- United States

- /

- Banks

- /

- NasdaqCM:BOTJ

If You Like EPS Growth Then Check Out Bank of the James Financial Group (NASDAQ:BOTJ) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Bank of the James Financial Group (NASDAQ:BOTJ). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Bank of the James Financial Group

Bank of the James Financial Group's Earnings Per Share Are Growing.

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. Impressively, Bank of the James Financial Group has grown EPS by 21% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

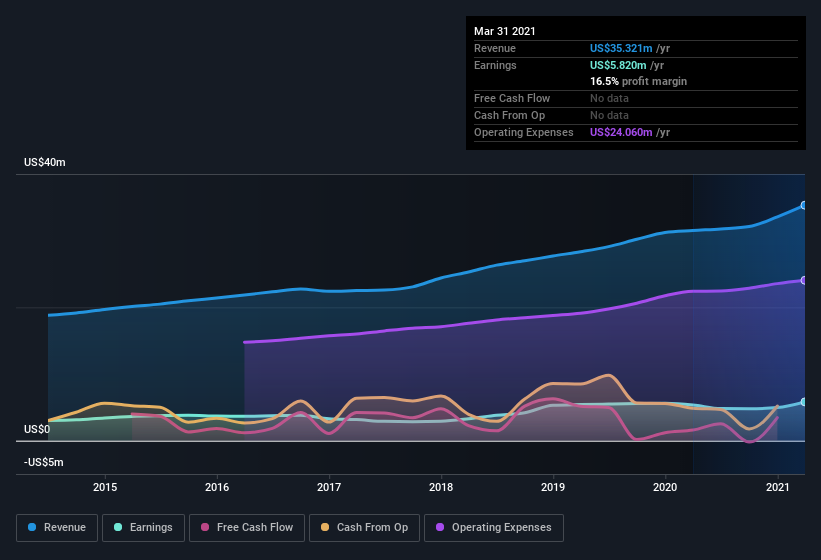

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). I note that Bank of the James Financial Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. Bank of the James Financial Group maintained stable EBIT margins over the last year, all while growing revenue 12% to US$35m. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Bank of the James Financial Group isn't a huge company, given its market capitalization of US$65m. That makes it extra important to check on its balance sheet strength.

Are Bank of the James Financial Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We note that Bank of the James Financial Group insiders spent US$200k on stock, over the last year; in contrast, we didn't see any selling. That's nice to see, because it suggests insiders are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Director Lydia Langley for US$20k worth of shares, at about US$9.89 per share.

Is Bank of the James Financial Group Worth Keeping An Eye On?

You can't deny that Bank of the James Financial Group has grown its earnings per share at a very impressive rate. That's attractive. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. To put it succinctly; Bank of the James Financial Group is a strong candidate for your watchlist. Still, you should learn about the 2 warning signs we've spotted with Bank of the James Financial Group .

As a growth investor I do like to see insider buying. But Bank of the James Financial Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Bank of the James Financial Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bank of the James Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:BOTJ

Bank of the James Financial Group

Operates as the bank holding company for Bank of the James that provides general retail and commercial banking services to individuals, businesses, associations and organizations, and governmental authorities in Virginia, the United States.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.