- United States

- /

- Banks

- /

- NYSE:CPF

Discover Top US Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As the U.S. stock market reaches new heights with the S&P 500 and Nasdaq Composite hitting record highs, investor focus is on the Federal Reserve's upcoming interest rate decision. In this environment of heightened market activity, dividend stocks offer a compelling option for those seeking steady income and potential growth, making them an attractive consideration for diversifying portfolios amidst economic shifts.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Isabella Bank (OTCPK:ISBA) | 4.97% | ★★★★★★ |

| BCB Bancorp (NasdaqGM:BCBP) | 4.92% | ★★★★★★ |

| Columbia Banking System (NasdaqGS:COLB) | 4.54% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.27% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.62% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

| Heritage Commerce (NasdaqGS:HTBK) | 4.74% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.46% | ★★★★★★ |

| Carter's (NYSE:CRI) | 6.08% | ★★★★★☆ |

Click here to see the full list of 135 stocks from our Top US Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

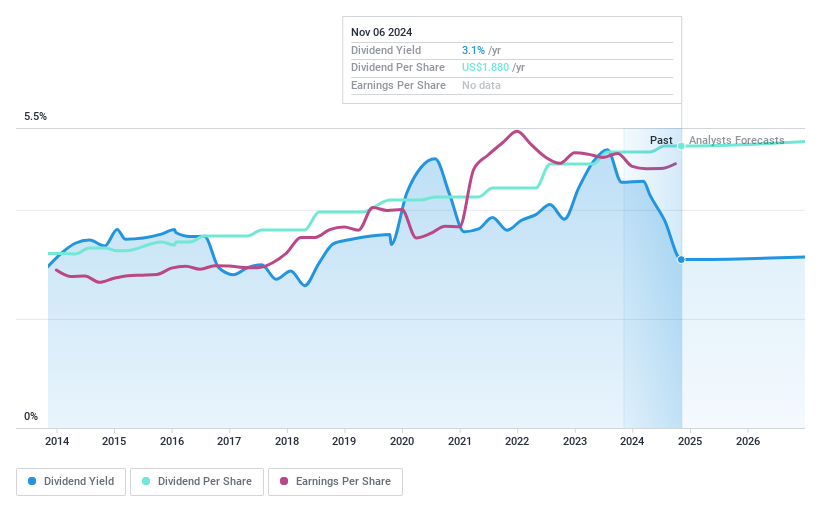

Community Trust Bancorp (NasdaqGS:CTBI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Community Trust Bancorp, Inc. operates as the bank holding company for Community Trust Bank, Inc., with a market cap of approximately $952.97 million.

Operations: Community Trust Bancorp, Inc. generates revenue through its Community Banking Services segment, which accounts for $226.76 million.

Dividend Yield: 3.1%

Community Trust Bancorp maintains a stable dividend history, with payments growing steadily over the past decade. The company recently declared a cash dividend of US$0.47 per share, payable in early 2025. Despite a relatively low yield of 3.09% compared to top-tier U.S. dividend payers, its dividends are well-covered by earnings with a payout ratio of 42%. Recent earnings reports show improved net interest income and net income year-over-year, supporting future dividend sustainability.

- Get an in-depth perspective on Community Trust Bancorp's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Community Trust Bancorp's current price could be quite moderate.

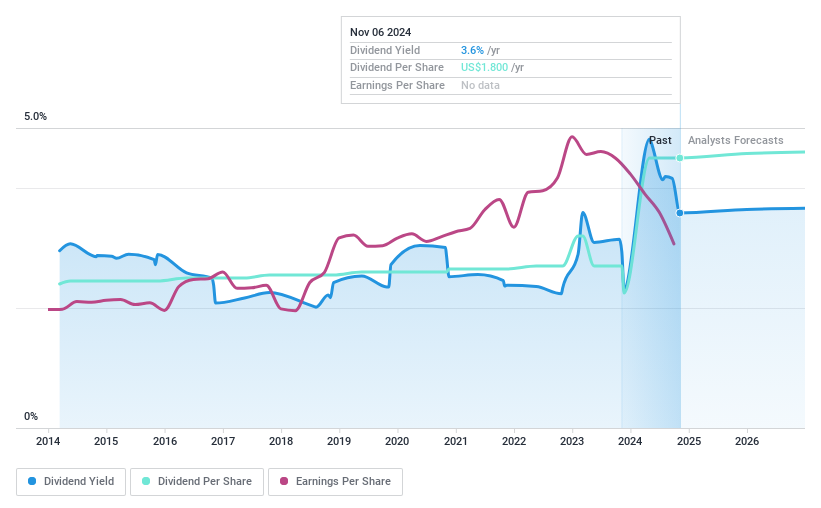

First Financial (NasdaqGS:THFF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: First Financial Corporation, with a market cap of $518.74 million, operates through its subsidiaries to offer a range of financial services.

Operations: First Financial Corporation generates revenue of $195.62 million through its banking segment.

Dividend Yield: 3.6%

First Financial Corporation's dividend history shows volatility, with past payments experiencing significant fluctuations. Despite this, the recent dividend of US$0.45 per share reflects a commitment to shareholders. The company's payout ratio stands at 48.9%, indicating dividends are currently well-covered by earnings and forecasted to remain so in three years with a 33.9% payout ratio. Recent financial results highlight increased net interest income but decreased net income, impacting overall dividend sustainability prospects.

- Click to explore a detailed breakdown of our findings in First Financial's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of First Financial shares in the market.

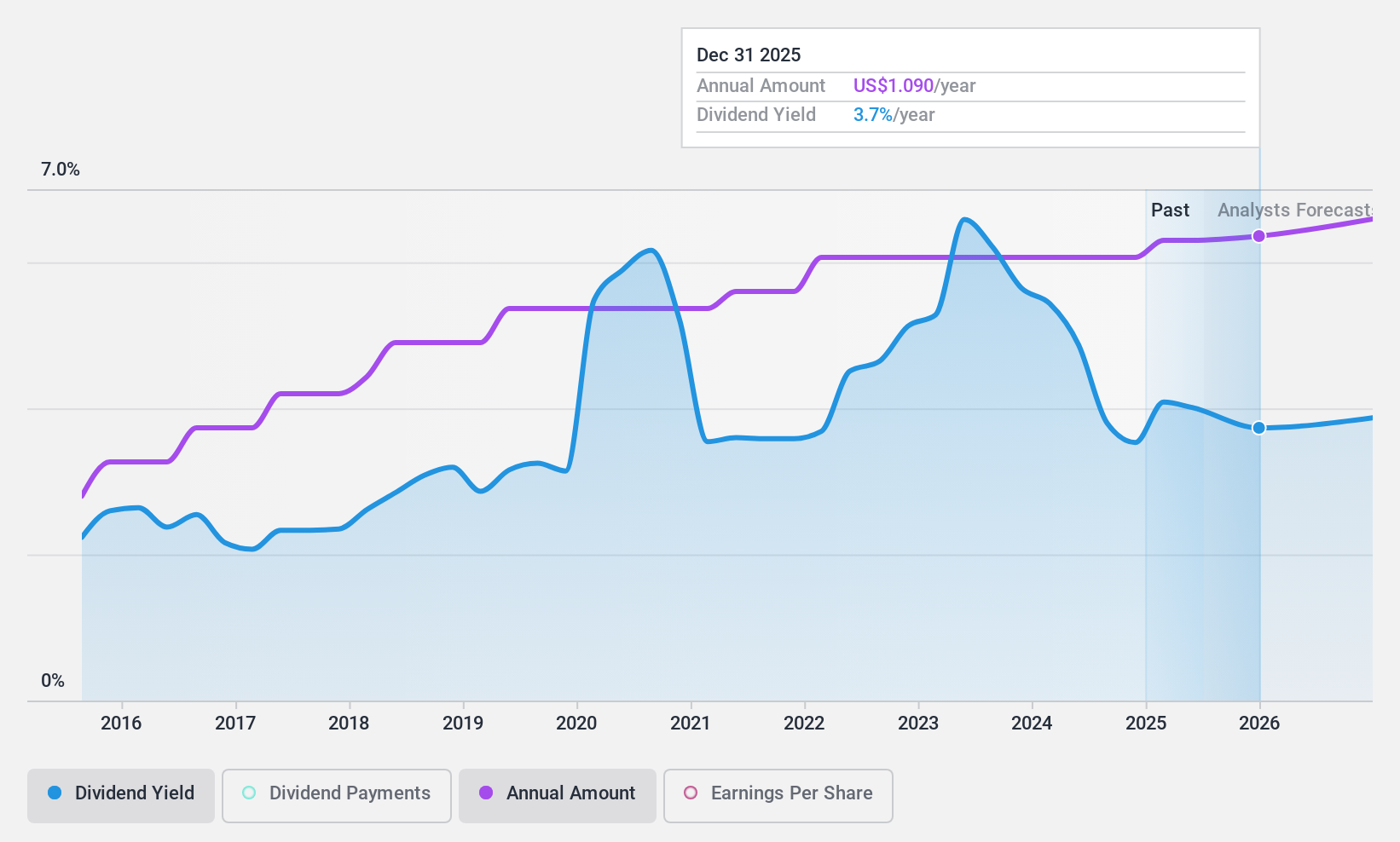

Central Pacific Financial (NYSE:CPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Central Pacific Financial Corp. is the bank holding company for Central Pacific Bank, offering a variety of commercial banking products and services to businesses, professionals, and individuals in the United States, with a market cap of approximately $742.38 million.

Operations: Central Pacific Financial Corp.'s revenue is primarily derived from its banking segment, which generated $244.64 million.

Dividend Yield: 3.3%

Central Pacific Financial maintains a stable dividend history, recently affirming a US$0.26 per share quarterly dividend. Despite net charge-offs of US$3.6 million and consistent net income growth, its 3.33% yield is below top-tier payers in the U.S. The payout ratio of 49.4% suggests dividends are well-covered by earnings and projected to remain sustainable with future coverage at 38.7%. Ongoing M&A discussions could influence financial dynamics further, pending outcomes.

- Click here to discover the nuances of Central Pacific Financial with our detailed analytical dividend report.

- According our valuation report, there's an indication that Central Pacific Financial's share price might be on the expensive side.

Key Takeaways

- Investigate our full lineup of 135 Top US Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPF

Central Pacific Financial

Operates as the bank holding company for Central Pacific Bank that provides a range of commercial banking products and services to businesses, professionals, and individuals in the United States.

Flawless balance sheet established dividend payer.