- United States

- /

- Banks

- /

- NasdaqGS:CLBK

Columbia Financial (CLBK): Is Recent Market Optimism Reflected in Today’s Valuation?

Reviewed by Kshitija Bhandaru

Columbia Financial (CLBK) gained momentum as investors responded to upbeat sentiment in the financial sector, following strong earnings from big banks and hints from the Federal Reserve of a coming shift in monetary policy. Elevated anticipation around the company’s upcoming earnings report and news of a share repurchase plan have kept market attention focused.

See our latest analysis for Columbia Financial.

Columbia Financial has seen heightened volatility lately, with recent excitement following sector-wide gains now giving way to a cooling off. Its 1-day share price return is down 4.18%, while its year-to-date return has slipped 11.62%. Despite upbeat momentum sparked by strong bank earnings and its own share buyback news, the stock’s one-year total shareholder return stands at -21.89%, signaling ongoing challenges even as long-term investors retain a modest five-year gain of just 9.03%.

If current financial sector buzz has you searching for other compelling ideas, consider broadening your scope to discover fast growing stocks with high insider ownership.

With shares now trading roughly 23% below analyst targets and recent performance still lagging, investors are left to consider whether Columbia Financial is undervalued at today’s levels or if the market has already accounted for any recovery ahead.

Price-to-Book Ratio of 1.3x: Is it justified?

Columbia Financial is currently trading at a price-to-book ratio of 1.3x, which makes it appear expensive relative to the averages seen among its peers. This premium pricing stands out, especially given the company’s recent share price performance and sector trends.

The price-to-book ratio measures how much investors are paying for each dollar of net assets on Columbia Financial's balance sheet. For banks, this multiple is an important gauge since it reflects market confidence in the value and profitability of their core lending and deposit businesses.

Despite being a seasoned institution, Columbia Financial’s price-to-book ratio of 1.3x is notably higher than both its immediate peers (average 0.9x) and the wider US Banks industry (average 1x). This market premium suggests elevated expectations or a potential overpricing compared to similar banks, especially given recent underperformance in returns.

See what the numbers say about this price — find out in our valuation breakdown.

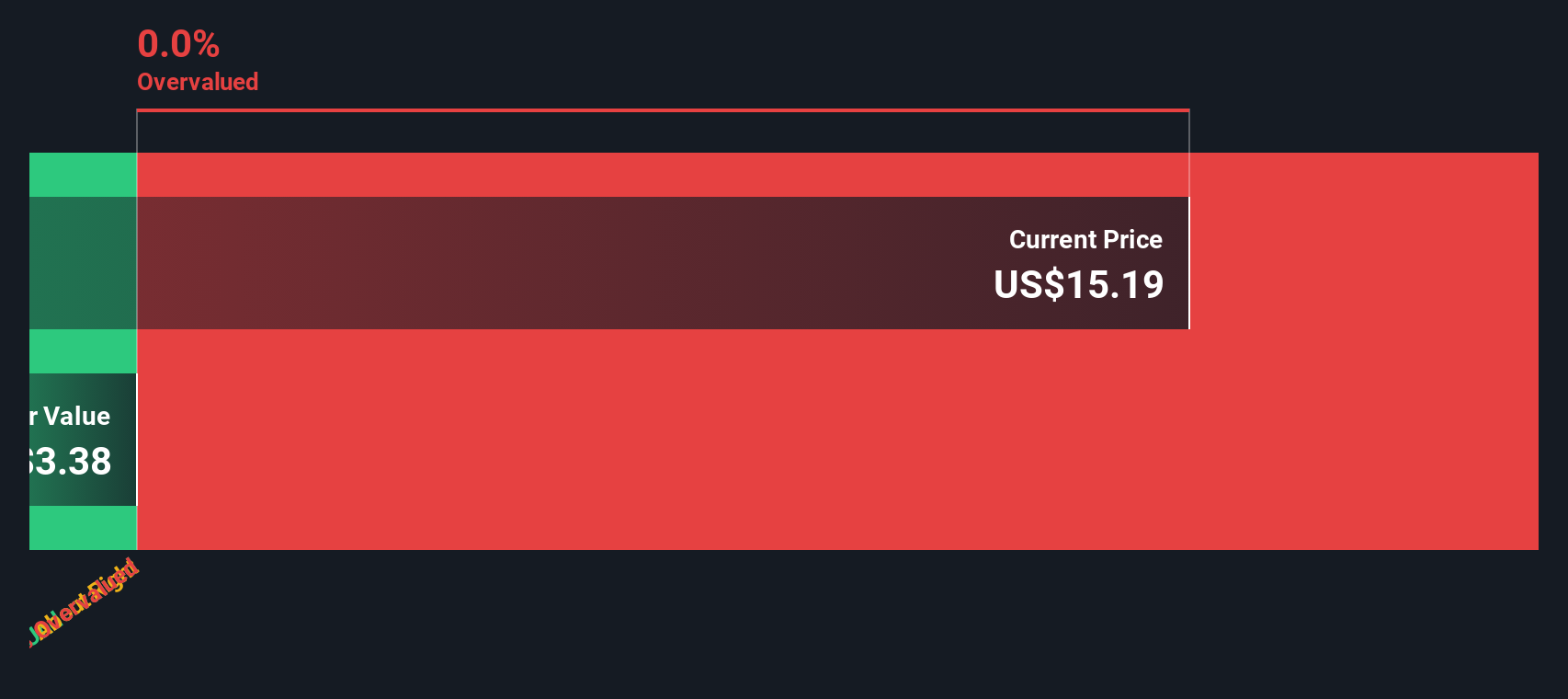

Result: Price-to-Book Ratio of 1.3x (OVERVALUED)

However, investors should note that weak one-year returns and ongoing earnings volatility could quickly challenge the view that shares are simply undervalued.

Find out about the key risks to this Columbia Financial narrative.

Another View: Discounted Cash Flow Paints a Different Picture

Looking through the lens of our DCF model, Columbia Financial appears to be trading well above its calculated fair value, which stands at just $0.95 per share. While multiples reflect current market sentiment, this cash flow view suggests significant overvaluation based on future fundamentals. Could the market be too optimistic, or is there something DCF cannot see?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Columbia Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Columbia Financial Narrative

If you want a different perspective or have your own conclusions from the data, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Columbia Financial research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Success favors the prepared, so don't let new opportunities pass you by. Use Simply Wall Street's powerful tools to find hidden gems and fresh possibilities.

- Capitalize on fast-moving tech by checking out these 24 AI penny stocks, which are making waves with advanced artificial intelligence breakthroughs and real-world innovations.

- Secure steady income streams by previewing these 20 dividend stocks with yields > 3%, which offer reliable yields above 3% for income-focused portfolios.

- Seize unique growth angles in tomorrow’s finance by reviewing these 79 cryptocurrency and blockchain stocks, which capture the momentum in blockchain and cryptocurrency trends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLBK

Columbia Financial

Operates as a bank holding company for Columbia Bank that provides banking and other financial services to businesses and consumers in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives