- United States

- /

- Banks

- /

- NasdaqGS:EBC

The one-year underlying earnings growth at Eastern Bankshares (NASDAQ:EBC) is promising, but the shareholders are still in the red over that time

It's understandable if you feel frustrated when a stock you own sees a lower share price. But often it is not a reflection of the fundamental business performance. The Eastern Bankshares, Inc. (NASDAQ:EBC) is down 14% over a year, but the total shareholder return is -12% once you include the dividend. That's better than the market which declined 20% over the last year. We wouldn't rush to judgement on Eastern Bankshares because we don't have a long term history to look at. The share price has dropped 15% in three months. Of course, this share price action may well have been influenced by the 15% decline in the broader market, throughout the period.

With the stock having lost 5.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Eastern Bankshares

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Eastern Bankshares share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It's surprising to see the share price fall so much, despite the improved EPS. But we might find some different metrics explain the share price movements better.

Eastern Bankshares managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

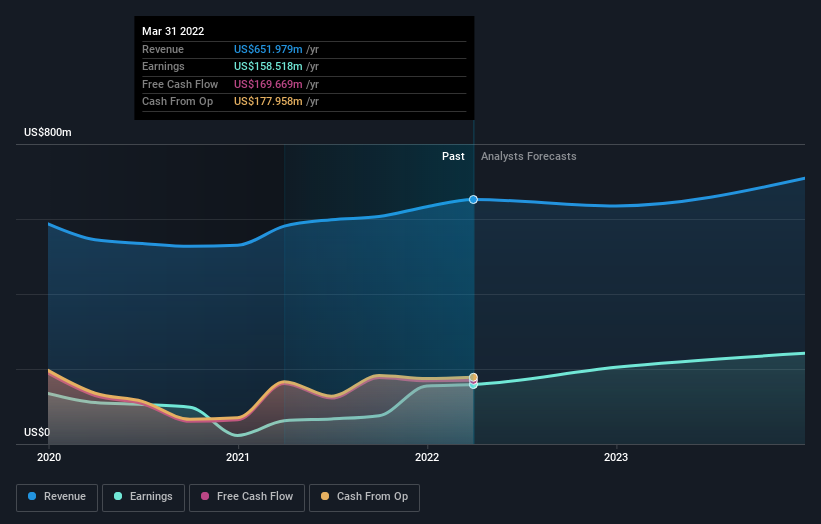

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that Eastern Bankshares has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Eastern Bankshares in this interactive graph of future profit estimates.

A Different Perspective

While they no doubt would have preferred make a profit, at least Eastern Bankshares shareholders didn't do too badly in the last year. Their loss of 12%, including dividends, actually beat the broader market, which lost around 20%. Things weren't so bad until the last three months, when the stock dropped 15%. It's always a worry to see a share price decline like that, but at the same time, it is an unavoidable part of investing. However, this could create an opportunity if the fundamentals remain strong. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Eastern Bankshares has 2 warning signs we think you should be aware of.

Of course Eastern Bankshares may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Bankshares might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:EBC

Eastern Bankshares

Operates as the bank holding company for Eastern Bank that provides banking products and services primarily to retail, commercial, and small business customers.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives