- United States

- /

- Banks

- /

- NasdaqGS:COLB

Columbia Banking System (NasdaqGS:COLB) Q1 2025 Results Show Decline in Net Income

Reviewed by Simply Wall St

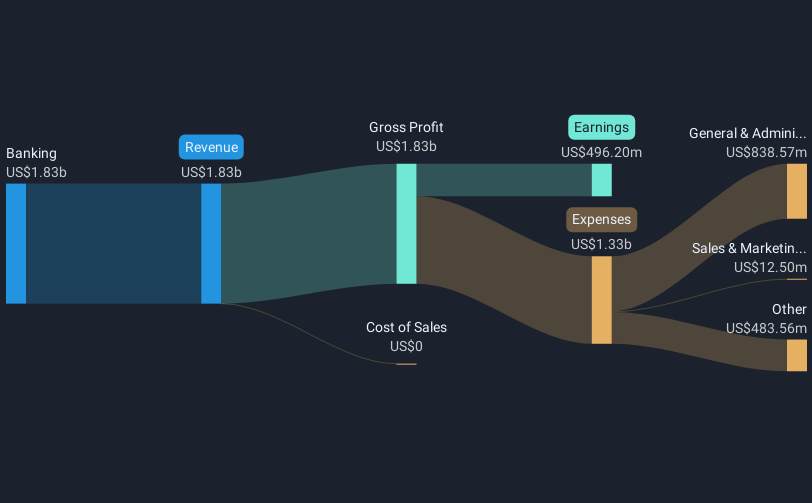

Columbia Banking System (NasdaqGS:COLB) recently announced its first-quarter 2025 financial results, revealing a small rise in net interest income and significant declines in net income and earnings per share. Despite these mixed results, the company's stock price climbed 23% over the past month. This movement aligns closely with a broader market trend, which saw a notable rise of 4% over the last week. Although the earnings underperformance could symbolize a potential headwind, the improvement in credit quality, as evidenced by reduced charge-offs, may have helped bolster investor confidence, aligning with broader market optimism.

The recent financial results of Columbia Banking System, which showed mixed performance with a rise in net interest income but declines in net income and earnings per share, could influence its future revenue and earnings projections. The positive market reaction, with a 23% share price increase over the past month, might reflect investor optimism in the broader market rally and improved credit quality. However, the challenges highlighted in the results might continue to exert pressure on earnings forecasts, particularly if inflationary pressures and high-cost wholesale funding persist.

Over a five-year period, Columbia Banking System's total shareholder returns (including dividends) amounted to 97.43%. This longer-term performance suggests that, despite recent earnings challenges, the company has provided substantial returns to its shareholders. In the context of broader performance, Columbia's share price exceeded the US market with an 11.6% return and outperformed the Banks industry’s 19.9% return over the past year.

With the current share price standing at US$23.25, the appreciation towards the analysts' consensus price target of US$27.32 implies a potential upside, representing a 14.9% increase. However, investors should consider the risks associated with earnings volatility, given the dependency on economic and market conditions. The company's initiatives like branch expansion and technological enhancements are expected to support longer-term growth, but the immediate impact on revenue and profit projections will need close observation as more concrete data emerge.

Learn about Columbia Banking System's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Umpqua Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives