- United States

- /

- Banks

- /

- NasdaqCM:FCAP

First Capital (FCAP) Margin Improvement Reinforces Bullish Investor Narratives

Reviewed by Simply Wall St

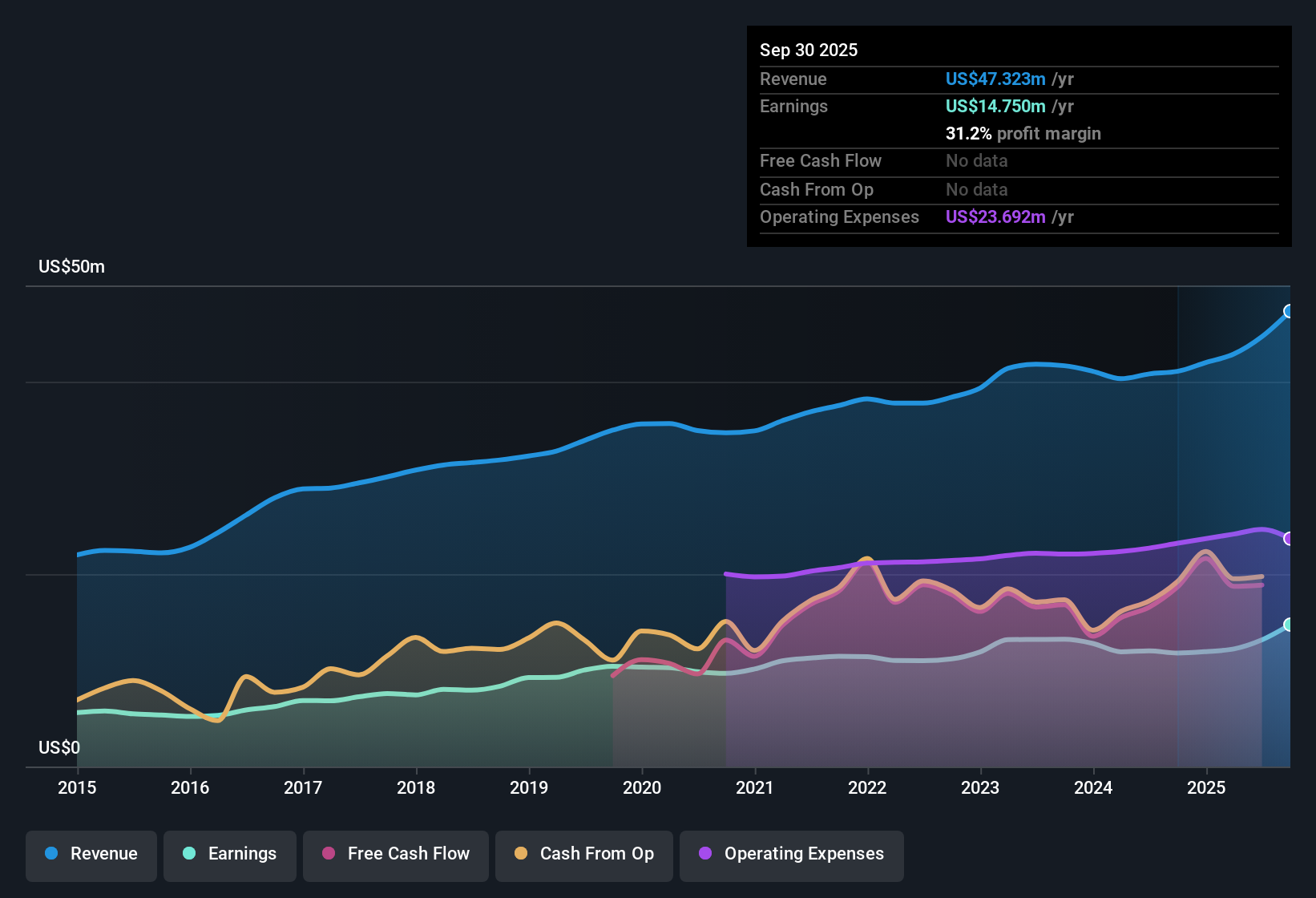

First Capital (FCAP) posted net profit margins of 31.2%, an improvement over last year’s 28.7%. Earnings growth surged by 25.1%, which is well above the company’s five-year average of 4.9% per year. Shares are trading at $42.92, below the estimated fair value of $72.33. This suggests potential for upside as investors take note of the company’s high-quality and accelerating earnings profile.

See our full analysis for First Capital.Next, we’ll see how these latest numbers compare to the prevailing narratives among investors and at Simply Wall St. Some expectations may be confirmed, while others could face a reality check.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Climb Above Peers

- First Capital’s net profit margin sits at 31.2%, outpacing last year’s 28.7% and exceeding the profit margins of many peer banks in the US sector.

- Margin expansion strongly backs prevailing optimism, as higher profitability signals better cost efficiency and solid core operations.

- With a rising net profit margin, the company’s recent acceleration in earnings growth is underpinned by operational strength rather than one-off gains.

- This level of profitability provides a buffer in more challenging periods and enhances confidence in the bank’s fundamentals without any flagged risk factors undermining the result.

Price-to-Earnings Undercuts Sector

- The company’s price-to-earnings ratio of 9.8x is below both the peer average of 10.8x and the US Banks industry at 11.2x, suggesting that investors are paying less for FCAP’s earnings compared to similar stocks.

- This valuation gap supports a positive outlook, as it leaves more room for upside when paired with visible profit gains.

- While margins and earnings growth are both strong, the discounted multiple reflects a combination of cautious market sentiment and the potential for a re-rating if the company continues to deliver such results.

- Ongoing track records of steady earnings growth and a high-quality profile reinforce the case for value-focused investors looking for both safety and upside in a dividend-paying stock.

Share Price Trades Well Below DCF Fair Value

- Shares are currently trading at $42.92, well under the DCF fair value of $72.33, signaling a significant valuation gap that may have been overlooked by the market.

- This disconnect bolsters the market’s prevailing view that FCAP is undervalued and could attract renewed attention as the gap between intrinsic value and share price narrows.

- A meaningful discount to fair value, combined with strong historical profit growth and improved margins, gives further weight to arguments for potential rerating during earnings season.

- Dividends and a reliable profitability track record add to FCAP’s attractiveness for long-term investors seeking both income and capital appreciation potential.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Capital's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite First Capital’s robust profit margins and undervaluation, the company’s steady but unspectacular five-year earnings growth rate may disappoint investors seeking consistent, reliable expansion.

If you’re aiming for stocks with a smoother growth trajectory, consider our stable growth stocks screener (2102 results) to target companies proven to deliver steady results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FCAP

First Capital

Operates as the bank holding company for First Harrison Bank that provides various banking services to individuals and business customers in Indiana and Kentucky, the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives