- United States

- /

- Banks

- /

- NasdaqGS:CHCO

City Holding (CHCO) Margins Rise to 40.3%, Reinforcing Bullish Profitability Narrative

Reviewed by Simply Wall St

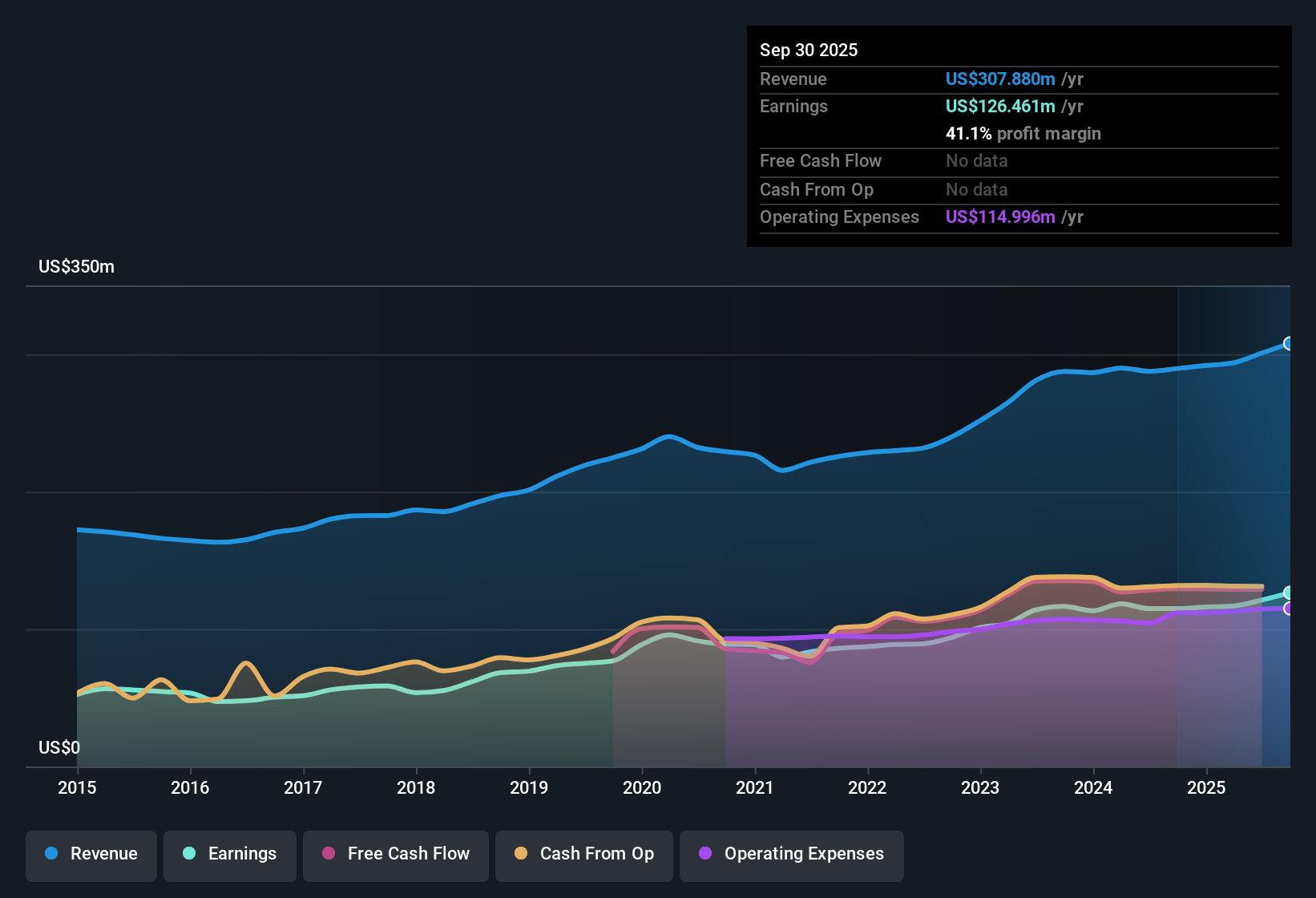

City Holding (CHCO) posted annual earnings growth of 5.4%, building on a five-year average increase of 8.9%. Net profit margins ticked up to 40.3% from 39.9% last year, and the company’s EPS remains supported by high-quality results. With revenue expected to grow at 3.3% per year compared to the broader US market’s projected 10.1% expansion, investors have their eye on a solid but slower runway for top-line gains.

See our full analysis for City Holding.Next up, we will see how these headline numbers measure up against the market’s consensus narrative and what that could mean for the story going forward.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Push Above 40%

- Net profit margins increased to 40.3%, up from 39.9% last year, highlighting efficient cost control even as revenue growth slows compared to the broader US market.

- What is surprising is that despite a slower revenue growth forecast of 3.3% per year (versus the US market’s 10.1%), the business sustains high profitability, which heavily supports the bullish case that operational discipline remains a core strength.

- Margin expansion of 0.4 percentage points this year demonstrates ongoing resilience in the core banking model.

- Bulls argue the current margin level indicates ongoing capacity to generate quality earnings even as top-line growth moderates.

Share Price Trades Below DCF Fair Value, But Premium to Peers

- At $122.47, City Holding’s share price is well below its DCF fair value estimate of $227.65, representing a deep 46% discount, while its price-to-earnings ratio of 14.7x stands above the peer (11.9x) and industry averages (11.2x).

- The prevailing market view wrestles with this tension: a wide fair value gap draws value investors, but paying a premium to sector multiples could limit near-term upside unless growth expectations accelerate.

- This P/E premium reflects market appreciation for City Holding’s balance sheet quality and proven dividend stability.

- Meanwhile, the share price discount to DCF signals embedded skepticism about whether current profits are fully sustainable or upside will materialize.

Dividend and Insider Activity Signal Stability

- City Holding offers an attractive dividend and stands out with no substantial insider selling reported in the past quarter, providing comfort for income-focused investors looking for steady payouts.

- Supporting the prevailing market view, these signals tilt the story toward safety: positive operational signs coupled with limited insider exits create a foundation for strong dividend credibility.

- Dividend appeal is amplified when margins and profit growth outpace peers, offering a relative haven for risk-averse investors.

- Insider holding patterns reinforce investor confidence, especially when contrasted with more volatile banks experiencing greater executive turnover.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on City Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While City Holding maintains robust profit margins, its slower revenue growth and premium price-to-earnings ratio raise concerns about its long-term upside potential.

If you want to sidestep growth limitations, use our high growth potential stocks screener (52 results) to uncover established companies that are forecast to deliver much stronger earnings expansion ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHCO

City Holding

Operates as a financial holding company for City National Bank of West Virginia that provides banking, trust and investment management, and other financial solutions in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives