- United States

- /

- Banks

- /

- NasdaqGS:BUSE

Is First Busey's New CFO Appointment Shifting the Digital Strategy Narrative for BUSE?

Reviewed by Sasha Jovanovic

- On September 24, 2025, First Busey Corporation announced the appointment of Christopher H.M. Chan as its new Chief Financial Officer, effective September 30, bringing in leadership with a strong background in corporate strategy and digital transformation.

- This executive change introduces expertise in digital channels and data science to First Busey’s finance team, potentially influencing the company’s future direction and priorities.

- We'll explore how the addition of digital strategy expertise at the CFO level could reshape First Busey's investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is First Busey's Investment Narrative?

If you're considering First Busey, you need to believe in the bank's ability to convert forecast revenue and earnings growth into lasting improvement in shareholder returns, especially with forecasts pointing to significant profit growth ahead. The arrival of Christopher H.M. Chan as CFO is a potentially material shift that could refocus attention on efficiency, technology investments, and digital customer experience, factors that matter for future competitiveness in regional banking. As the bank continues digesting its CrossFirst merger, pursuing buybacks, and issuing dividends, these short-term catalysts are now accompanied by the risk of execution as Mr. Chan transitions into the role and sets new priorities. Given the large one-off loss this year, recent underperformance versus the market, and higher-than-average valuation multiples, investors should keep an eye on how quickly Chan's data-driven approach translates into tangible financial results, or if integration challenges persist. Recent price action has been muted, which may reflect caution as the market waits to see whether new leadership sparks a meaningful shift in direction or simply maintains the course.

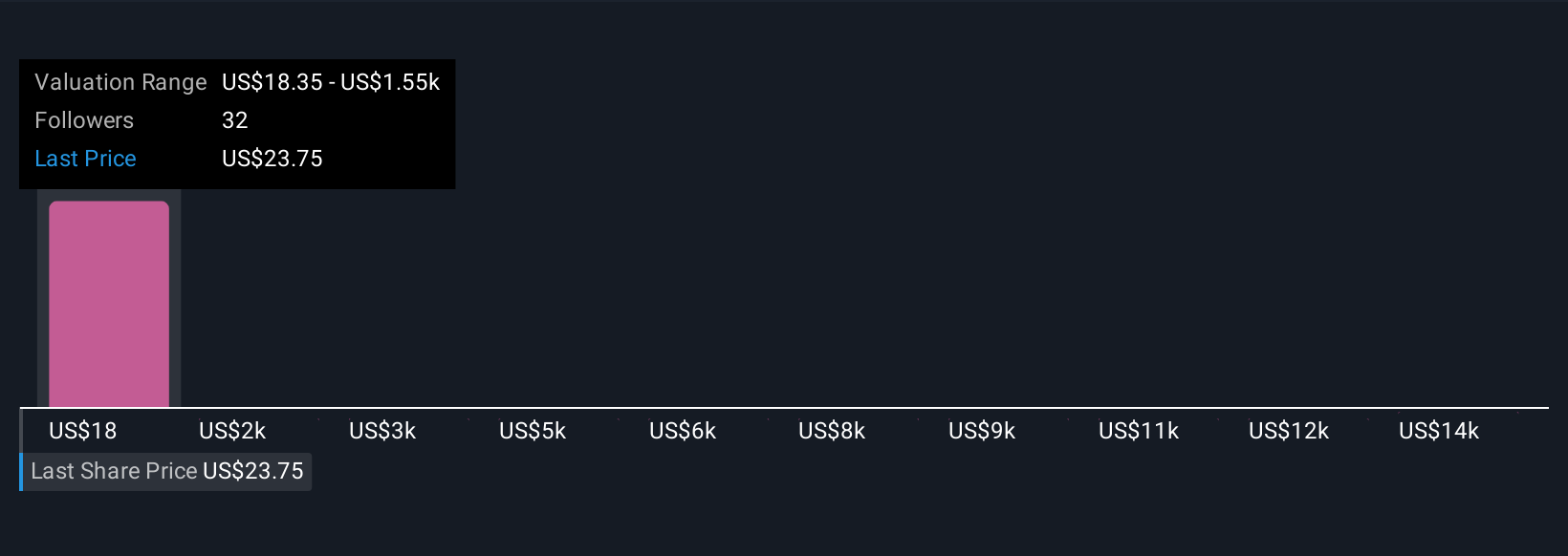

But investors should weigh the risk that expected earnings growth could take longer to materialize than anticipated. Despite retreating, First Busey's shares might still be trading 48% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 5 other fair value estimates on First Busey - why the stock might be worth 21% less than the current price!

Build Your Own First Busey Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Busey research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free First Busey research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Busey's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BUSE

First Busey

Operates as the bank holding company for Busey Bank that engages in the provision of retail and commercial banking products and services to individual, corporate, institutional, and governmental customers in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives