- United States

- /

- Banks

- /

- NasdaqCM:CIVB

Civista Bancshares (CIVB) Net Margin Expansion Reinforces Bullish Narratives on Profitability

Reviewed by Simply Wall St

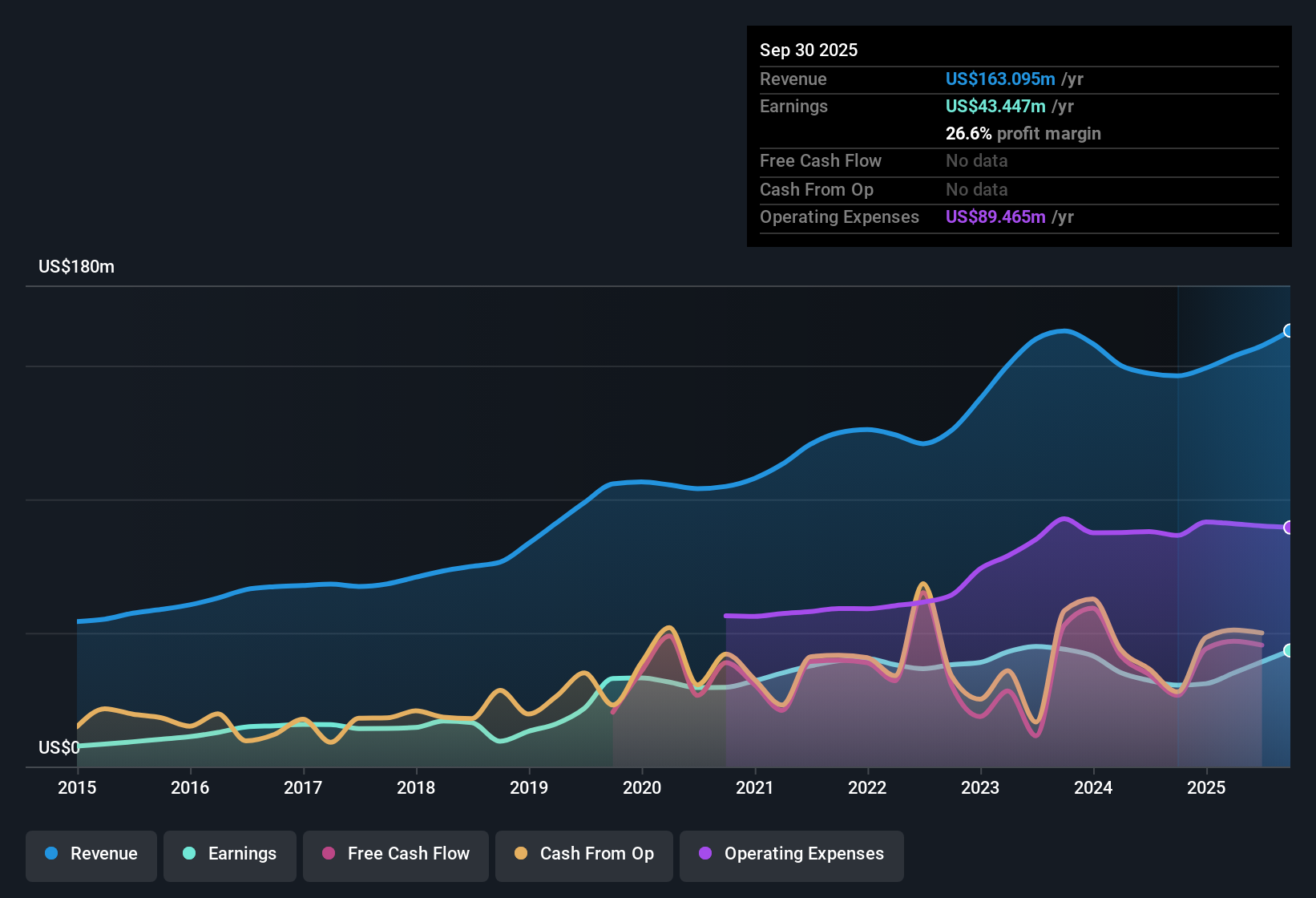

Civista Bancshares (CIVB) posted annual earnings growth of 21.6%, a sharp jump over its 5-year average of just 0.3%. Net margin expanded to 24.9% from 21.9% a year ago, while the company’s forecast earnings growth of 8.54% per year keeps investors optimistic going forward. With its Price-to-Earnings ratio at 10.5x, which is below both industry and peer averages, and a share price well under its estimated fair value, Civista looks set to attract attention as profitability and value lead the story.

See our full analysis for Civista Bancshares.Next, we’ll see how these latest numbers stack up against the popular narratives and whether investor confidence finds new reasons for conviction or surprise.

See what the community is saying about Civista Bancshares

Margin Expansion Outpaces Industry Trends

- Net margin rose to 24.9%, surpassing the previous year’s 21.9%, while peers in the US Banks industry average lower profitability.

- According to analysts' consensus view, ongoing strategic acquisitions and investments in digital account origination are forecast to push profit margins further, with expectations for margins to reach 29.6% within three years.

- This anticipated margin expansion is supported by recent moves, such as acquiring Farmers Savings Bank and launching the Mantle platform. These actions are expected to broaden Civista's deposit base and reduce funding costs.

- Consensus narrative notes that these efforts position Civista to benefit from dynamic Midwest market growth and add durable income streams despite rising competition.

Growth Outlook Drives Revenue Momentum

- Analysts project revenues will grow by 14.4% annually for the next three years, with future earnings expected to reach $69.7 million by around September 2028, up from $39.2 million now.

- Consensus narrative emphasizes that these growth rates reflect the benefits of recent capital raises and Civista’s ability to expand organically in urban Midwest centers.

- Disciplined portfolio management is cited as a key factor reducing credit risk and supporting long-term revenue growth via steady loan expansion.

- Consensus narrative highlights that market share gains in population-growth regions and prudent lending keep Civista on track with broader banking sector trends.

Valuation Discount Versus Peers and Targets

- Civista trades at a 10.5x Price-to-Earnings ratio, below both the US Banks industry average (11.3x) and peers (14.1x), with its share price ($21.28) sitting well below the analyst price target of $24.00 and DCF fair value of $37.18.

- Consensus narrative underscores how this valuation gap, combined with forecast margin gains and limited identified risks, offers an appealing setup for investors seeking quality at a relative discount.

- This pricing advantage is further backed by a healthy dividend and steady forward growth, reinforcing Civista’s standing as both a value and income play among community banks.

- Consensus narrative notes the current share price leaves substantial upside if Civista grows as projected and maintains its improved profitability versus industry benchmarks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Civista Bancshares on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data from a unique angle? Share your take in just a few minutes and shape the story your way with Do it your way.

A great starting point for your Civista Bancshares research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Civista Bancshares is projected to lift growth and margins, its revenue expansion relies on ongoing acquisitions and faces rising competition from larger banks.

If you prefer steadier performance during market shifts, consider focusing on stable growth stocks screener (2088 results) to identify companies with reliable earnings and revenue momentum through changing cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CIVB

Civista Bancshares

Operates as the financial holding company for Civista Bank that provides community banking services in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives