- United States

- /

- Banks

- /

- NasdaqGS:EFSC

Will Executive Appointments and Strong Earnings Redefine Enterprise Financial Services' (EFSC) Growth Trajectory?

Reviewed by Sasha Jovanovic

- Enterprise Financial Services Corp. recently announced a series of executive leadership changes, including the promotion of Keene Turner to Chief Operating Officer while retaining his Chief Financial Officer role, and Doug Bauche to Chief Banking Officer, as part of its succession planning and operational realignment.

- These appointments, combined with the company’s stronger-than-expected second quarter earnings, highlight ongoing efforts to enhance executive capabilities and position the bank for future growth amid industry consolidation and expansion initiatives.

- We’ll explore how the addition of COO responsibilities for Mr. Turner could influence Enterprise Financial Services’ investment narrative and operational execution.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Enterprise Financial Services Investment Narrative Recap

For investors considering Enterprise Financial Services, belief in the company's disciplined approach to growth and operational execution is key, especially as it navigates industry consolidation in core markets. The recent executive changes, including Keene Turner’s promotion to Chief Operating Officer, are designed to support continuity and execution, but should not have a material impact on the most immediate catalyst: upcoming earnings performance. The greatest risk to watch remains exposure to regional commercial real estate cycles, which could pressure asset quality if market conditions weaken.

Of the recent announcements, the strong second quarter results, with net income of US$51.38 million and net interest income rising to US$152.76 million, stand out. This performance reinforces lender stability and offers near-term support for the growth narrative, particularly ahead of the company’s third quarter earnings release later this month. However, investors should consider these results within the context of broader risks, especially as the bank scales specialty lending and expands exposure in select regions.

But amid improving margins, the potential for regional credit deterioration remains a factor investors should be aware of, especially if...

Read the full narrative on Enterprise Financial Services (it's free!)

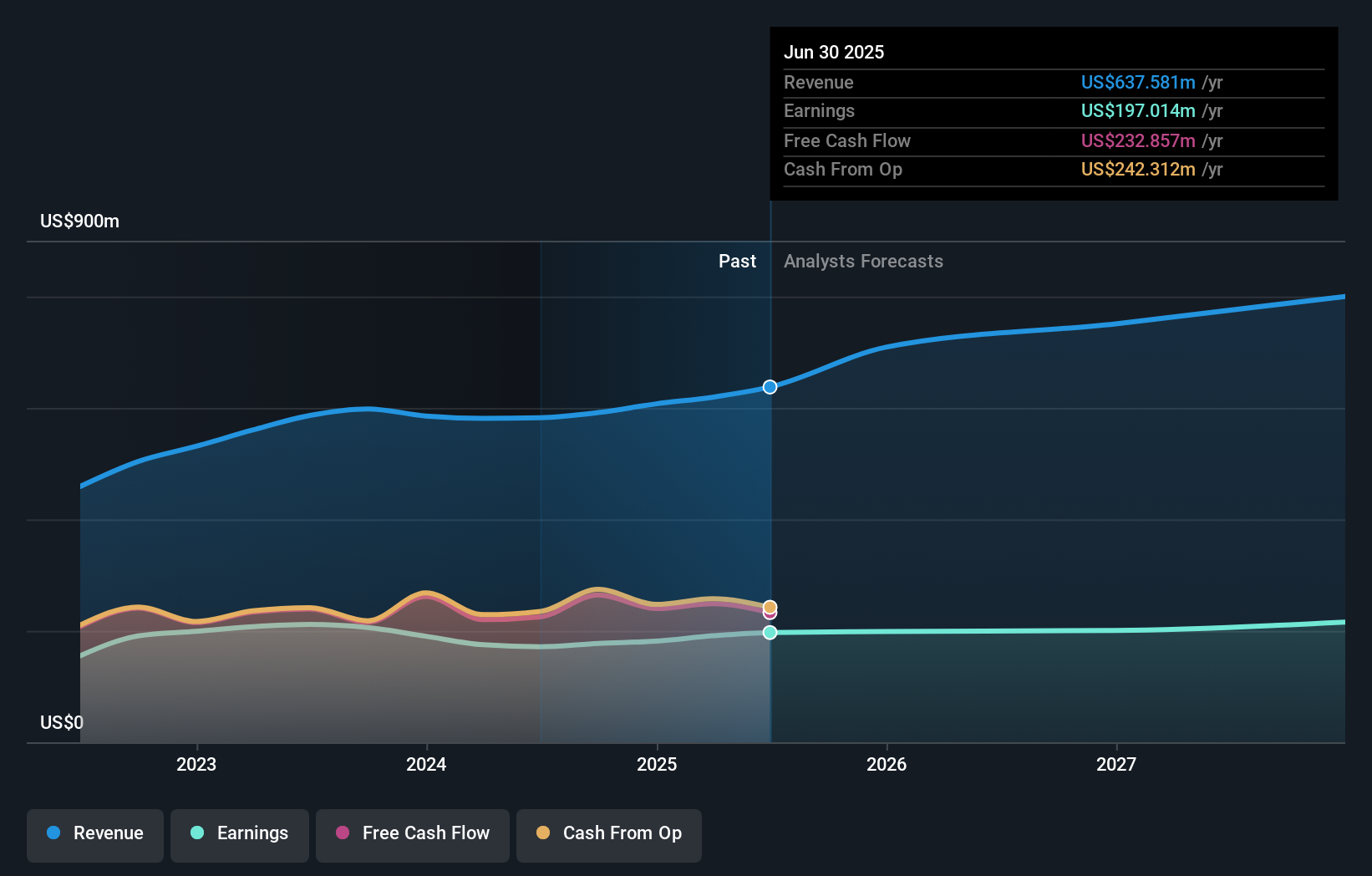

Enterprise Financial Services' narrative projects $850.9 million in revenue and $205.1 million in earnings by 2028. This requires 10.1% yearly revenue growth and an increase of $8.1 million in earnings from the current $197.0 million.

Uncover how Enterprise Financial Services' forecasts yield a $67.00 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have all assigned a US$67 fair value to Enterprise Financial Services, with analysis limited to 1 perspective. While consensus suggests strong value, the risk tied to the company’s commercial real estate loan book could affect performance if regional markets experience new stress. Consider the full range of community viewpoints as you assess the stock.

Explore another fair value estimate on Enterprise Financial Services - why the stock might be worth just $67.00!

Build Your Own Enterprise Financial Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enterprise Financial Services research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Enterprise Financial Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enterprise Financial Services' overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EFSC

Enterprise Financial Services

Operates as the financial holding company for Enterprise Bank & Trust that offers banking and wealth management services to individuals and corporate customers in Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives