- United States

- /

- Banks

- /

- OTCPK:CIZN

Don't Buy Citizens Holding Company (NASDAQ:CIZN) For Its Next Dividend Without Doing These Checks

It looks like Citizens Holding Company (NASDAQ:CIZN) is about to go ex-dividend in the next four days. If you purchase the stock on or after the 16th of March, you won't be eligible to receive this dividend, when it is paid on the 31st of March.

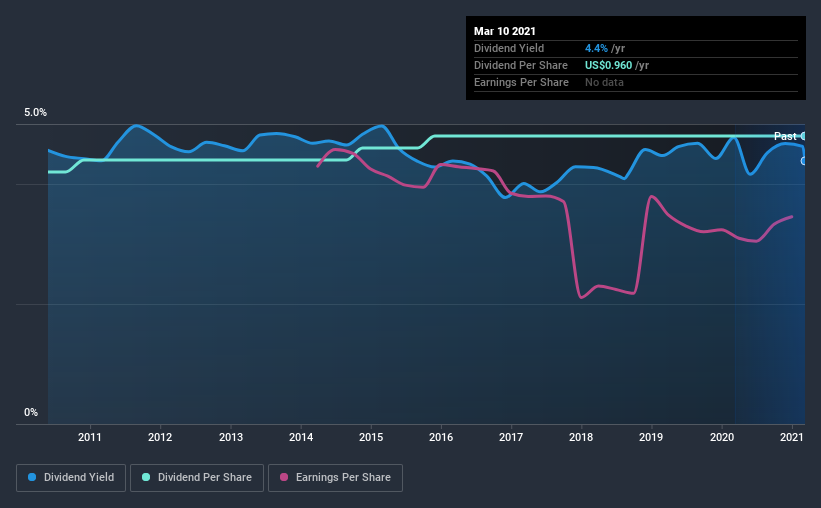

Citizens Holding's next dividend payment will be US$0.24 per share, on the back of last year when the company paid a total of US$0.96 to shareholders. Looking at the last 12 months of distributions, Citizens Holding has a trailing yield of approximately 4.4% on its current stock price of $21.89. If you buy this business for its dividend, you should have an idea of whether Citizens Holding's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

See our latest analysis for Citizens Holding

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Its dividend payout ratio is 77% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. It could become a concern if earnings started to decline.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see how much of its profit Citizens Holding paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's not ideal to see Citizens Holding's earnings per share have been shrinking at 4.4% a year over the previous five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Citizens Holding has delivered an average of 1.3% per year annual increase in its dividend, based on the past 10 years of dividend payments.

To Sum It Up

Is Citizens Holding an attractive dividend stock, or better left on the shelf? Earnings per share have been declining and the company is paying out more than half its profits to shareholders; not an enticing combination. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

Although, if you're still interested in Citizens Holding and want to know more, you'll find it very useful to know what risks this stock faces. Our analysis shows 1 warning sign for Citizens Holding and you should be aware of this before buying any shares.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Citizens Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:CIZN

Citizens Holding

Operates as the bank holding company for The Citizens Bank of Philadelphia that provides various banking products and services.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success