- United States

- /

- Banks

- /

- NasdaqGS:CBSH

A Fresh Look at Commerce Bancshares (CBSH) Valuation Following Cautious Analyst Ratings and Third-Quarter Earnings Miss

Reviewed by Simply Wall St

Commerce Bancshares (CBSH) caught attention after higher loan loss provisions and lower net interest income pushed third-quarter earnings below expectations. This financial update has prompted a cautious tone from analysts and investors alike.

See our latest analysis for Commerce Bancshares.

The share price of Commerce Bancshares has lost momentum this year, falling 8.6% over the last week and nearly 13% year-to-date, as cautious sentiment grows after weaker third-quarter results and rising loan charge-offs. Despite these recent challenges, its five-year total shareholder return remains a strong 22%. This suggests that the long-term growth story is still intact even as near-term headwinds persist.

If the latest volatility has you exploring other opportunities, consider widening your search and discover fast growing stocks with high insider ownership.

With analysts largely holding steady on neutral ratings while lowering price targets, investors are left to ponder whether Commerce Bancshares' recent pullback adequately reflects future risks or if a genuine buying opportunity has emerged.

Price-to-Earnings of 12.9x: Is it justified?

Commerce Bancshares is trading at a price-to-earnings (P/E) ratio of 12.9x, higher than the US Banks industry average of 11.3x and its peer group at 11.5x. With a last close price of $53.84, investors are paying a premium compared to the sector.

The P/E ratio measures how much investors are willing to pay per dollar of earnings. For banks, this multiple reflects expectations for future profitability and risk, making it an important benchmark within the sector.

Commerce Bancshares' elevated P/E suggests the market anticipates steadier or superior earnings growth compared to its peers. However, compared to the estimated fair P/E of 12.5x, the stock still appears relatively expensive, hinting that the premium price may not be matched by proportionate growth or quality advantages.

When viewed side by side with industry and fair value ratios, Commerce Bancshares stands out as a pricier choice in an otherwise competitive field. The difference is not dramatic. Investors expecting strong outperformance may want to scrutinize the justification for this market confidence.

Explore the SWS fair ratio for Commerce Bancshares

Result: Price-to-Earnings of 12.9x (OVERVALUED)

However, ongoing declines in share price and slower net income growth still present notable risks. These factors could challenge Commerce Bancshares' long-term outlook.

Find out about the key risks to this Commerce Bancshares narrative.

Another View: SWS DCF Model Points to Undervaluation

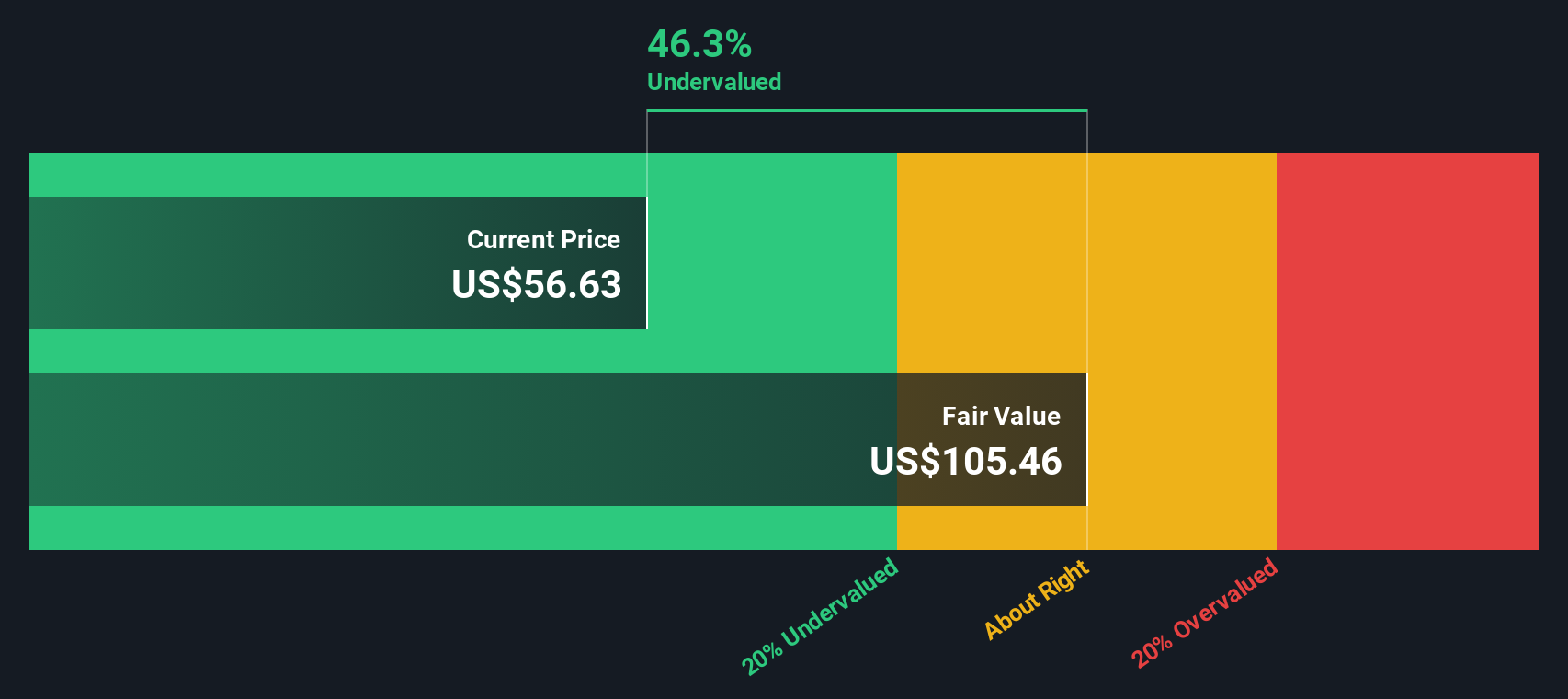

While Commerce Bancshares looks expensive based on its price-to-earnings ratio, our SWS DCF model offers a different perspective. The DCF suggests shares are trading 48.3% below fair value, which may indicate significant undervaluation if its long-term cash flows are realized. Which view will prove correct as the story unfolds?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Commerce Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Commerce Bancshares Narrative

If you have a different perspective or want to dig deeper into the numbers, it only takes a few minutes to develop your own argument. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Commerce Bancshares.

Looking for more investment ideas?

Every day, smart investors are making the most of Simply Wall Street’s powerful Screener to spot opportunities others might miss. Secure your edge by taking action now.

- Accelerate your search for growth with these 24 AI penny stocks poised to reshape industries and unlock new frontiers with artificial intelligence innovation.

- Capture steady potential income by checking out these 17 dividend stocks with yields > 3% offering attractive yields and stability in a shifting market landscape.

- Ride the wave of blockchain transformation by exploring these 79 cryptocurrency and blockchain stocks, which is driving advances in decentralized tech and fintech breakthroughs before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CBSH

Commerce Bancshares

Operates as the bank holding company for Commerce Bank that provides retail, mortgage banking, corporate, investment, trust, and asset management products and services to individuals and businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion