Bank of Marin Bancorp's (NASDAQ:BMRC) investors are due to receive a payment of US$0.24 per share on 11th of February. Based on this payment, the dividend yield will be 2.5%, which is fairly typical for the industry.

See our latest analysis for Bank of Marin Bancorp

Bank of Marin Bancorp's Payment Has Solid Earnings Coverage

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Prior to this announcement, Bank of Marin Bancorp's dividend was comfortably covered by both cash flow and earnings. This means that a large portion of its earnings are being retained to grow the business.

The next year is set to see EPS grow by 15.0%. Assuming the dividend continues along recent trends, we think the payout ratio could be 45% by next year, which is in a pretty sustainable range.

Bank of Marin Bancorp Has A Solid Track Record

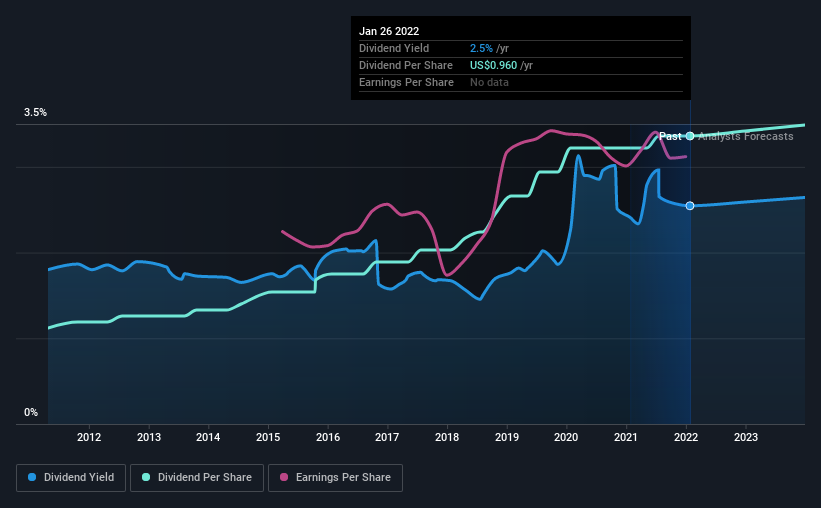

The company has a sustained record of paying dividends with very little fluctuation. The dividend has gone from US$0.32 in 2012 to the most recent annual payment of US$0.96. This means that it has been growing its distributions at 12% per annum over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth May Be Hard To Achieve

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, Bank of Marin Bancorp's EPS was effectively flat over the past five years, which could stop the company from paying more every year. Growth of 1.9% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

The company has also been raising capital by issuing stock equal to 18% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

We Really Like Bank of Marin Bancorp's Dividend

Overall, we think that this is a great income investment, and we think that maintaining the dividend this year may have been a conservative choice. Distributions are quite easily covered by earnings, which are also being converted to cash flows. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've picked out 1 warning sign for Bank of Marin Bancorp that investors should know about before committing capital to this stock. We have also put together a list of global stocks with a solid dividend.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Marin Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BMRC

Bank of Marin Bancorp

Operates as the holding company for Bank of Marin that provides a range of financial services to small to medium-sized businesses, not-for-profit organizations, and commercial real estate investors in the United States.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives