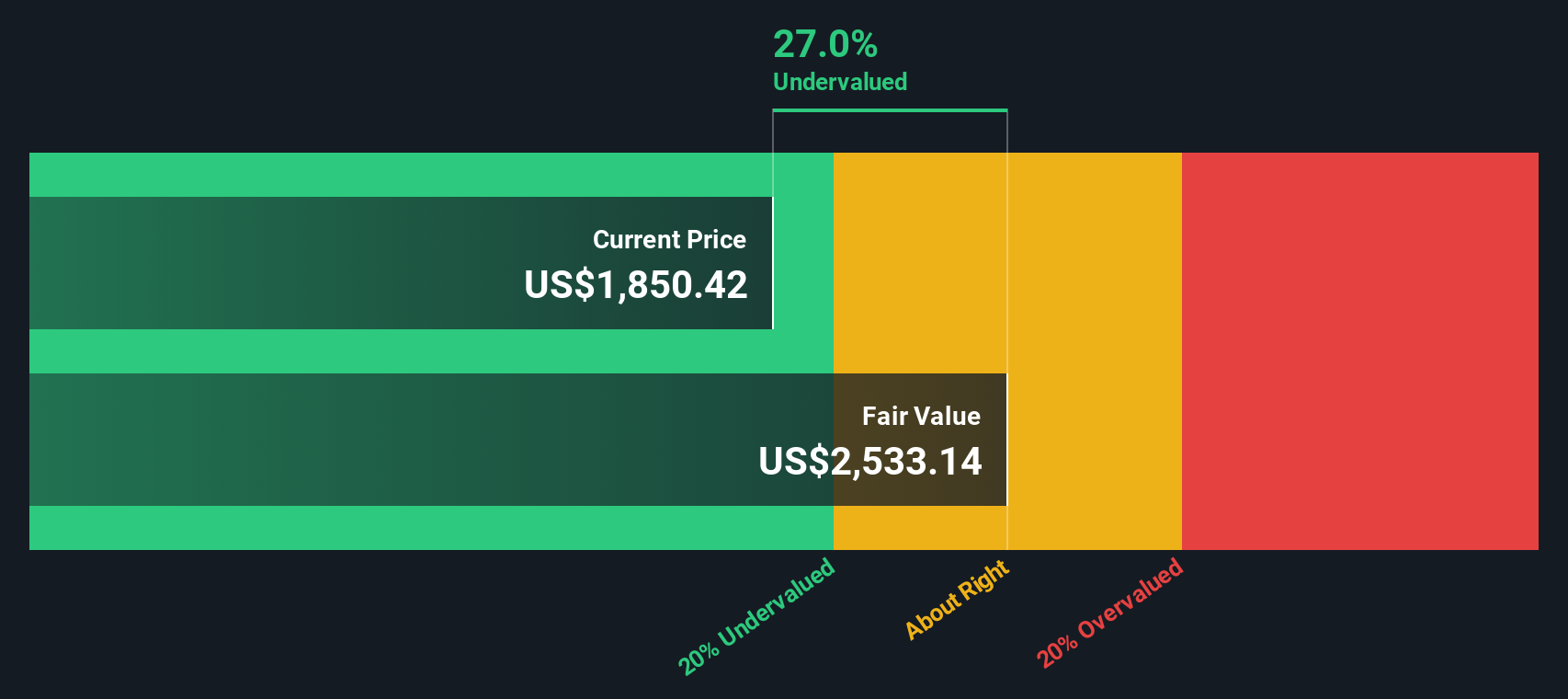

With the buyback now complete and shares trading below some intrinsic value estimates, the big question is whether the market is underpricing First Citizens BancShares’ potential, or if everyone is simply considering what might come next.

Most Popular Narrative: 16.2% Undervalued

According to community narrative, First Citizens BancShares is viewed as undervalued, with a fair value estimate notably above the current market price. This valuation draws on expectations of future earnings trends and a higher earnings multiple in coming years.

The company is leveraging its strong balance sheet and liquidity position to continue share repurchase programs. These programs are expected to improve earnings per share (EPS) significantly by reducing the number of shares outstanding. First Citizens anticipates further growth in deposits through its Direct Bank and General Bank, using digital strategies and proactive marketing to attract and retain clients. This could potentially enhance net interest income as deposit rates decline.

What powers this bullish view? The answer lies in projected business momentum, digital banking strategies, and a controversial multiple that is considerably above where peers currently trade. Interested in learning how this narrative sees First Citizens advancing ahead of the market? Examine the playbook and discover the reasoning behind each figure.

Result: Fair Value of $2,303.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts. However, ongoing uncertainty around interest rate cuts and potential credit exposure in acquired portfolios could challenge even the most optimistic outlooks for First Citizens BancShares. Find out about the key risks to this First Citizens BancShares narrative.Another View: Discounted Cash Flow Perspective

While the market narrative points to undervaluation based on future earnings potential, our DCF model reaches a similar conclusion. This suggests shares may still trade below what long-term cash flows imply. But is this the whole story?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Citizens BancShares Narrative

If you want to dig deeper or shape your own interpretation, it’s quick and easy to assemble your own view using the same data. do it your way.

A great starting point for your First Citizens BancShares research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors know the advantage of seeking out unique opportunities across the market, not just sticking to what’s familiar. Your next standout stock might be just around the corner, so don’t let promising investment ideas slip by. Use these powerful tools to uncover fresh stocks with serious potential today:

- Unlock growth by exploring industry leaders making advances in artificial intelligence with AI penny stocks.

- Find resilient income streams by looking into companies that offer dividend stocks with yields > 3% and benefit from yields that can help strengthen your portfolio’s stability.

- Add to your watchlist with rising stars backed by solid fundamentals by reviewing undervalued stocks based on cash flows and discover companies the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FCNC.A

First Citizens BancShares

Operates as the holding company for First-Citizens Bank & Trust Company that provides retail and commercial banking services to individuals, businesses, and professionals in the United States and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives