- United States

- /

- Banks

- /

- NYSE:EQBK

What Type Of Shareholders Own The Most Number of Equity Bancshares, Inc. (NASDAQ:EQBK) Shares?

The big shareholder groups in Equity Bancshares, Inc. (NASDAQ:EQBK) have power over the company. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. I generally like to see some degree of insider ownership, even if only a little. As Nassim Nicholas Taleb said, 'Don’t tell me what you think, tell me what you have in your portfolio.

With a market capitalization of US$568m, Equity Bancshares is a small cap stock, so it might not be well known by many institutional investors. Taking a look at our data on the ownership groups (below), it seems that institutions are noticeable on the share registry. Let's take a closer look to see what the different types of shareholders can tell us about Equity Bancshares.

See our latest analysis for Equity Bancshares

What Does The Institutional Ownership Tell Us About Equity Bancshares?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

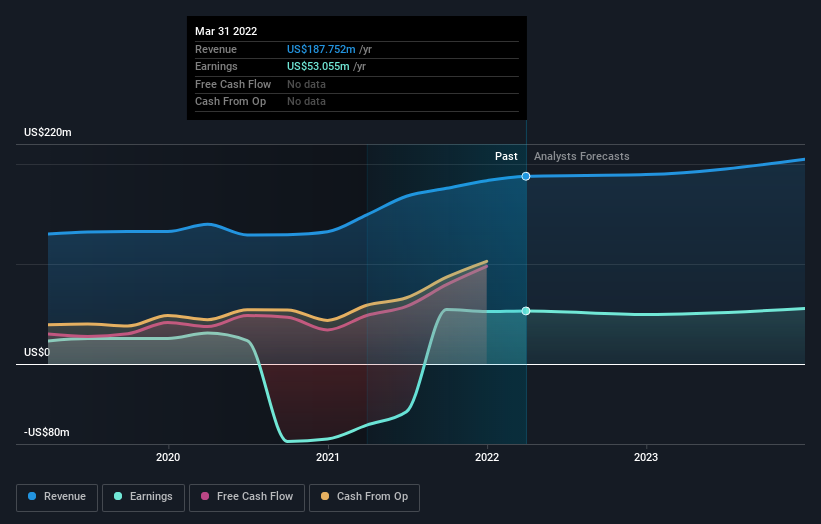

As you can see, institutional investors have a fair amount of stake in Equity Bancshares. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Equity Bancshares' historic earnings and revenue below, but keep in mind there's always more to the story.

Our data indicates that hedge funds own 6.4% of Equity Bancshares. That's interesting, because hedge funds can be quite active and activist. Many look for medium term catalysts that will drive the share price higher. The company's largest shareholder is T. Rowe Price Group, Inc., with ownership of 8.2%. BlackRock, Inc. is the second largest shareholder owning 6.5% of common stock, and FJ Capital Management, LLC holds about 6.3% of the company stock. Furthermore, CEO Brad Elliott is the owner of 1.5% of the company's shares.

After doing some more digging, we found that the top 16 have the combined ownership of 50% in the company, suggesting that no single shareholder has significant control over the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Equity Bancshares

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Shareholders would probably be interested to learn that insiders own shares in Equity Bancshares, Inc.. It has a market capitalization of just US$568m, and insiders have US$35m worth of shares, in their own names. This shows at least some alignment. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 34% stake in the company, and hence can't easily be ignored. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Private Equity Ownership

With an ownership of 5.2%, private equity firms are in a position to play a role in shaping corporate strategy with a focus on value creation. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Equity Bancshares better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Equity Bancshares you should know about.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Equity Bancshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EQBK

Equity Bancshares

Operates as the bank holding company for Equity Bank that provides a range of banking, mortgage banking, and financial services to individual and corporate customers.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026