- United States

- /

- Banks

- /

- NasdaqGS:CFB

Should CrossFirst Bankshares (NASDAQ:CFB) Be Disappointed With Their 19% Profit?

On average, over time, stock markets tend to rise higher. This makes investing attractive. But if you choose that path, you're going to buy some stocks that fall short of the market. Unfortunately for shareholders, while the CrossFirst Bankshares, Inc. (NASDAQ:CFB) share price is up 19% in the last year, that falls short of the market return. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

Check out our latest analysis for CrossFirst Bankshares

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over the last twelve months, CrossFirst Bankshares actually shrank its EPS by 59%.

This means it's unlikely the market is judging the company based on earnings growth. Therefore, it seems likely that investors are putting more weight on metrics other than EPS, at the moment.

Unfortunately CrossFirst Bankshares' fell 4.1% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

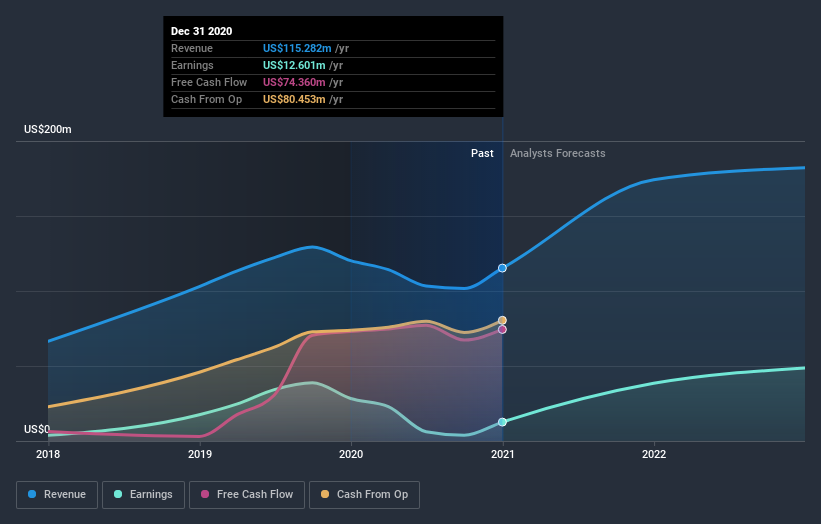

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling CrossFirst Bankshares stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

We're happy to report that CrossFirst Bankshares are up 19% over the year. While it's always nice to make a profit on the stock market, we do note that the TSR was no better than the broader market return of about 39%. However, that falls short of the 47% gain it has made, for shareholders, in the last three months. It's worth taking note when returns accelerate, as it can indicate positive change in the underlying business, and winners often keep winning. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for CrossFirst Bankshares that you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading CrossFirst Bankshares or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CFB

CrossFirst Bankshares

Operates as the bank holding company for CrossFirst Bank that provides various banking and financial services to businesses, business owners, professionals, and its personal networks.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives