- United States

- /

- Banks

- /

- NasdaqGS:CCB

Coastal Financial (CCB) Is Up 6.7% After Inflation Report Sparks Hopes for Fed Rate Cuts

Reviewed by Sasha Jovanovic

- Regional bank stocks, including Coastal Financial, advanced after a past inflation report came in softer than expected, fueling optimism for future Federal Reserve interest rate cuts.

- This development raised hopes for reduced funding costs and stronger loan demand, providing a broad sentiment boost across the regional banking sector.

- We'll explore how the prospect of lower interest rates could alter Coastal Financial's investment narrative and future growth expectations.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Coastal Financial's Investment Narrative?

If you’re considering Coastal Financial as an investment, the biggest themes to grasp are the bank’s strong growth trajectory and the current climate for regional financial stocks. Shares have rebounded sharply alongside regional banking peers after softer inflation numbers fueled hopes for lower interest rates ahead. The prospect of rate cuts could give Coastal some breathing room on funding costs and potentially revive loan demand, both key short-term catalysts that previously looked at risk given margin pressure and slowing net income growth. At the same time, multiple executive changes, including a new CFO from the fintech sector, reflect a push to strengthen leadership as the bank ramps up digital expansion. However, removal from the Russell indices and recent fluctuations in earnings and credit quality are still fresh concerns. The recent market momentum may ease some risks for now, but not all headwinds are resolved. But the removal from key indices and above-average charge-offs remain important risks to consider.

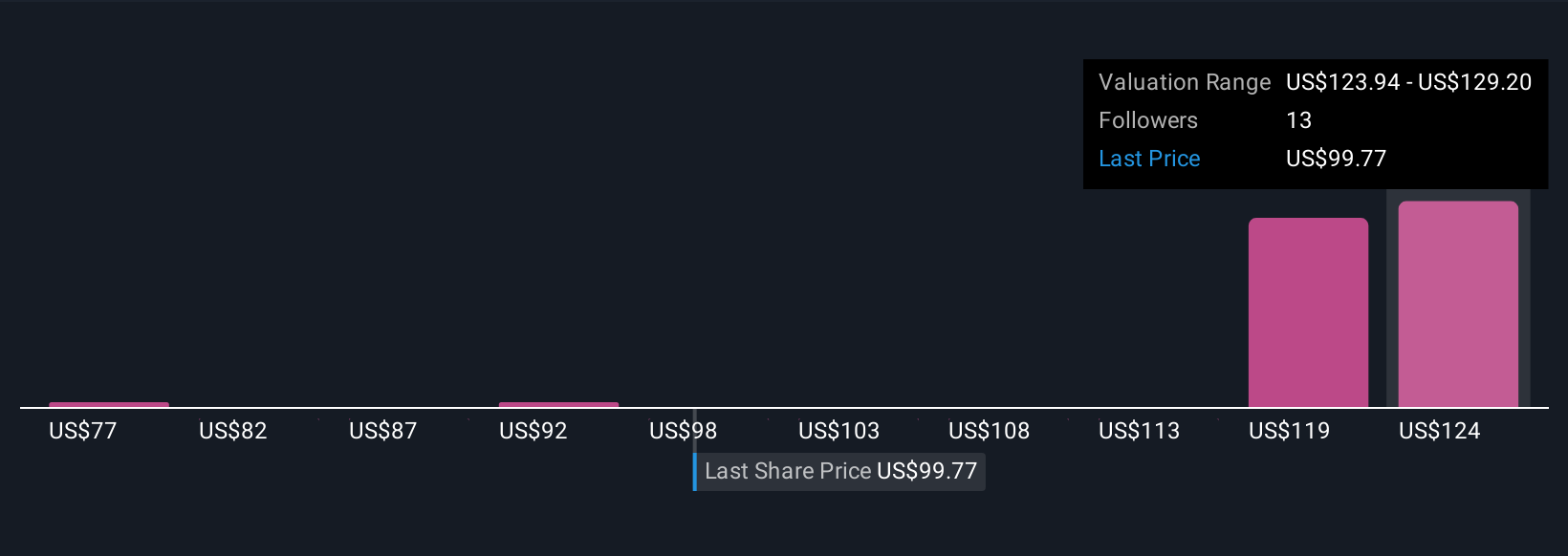

Coastal Financial's shares have been on the rise but are still potentially undervalued by 9%. Find out what it's worth.Exploring Other Perspectives

Explore 4 other fair value estimates on Coastal Financial - why the stock might be worth 30% less than the current price!

Build Your Own Coastal Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coastal Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Coastal Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coastal Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CCB

Coastal Financial

Operates as the bank holding company for Coastal Community Bank that provides various banking products and services to small and medium-sized businesses, professionals, and individuals in the Puget Sound region in Washington.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives