- United States

- /

- Banks

- /

- NasdaqGM:EBMT

Here's Why Eagle Bancorp Montana, Inc.'s (NASDAQ:EBMT) CEO Compensation Is The Least Of Shareholders' Concerns

CEO Pete Johnson has done a decent job of delivering relatively good performance at Eagle Bancorp Montana, Inc. (NASDAQ:EBMT) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 22 April 2021. We present our case of why we think CEO compensation looks fair.

See our latest analysis for Eagle Bancorp Montana

Comparing Eagle Bancorp Montana, Inc.'s CEO Compensation With the industry

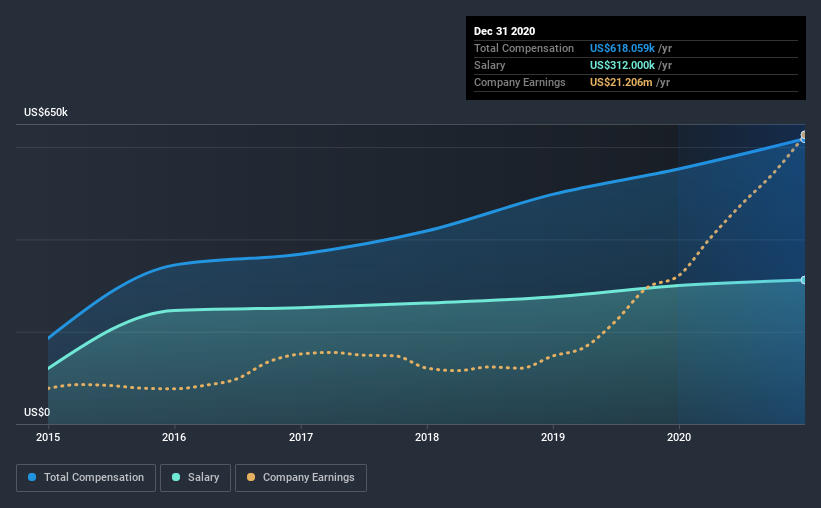

According to our data, Eagle Bancorp Montana, Inc. has a market capitalization of US$160m, and paid its CEO total annual compensation worth US$618k over the year to December 2020. That's a notable increase of 12% on last year. Notably, the salary which is US$312.0k, represents a considerable chunk of the total compensation being paid.

For comparison, other companies in the same industry with market capitalizations ranging between US$100m and US$400m had a median total CEO compensation of US$772k. From this we gather that Pete Johnson is paid around the median for CEOs in the industry. Moreover, Pete Johnson also holds US$2.1m worth of Eagle Bancorp Montana stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$312k | US$300k | 50% |

| Other | US$306k | US$253k | 50% |

| Total Compensation | US$618k | US$553k | 100% |

Talking in terms of the industry, salary represented approximately 42% of total compensation out of all the companies we analyzed, while other remuneration made up 58% of the pie. Eagle Bancorp Montana pays out 50% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Eagle Bancorp Montana, Inc.'s Growth Numbers

Eagle Bancorp Montana, Inc.'s earnings per share (EPS) grew 46% per year over the last three years. It achieved revenue growth of 48% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Eagle Bancorp Montana, Inc. Been A Good Investment?

Eagle Bancorp Montana, Inc. has generated a total shareholder return of 20% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We did our research and identified 4 warning signs (and 2 which can't be ignored) in Eagle Bancorp Montana we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Eagle Bancorp Montana or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eagle Bancorp Montana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:EBMT

Eagle Bancorp Montana

Operates as the bank holding company for Opportunity Bank of Montana that provides various retail banking products and services to small businesses and individuals in Montana.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives