- United States

- /

- Banks

- /

- NasdaqGS:EFSC

Enterprise Financial Services (EFSC): Assessing Valuation Following S&P Banks Index Inclusion

Reviewed by Kshitija Bhandaru

Enterprise Financial Services (EFSC) just got a fresh spotlight after being added to the S&P Banks Select Industry Index. It is a move that tends to catch the eye of investors, since inclusion in a widely followed index often brings new attention from index funds and large institutions. For many, this can signal the company’s growing relevance in the banking sector and potentially open the door to greater liquidity for the stock.

This boost comes as Enterprise Financial Services has quietly stacked up solid returns over the past year, with shares climbing 19% in that period. Momentum has been positive in the past three months as well, and yearly numbers outpace average market gains. While the stock has seen some slight dips in recent weeks, the longer-term trajectory suggests growing interest, especially as the company continues to deliver steady revenue and bottom-line growth.

That raises the important question: is Enterprise Financial Services still trading at a reasonable valuation, or has the rising tide from index inclusion and market optimism already been fully priced in?

Most Popular Narrative: 10% Undervalued

The prevailing narrative sees Enterprise Financial Services trading at a notable discount to its projected fair value. This view is supported by expectations of strong financial performance and strategic growth initiatives in digital banking and branch expansion.

“Margins and earnings are positioned for expansion as Enterprise Financial Services capitalizes on investments in digital banking and operational efficiency, leveraging technology to both acquire new customers, especially through digital channels, and reduce cost-to-serve. This should support higher net margins.”

Think a regional bank can’t outpace its peers with the right digital moves? This narrative points to a growth formula fueled by higher margins and strategic reinvestment in technology. The secret sauce? Analysts are betting on ambitious targets that could shake up how investors see fair value. You will have to dig deeper to see what makes the math work.

Result: Fair Value of $67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain if fintech competitors accelerate digital disruption or if regional slowdowns in key markets dampen loan growth and revenue expansion.

Find out about the key risks to this Enterprise Financial Services narrative.Another View: SWS DCF Model

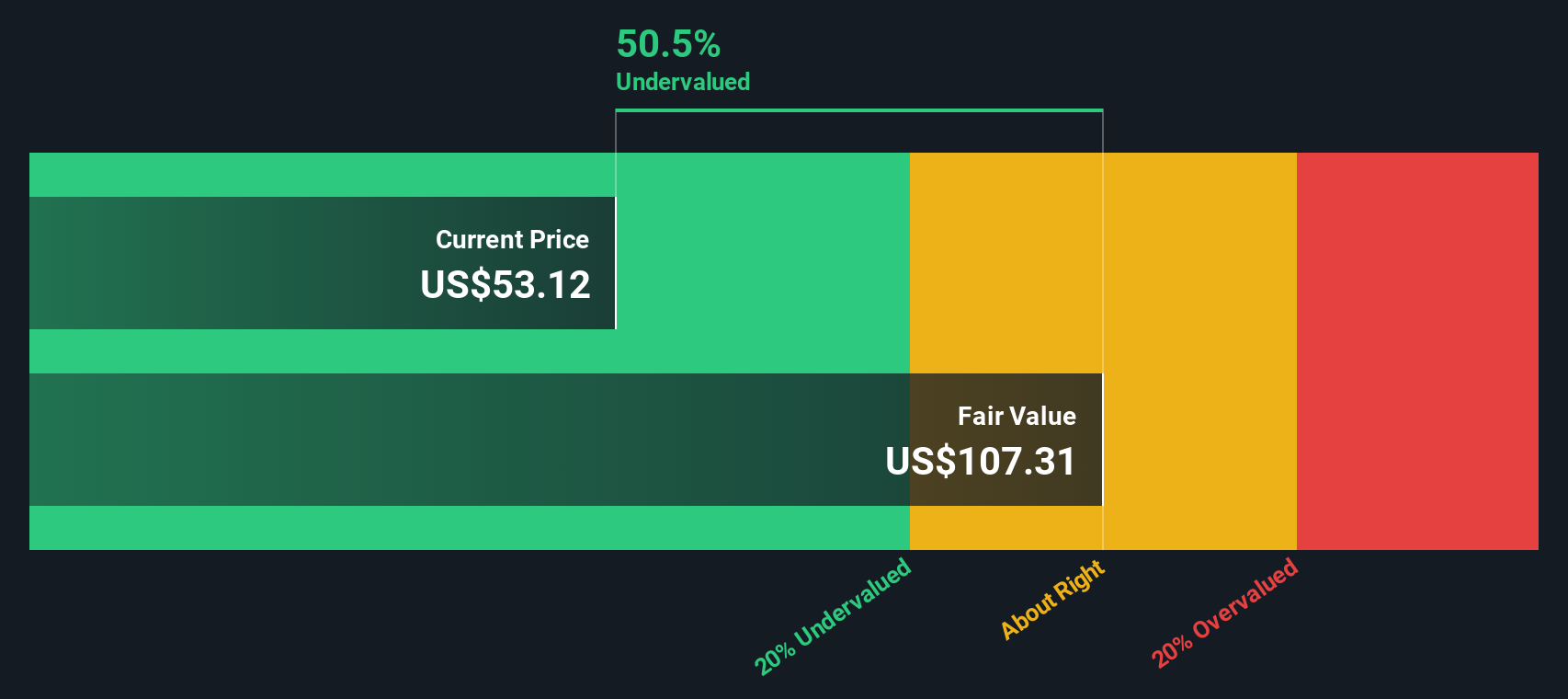

Our DCF model presents a more optimistic picture, suggesting Enterprise Financial Services is trading well below its calculated intrinsic value. This raises the question: could the market be overlooking hidden value, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Enterprise Financial Services for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Enterprise Financial Services Narrative

If you have a different angle or believe the numbers tell another story, the platform makes it easy to craft your own analysis in just minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Enterprise Financial Services.

Looking for More High-Potential Investment Ideas?

Seize this moment to uncover fresh opportunities that could supercharge your portfolio. Let Simply Wall Street's powerful screener connect you with ideas you might otherwise miss.

- Uncover hidden value in companies with strong cash flow by using our undervalued stocks based on cash flows tool to pinpoint stocks trading below their true worth.

- Grow your income stream by tracking down companies offering generous payouts with the help of our dividend stocks with yields > 3% feature, crafted for yield-seeking investors.

- Position yourself at the forefront of finance by selecting emerging leaders in digital currencies through the cryptocurrency and blockchain stocks search for innovators in blockchain and cryptocurrency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EFSC

Enterprise Financial Services

Operates as the financial holding company for Enterprise Bank & Trust that offers banking and wealth management services to individuals and corporate customers in Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives