- United States

- /

- Banks

- /

- NasdaqGS:COLB

Columbia Banking System (COLB) Ups Dividend: What Does This Signal About Its Capital Strategy?

Reviewed by Sasha Jovanovic

- On November 14, 2025, Columbia Banking System, Inc. announced that its Board of Directors approved a 3% increase in its quarterly cash dividend to US$0.37 per common share, payable on December 15, 2025, for shareholders of record as of November 28, 2025.

- This dividend increase highlights the company's ongoing commitment to shareholder returns and signals the Board's confidence in Columbia's financial health.

- We'll explore how this higher dividend payout underscores management's capital management approach and what it might mean for Columbia's investment case.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Columbia Banking System Investment Narrative Recap

Investors who see long-term value in Columbia Banking System need to believe in the bank’s ability to manage growth and integrate acquisitions without sacrificing financial stability or shareholder returns. The recent dividend increase to US$0.37 per share reinforces management’s focus on rewarding shareholders, but does not materially alter the biggest short-term catalyst, which remains the successful integration of the Pacific Premier acquisition, or the main risk of regional economic exposure.

Among recent developments, the Q3 2025 earnings report stands out as particularly relevant, with net interest income increasing but net income coming in lower year over year. The dividend increase arrives against this mixed earnings backdrop, making it a reflection of board confidence in normalized profitability, even as integration and profitability pressures persist.

However, contrasting Columbia’s dividend growth story is the risk tied to its high geographic concentration, information investors need to be aware of as they consider…

Read the full narrative on Columbia Banking System (it's free!)

Columbia Banking System's narrative projects $3.5 billion revenue and $1.3 billion earnings by 2028. This requires 22.8% yearly revenue growth and an increase of $771.5 million in earnings from $528.5 million today.

Uncover how Columbia Banking System's forecasts yield a $29.46 fair value, a 9% upside to its current price.

Exploring Other Perspectives

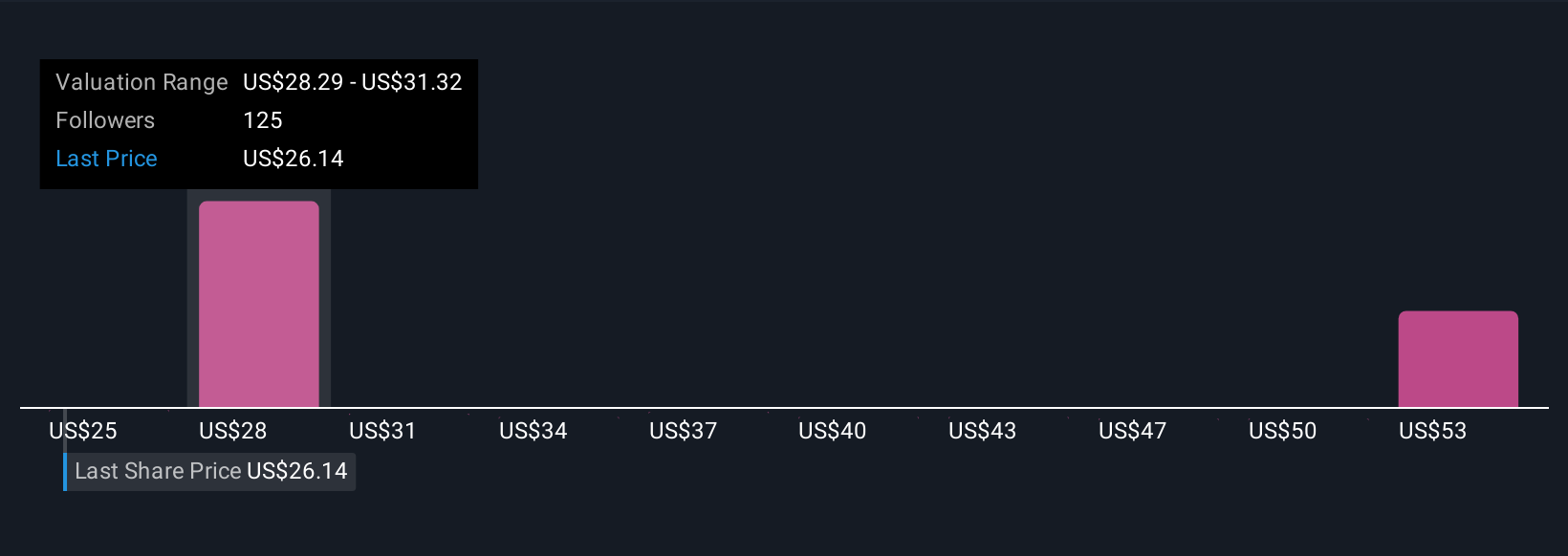

Nineteen members of the Simply Wall St Community estimate Columbia’s fair value between US$25.25 and US$57.68 per share. While optimism surrounds future expansion, many highlight that regional concentration could shape the company’s performance in coming quarters, explore these diverse viewpoints for a fuller understanding.

Explore 19 other fair value estimates on Columbia Banking System - why the stock might be worth over 2x more than the current price!

Build Your Own Columbia Banking System Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Columbia Banking System research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Columbia Banking System research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Columbia Banking System's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives