- United States

- /

- Banks

- /

- NasdaqGS:CFB

Here's Why We Think CrossFirst Bankshares (NASDAQ:CFB) Is Well Worth Watching

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like CrossFirst Bankshares (NASDAQ:CFB). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

See our latest analysis for CrossFirst Bankshares

CrossFirst Bankshares's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Who among us would not applaud CrossFirst Bankshares's stratospheric annual EPS growth of 42%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

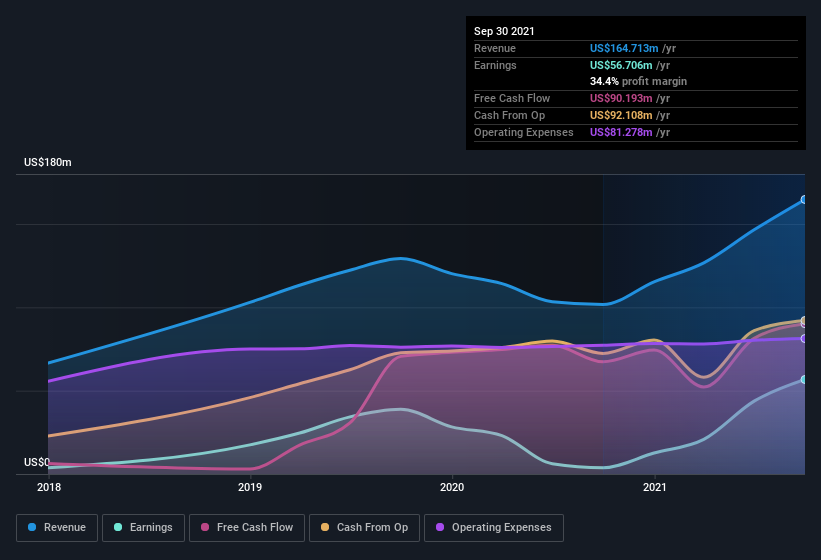

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Not all of CrossFirst Bankshares's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note CrossFirst Bankshares's EBIT margins were flat over the last year, revenue grew by a solid 62% to US$165m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of CrossFirst Bankshares's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are CrossFirst Bankshares Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

CrossFirst Bankshares top brass are certainly in sync, not having sold any shares, over the last year. But my excitement comes from the US$107k that Chief Financial Officer Benjamin Clouse spent buying shares (at an average price of about US$14.49).

The good news, alongside the insider buying, for CrossFirst Bankshares bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold US$42m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 5.9% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Mike Maddox, is paid less than the median for similar sized companies. For companies with market capitalizations between US$400m and US$1.6b, like CrossFirst Bankshares, the median CEO pay is around US$2.3m.

CrossFirst Bankshares offered total compensation worth US$1.2m to its CEO in the year to . That seems pretty reasonable, especially given its below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is CrossFirst Bankshares Worth Keeping An Eye On?

CrossFirst Bankshares's earnings per share have taken off like a rocket aimed right at the moon. The cherry on top is that insiders own a bunch of shares, and one has been buying more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe CrossFirst Bankshares deserves timely attention. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if CrossFirst Bankshares is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of CrossFirst Bankshares, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CFB

CrossFirst Bankshares

Operates as the bank holding company for CrossFirst Bank that provides various banking and financial services to businesses, business owners, professionals, and its personal networks.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives