- United States

- /

- Banks

- /

- NasdaqCM:CFBK

Should You Be Adding CF Bankshares (NASDAQ:CFBK) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like CF Bankshares (NASDAQ:CFBK), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for CF Bankshares

CF Bankshares's Improving Profits

Over the last three years, CF Bankshares has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, CF Bankshares's EPS shot from US$2.05 to US$4.53, over the last year. You don't see 121% year-on-year growth like that, very often. The best case scenario? That the business has hit a true inflection point.

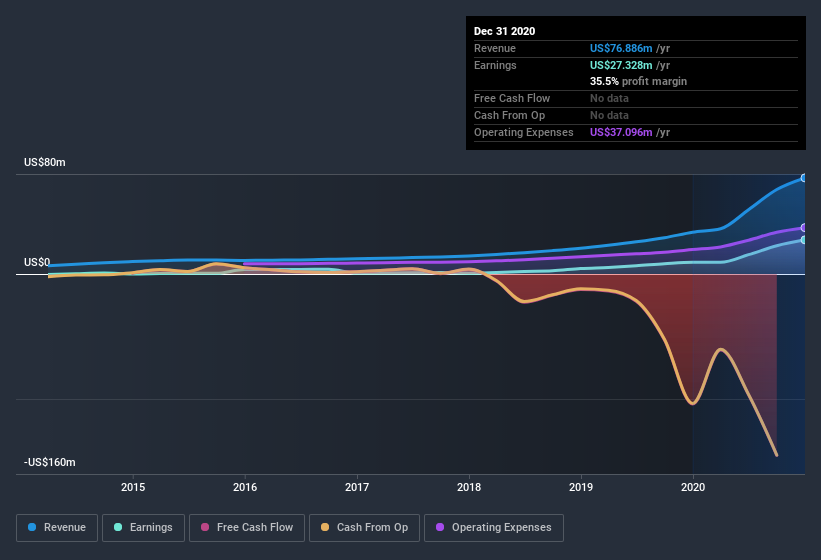

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of CF Bankshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. CF Bankshares maintained stable EBIT margins over the last year, all while growing revenue 130% to US$77m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

CF Bankshares isn't a huge company, given its market capitalization of US$131m. That makes it extra important to check on its balance sheet strength.

Are CF Bankshares Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

We note that CF Bankshares insiders spent US$154k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. We also note that it was the Independent Director, David Royer, who made the biggest single acquisition, paying US$74k for shares at about US$10.50 each.

The good news, alongside the insider buying, for CF Bankshares bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have US$16m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 12% of the company; visible skin in the game.

Should You Add CF Bankshares To Your Watchlist?

CF Bankshares's earnings per share have taken off like a rocket aimed right at the moon. What's more insiders own a significant stake in the company and have been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest CF Bankshares belongs on the top of your watchlist. However, before you get too excited we've discovered 3 warning signs for CF Bankshares (1 can't be ignored!) that you should be aware of.

The good news is that CF Bankshares is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading CF Bankshares or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:CFBK

CF Bankshares

Operates as the bank holding company for CFBank, National Association that provides various banking products and services.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives