- United States

- /

- Banks

- /

- NasdaqGS:COLB

Columbia Banking System (COLB): Fresh Valuation Insights After Regional Bank Rally on Fed Signals

Reviewed by Simply Wall St

If you have been watching Columbia Banking System (COLB) lately, the last few trading sessions may have caught your attention. Shares jumped as regional bank stocks rallied, sparked by comments from Federal Reserve Chair Jerome Powell at Jackson Hole. Powell’s hints at possible interest rate cuts sent a wave of optimism through regional banks like Columbia, which tend to react quickly to changes in the rate environment.

This move follows a year marked by more gradual gains. Columbia Banking System’s stock has risen about 12% over the past twelve months, buoyed by waves of improved sentiment whenever rate cuts come back into focus. Participation in key industry conferences and a steady dividend highlight a business that aims to communicate stability and future prospects. However, the shift in monetary outlook is what pushed shares higher in the past month.

With the stock now back in the spotlight, the question is whether the market is reflecting all of Columbia's potential growth, or if there is still value left for buyers willing to look deeper. Is this price movement the start of a new trend, or are investors already paying up for what comes next?

Most Popular Narrative: 2.5% Undervalued

According to community narrative, Columbia Banking System is trading slightly below its estimated fair value, signaling modest upside potential as major strategic moves play out.

The planned acquisition and integration of Pacific Premier is expected to significantly expand Columbia's customer base and market reach in high-growth Western U.S. regions. This could increase loan and deposit growth as both population and economic activity continue to rise in these areas, potentially having a positive impact on revenue and long-term earnings.

What is really fueling this price target? Under the surface, aggressive growth projections and a potential shift in future profit margins could alter the company's earnings trajectory. Interested in which assumptions are powering this fair value estimate? Explore further to uncover the financial reasoning behind the market’s current valuation.

Result: Fair Value of $27.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, concentrated exposure to Western U.S. markets and challenges in integrating major acquisitions could quickly undermine the current growth outlook for Columbia.

Find out about the key risks to this Columbia Banking System narrative.Another View: Discounted Cash Flow Perspective

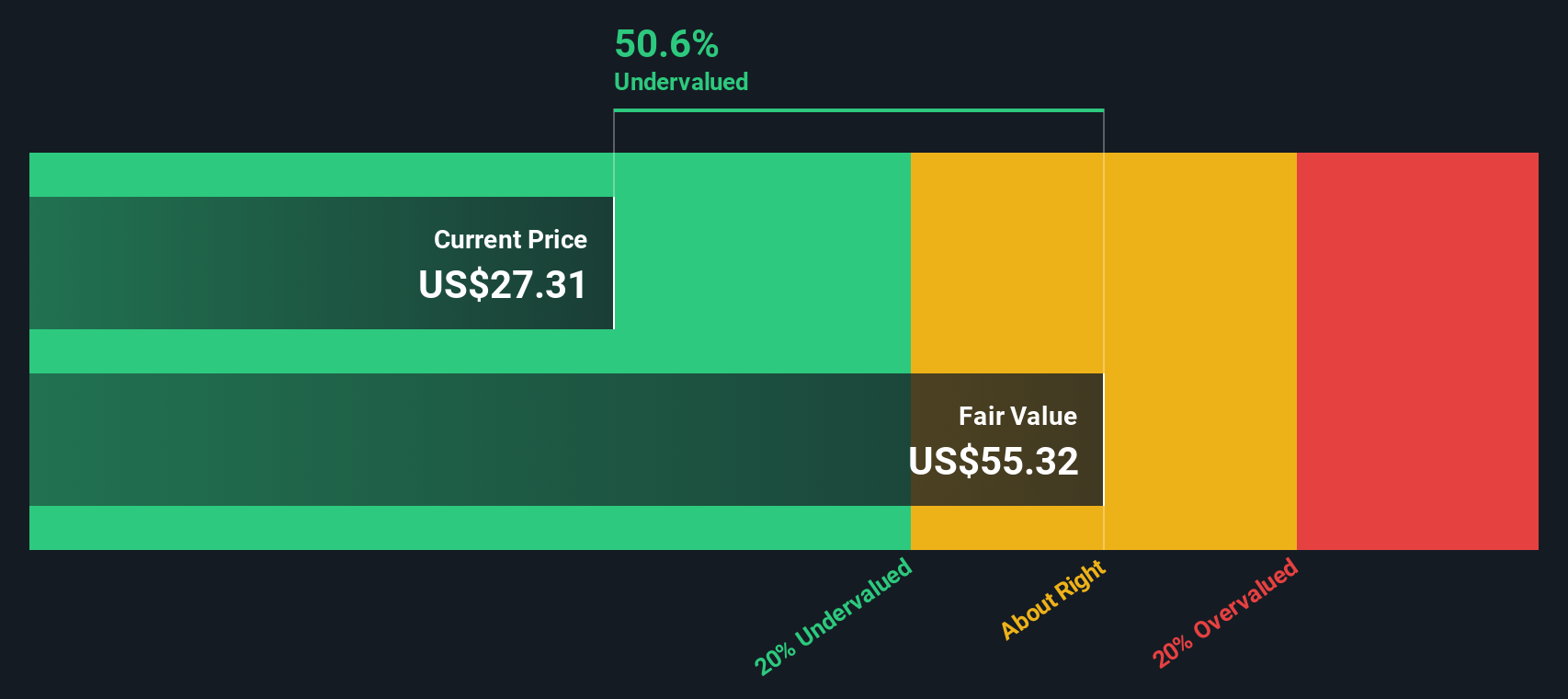

Looking at Columbia Banking System from our DCF model offers a notably different result. This suggests the shares are much further below their estimated fair value. Is the market missing something, or is the gap justified?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Columbia Banking System Narrative

If you want to dig into the numbers yourself and craft a perspective that fits your outlook, you can build your own narrative in just a few minutes, or simply do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Columbia Banking System.

Looking for More Smart Investment Ideas?

Why stop with Columbia? Sharpen your strategy by checking out other stock ideas that could put you ahead of the market. Opportunity knocks for those who seize it first. See what might be next for your portfolio with these hand-picked stock groups:

- Maximize your income with companies offering dividend stocks with yields > 3% and enjoy reliable cash flow with every payout.

- Jump on the AI trend by investing in AI penny stocks that are pioneering the future of intelligent technology and leading innovation in every sector.

- Tap into the healthcare revolution and scan the fast-growing landscape of healthcare AI stocks that blend cutting-edge medical breakthroughs with artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Umpqua Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives