Last Update 15 Dec 25

Fair value Increased 0.52%COLB: Future Returns Will Reflect Buybacks And Dividend Increases Amid Mixed Earnings Outlook

Analysts have nudged their price target on Columbia Banking System modestly higher to about $29.62 from roughly $29.46. They cite a more attractive risk and reward profile supported by upgraded ratings, incremental price target increases across the Street, and expectations for improved earnings consistency and capital deployment despite tempered outer year EPS estimates.

Analyst Commentary

Street research on Columbia Banking System highlights a mix of constructive long term views and near term caution, with adjustments to earnings forecasts and price targets shaping the stock's current valuation narrative.

Bullish Takeaways

- Bullish analysts argue the stock remains inexpensive relative to its peer group and its own historical multiples, noting it has meaningfully lagged despite improving fundamentals.

- Improved earnings visibility and consistency, supported by clearer guidance and better control of non interest expenses, are viewed as key to unlocking a higher, more sustainable valuation.

- Capital flexibility, including the potential for share buybacks, is seen as an important catalyst that could enhance per share earnings growth and support upside to current price targets.

- JPMorgan points to expectations for solid loan and deposit growth and gradually improving net interest margins, reinforcing a constructive outlook on medium term growth and returns.

Bearish Takeaways

- Bearish analysts are trimming outer year EPS estimates, reflecting a smaller planned balance sheet and pressure on net interest margin that could cap earnings growth versus earlier expectations.

- Concerns that structural margin headwinds will offset some benefits from better expense control and buybacks create uncertainty around the pace of earnings recovery.

- The modest lowering of certain price targets, even with positive ratings, signals that execution on balance sheet optimization and margin management is crucial to justify further multiple expansion.

- Some investors may remain cautious until Columbia demonstrates that forecasted improvements in profitability and capital deployment can be delivered consistently across multiple years.

What's in the News

- Board authorizes a share repurchase program of up to $700 million, with the buyback plan effective through November 30, 2026 (Key Developments).

- Quarterly cash dividend increased by 3% to $0.37 per common share, payable December 15, 2025, reflecting a more shareholder-friendly capital return stance (Key Developments).

- HoldCo Asset Management issues an activist presentation to the Board, signaling potential proxy pressure if strategic and governance concerns are not addressed (Key Developments).

- Chief Financial Officer Ronald Farnsworth to step down effective December 31, 2025, with Deputy CFO Ivan Seda promoted to CFO to ensure continuity in financial leadership (Key Developments).

- Net charge-offs for the quarter ended September 30, 2025, reported at $22 million, down from $30 million a year earlier, indicating improving credit performance (Key Developments).

Valuation Changes

- Fair Value: nudged higher from approximately $29.46 to about $29.62, reflecting a very modest upward revision in intrinsic value estimates.

- Discount Rate: effectively unchanged, edging fractionally lower from about 6.96% to 6.96%, implying a stable risk assessment.

- Revenue Growth: steady, with long term growth expectations essentially flat at roughly 19.59%.

- Net Profit Margin: maintained at about 35.08%, with only immaterial numerical rounding changes in the model.

- Future P/E: risen slightly from approximately 11.47x to about 11.53x, indicating a marginally higher multiple applied to forward earnings.

Key Takeaways

- Expansion into high-growth Western regions and diversification of fee-based services are expected to drive revenue growth and stabilize earnings.

- Strategic investments in digital banking and operational efficiency should boost customer engagement, reduce costs, and enhance profitability.

- Heavy regional concentration, integration risks, lagging digital innovation, funding challenges, and portfolio runoff all threaten profitability and sustainable long-term revenue growth.

Catalysts

About Columbia Banking System- Operates as the Bank holding company of Umpqua Bank that provides banking, private banking, mortgage, and other financial services in the United States.

- The planned acquisition and integration of Pacific Premier is positioned to significantly expand Columbia's customer base and market reach in high-growth Western U.S. regions, increasing loan and deposit growth as both population and economic activity continue to rise in these areas; this is likely to have a positive impact on revenue and long-term earnings.

- Continued investment in AI, digital banking platforms, and embedded financial products is expected to drive greater customer engagement, acquisition, and retention-particularly as more consumers and businesses shift to digital channels-supporting higher fee income and reduced operating costs, thus improving net margins and earnings.

- The strategic expansion of fee-based businesses (treasury management, trust/custodial services, commercial card, merchant, and international banking), including new lines brought by Pacific Premier, should diversify revenue streams well beyond traditional lending, providing steadier top-line growth and helping to stabilize net margins.

- Columbia's disciplined approach to business banking, strong relationship focus, and targeting of small business clients positions it to benefit from the steady trend of small business formation in the U.S., which is likely to propel loan growth and recurring fee income, supporting revenue and earnings expansion.

- Ongoing operational efficiency initiatives, realized cost synergies from the Umpqua merger, and a robust capital position set the stage for ongoing improvements in operating leverage, capital returns, and ultimately, stronger net margins and book value per share.

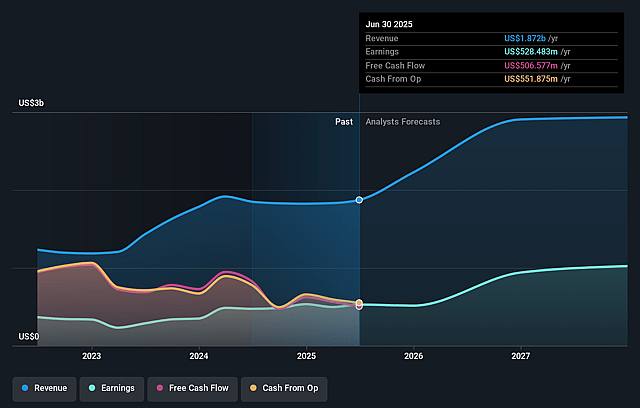

Columbia Banking System Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Columbia Banking System's revenue will grow by 22.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 28.2% today to 36.9% in 3 years time.

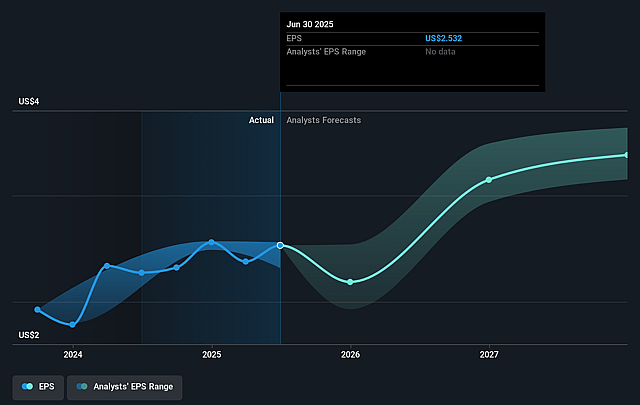

- Analysts expect earnings to reach $1.3 billion (and earnings per share of $3.38) by about September 2028, up from $528.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.8x on those 2028 earnings, down from 10.3x today. This future PE is lower than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to grow by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.35%, as per the Simply Wall St company report.

Columbia Banking System Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geographic and client base concentration remains high, with legacy and expanded operations still heavily dependent on the Western U.S. and specific new markets (e.g., Intermountain states), leaving Columbia Banking System vulnerable to regional economic downturns-potentially impacting credit quality, loan losses, and ultimately net margins and earnings.

- The company is engaged in multiple major integrations in close succession (recent Umpqua merger and upcoming Pacific Premier acquisition), which heightens execution risk; failure to realize anticipated synergies or unexpected integration costs could put pressure on operating efficiency and net margins.

- While technology investment in AI and fintech is mentioned, ongoing digitalization across banking creates competitive risk if Columbia lags relative to national banks or fintechs in delivering innovative online and mobile experiences; this could drive higher customer attrition and limit new customer acquisition, negatively affecting revenue and long-term growth.

- Prolonged deposit outflows, influenced by seasonal factors but also by customers' shifting funds into wealth management products or paying down debt, combined with reliance on wholesale funding to cover deposit shortfalls, could increase funding costs and compress net interest margins, eroding profitability.

- Continued runoff and repricing of the $6 billion legacy transactional asset portfolio creates an earnings headwind, and muted or negative net loan growth may persist during the multi-year transition; this could constrain revenue growth and delay improvement in overall profitability despite efforts to remix and improve the loan book.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $28.333 for Columbia Banking System based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $35.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $1.3 billion, and it would be trading on a PE ratio of 5.8x, assuming you use a discount rate of 7.3%.

- Given the current share price of $25.96, the analyst price target of $28.33 is 8.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Columbia Banking System?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.