- United States

- /

- Banks

- /

- NasdaqGS:FBNC

First Bancorp (FBNC): Assessing Valuation After Surprising 16% Revenue Growth in the Second Quarter

Reviewed by Simply Wall St

First Bancorp (FBNC) caught investor attention after reporting a 16% year-over-year increase in second quarter revenue, which surpassed expectations. This outperformance has sparked discussion about the bank's underlying growth and future prospects.

See our latest analysis for First Bancorp.

After the strong revenue showing, First Bancorp’s share price gathered momentum and delivered a 1-month share price return of nearly 5%, rising over 18% since the start of the year. While recent gains reflect renewed optimism around growth potential, its 10% total shareholder return over the past year shows that long-term investors have seen steady, although more moderate, progress.

If you’re curious about where other fast-moving opportunities might be hiding, now’s a great moment to discover fast growing stocks with high insider ownership.

With shares up nearly 20% this year and trading at a meaningful discount to analyst price targets, the question now is whether First Bancorp’s recent momentum offers real value or if future growth is already factored in by the market.

Price-to-Earnings of 21.5x: Is it justified?

First Bancorp shares currently trade at a price-to-earnings (P/E) ratio of 21.5x, which stands out compared to both peers and industry benchmarks.

The price-to-earnings ratio helps investors evaluate how much they are paying for each dollar of earnings. This metric is important for banks like First Bancorp, where earnings consistency matters. A higher P/E can suggest that investors expect stronger growth in the future, but it can also indicate over-optimism if not supported by strong fundamentals.

In First Bancorp’s case, the current multiple is well above the US Banks industry average of 11.4x and the peer average of 11x. Compared to the estimated fair P/E ratio of 15.2x for First Bancorp, the current price appears expensive. If the market were to reprice the stock according to the fair ratio, there could be downside risk from these levels.

Explore the SWS fair ratio for First Bancorp

Result: Price-to-Earnings of 21.5x (OVERVALUED)

However, investors should note that a prolonged earnings slowdown or a shift in market sentiment could quickly reverse First Bancorp’s recent momentum.

Find out about the key risks to this First Bancorp narrative.

Another View: The DCF Perspective

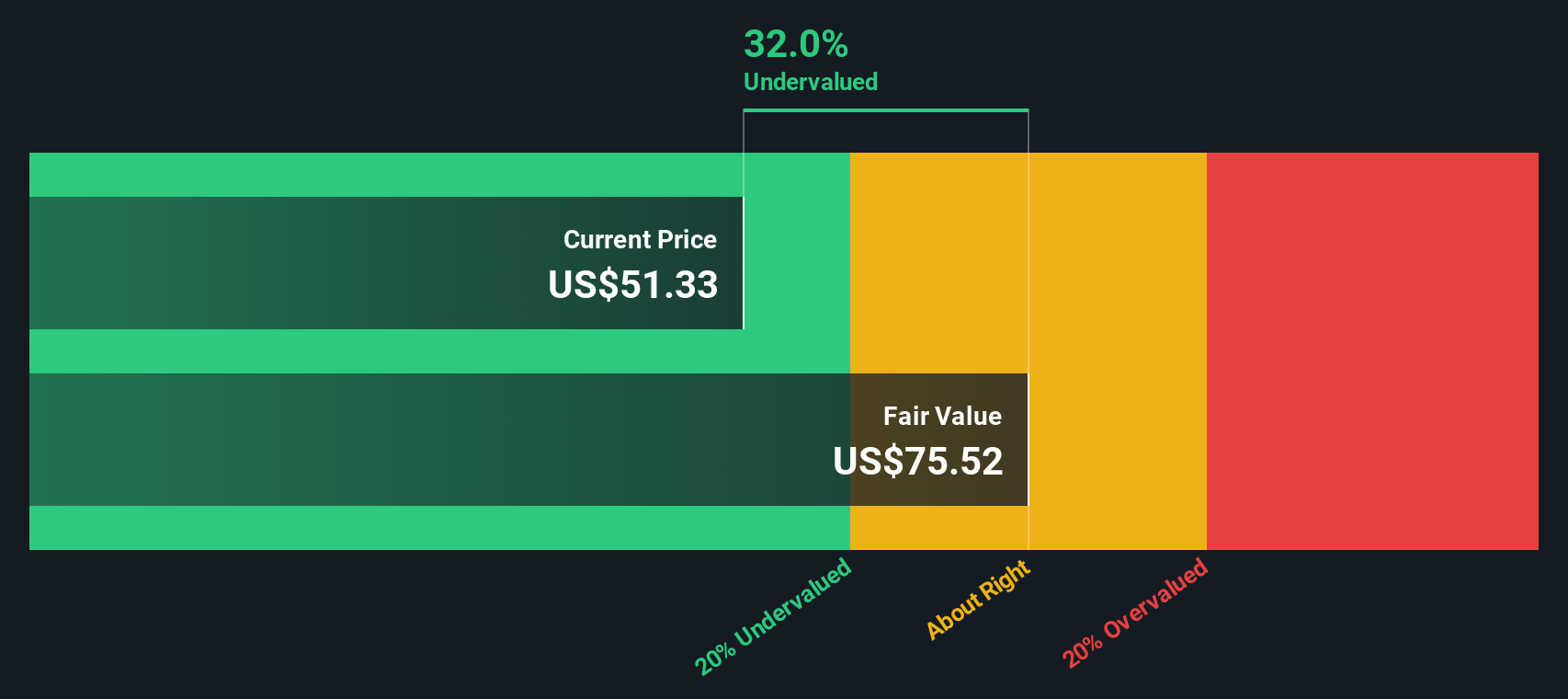

While the market currently prices First Bancorp at a premium based on its price-to-earnings ratio, our SWS DCF model offers a different perspective. According to this method, the shares are trading around 40% below our fair value estimate, which suggests notable upside potential for patient investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Bancorp Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you’re always welcome to build your own analysis and shape the story in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Bancorp.

Looking for more investment ideas?

If you want to maximize your edge and never miss the next big opportunity, tap into Simply Wall Street’s screeners filled with powerful new stock ideas. Your best pick might be waiting just one click away.

- Capture standout value by tapping into these 913 undervalued stocks based on cash flows to find stocks trading well below their true worth.

- Capitalize on the booming growth in digital health by uncovering future leaders with these 30 healthcare AI stocks.

- Collect consistent income by selecting from these 15 dividend stocks with yields > 3% featuring strong yields above 3% and proven dividend strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FBNC

First Bancorp

Operates as the bank holding company for First Bank that provides banking products and services for individuals and businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026