- United States

- /

- Communications

- /

- NasdaqGS:ITRN

Undiscovered Gems: Exploring Hidden US Stocks In November 2025

Reviewed by Simply Wall St

As U.S. markets soar at the start of a holiday-shortened trading week, with key indices like the Nasdaq and S&P 500 making significant gains, investors are buoyed by optimism around potential Federal Reserve interest rate cuts. Amidst this backdrop of market enthusiasm, identifying hidden gems in the small-cap sector can be particularly rewarding as these stocks often offer unique growth opportunities that may not yet be reflected in their valuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

We're going to check out a few of the best picks from our screener tool.

Burke & Herbert Financial Services (BHRB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp. is the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland, with a market cap of $951.91 million.

Operations: Burke & Herbert Financial Services generates revenue primarily through its community banking segment, which contributes $331.64 million. The company's financial performance is reflected in its net profit margin, which stands at 22%.

Burke & Herbert Financial Services, with assets totaling US$7.9 billion and equity of US$822.2 million, stands out in its sector. Total deposits reach US$6.4 billion while loans amount to US$5.5 billion, reflecting a net interest margin of 3.1%. The company’s allowance for bad loans is at 1.6% of total loans, indicating a low-risk profile supported by customer deposits as primary funding sources for 91% of liabilities. Earnings surged by an impressive 415%, far outpacing the industry average growth rate of 18%. Trading at a notable discount to estimated fair value enhances its appeal in the market landscape.

Business First Bancshares (BFST)

Simply Wall St Value Rating: ★★★★★★

Overview: Business First Bancshares, Inc. is the bank holding company for b1BANK, offering a range of banking products and services in Louisiana and Texas, with a market cap of $761.71 million.

Operations: b1BANK generates revenue primarily through its community banking segment, which reported $303.64 million.

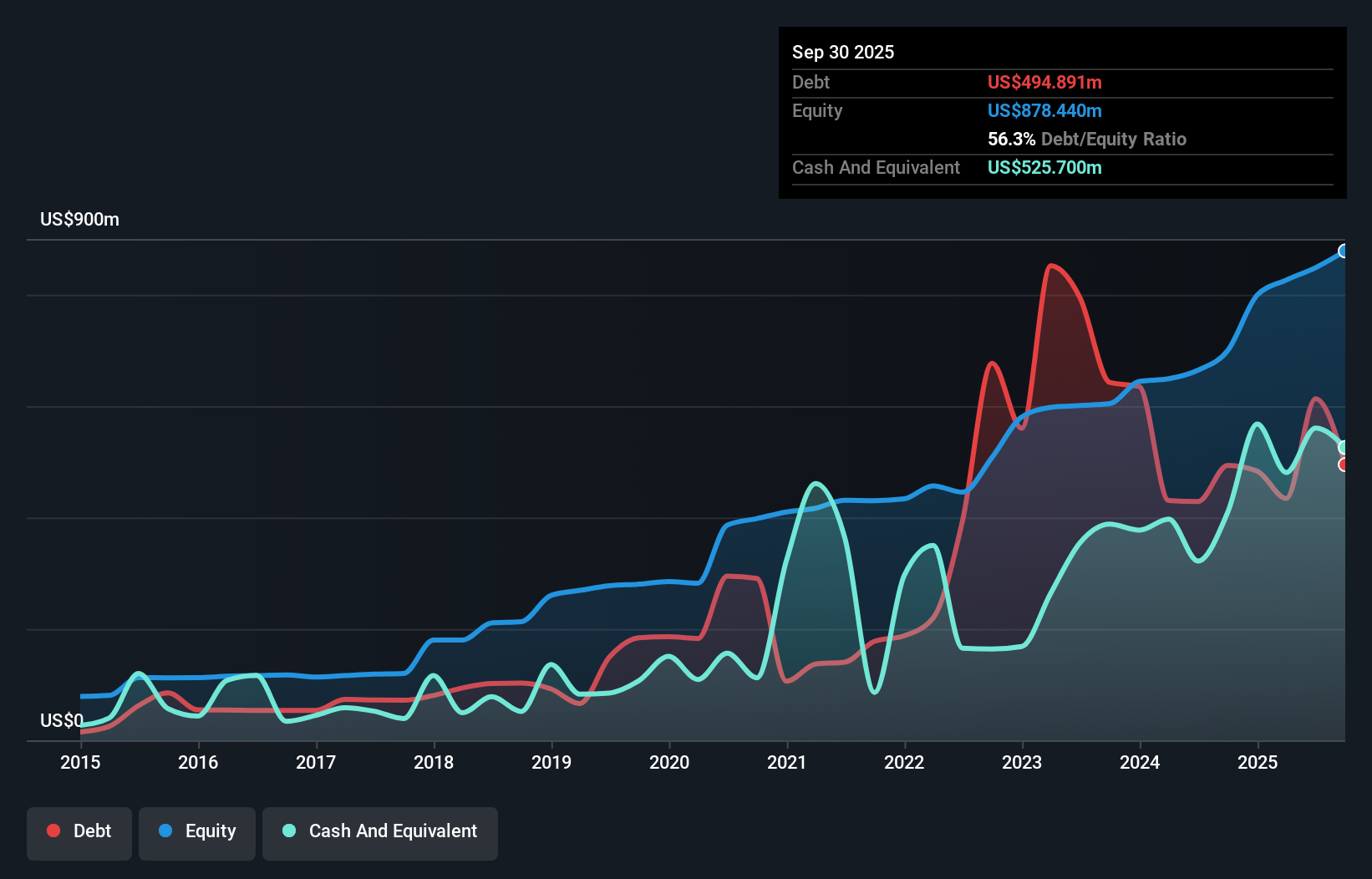

With assets totaling $8 billion and equity of $878.4 million, Business First Bancshares is making waves in the financial sector. The bank's reliance on customer deposits, which account for 92% of its liabilities, highlights a stable funding base. It boasts a net interest margin of 3.5% and has an allowance for bad loans at 0.8% of total loans, reflecting prudent risk management. Recent earnings growth outpaced the industry with a notable 29.7%. A share buyback program worth $30 million signals confidence in future prospects while recent dividend increases further enhance shareholder value at this promising institution.

Ituran Location and Control (ITRN)

Simply Wall St Value Rating: ★★★★★★

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally, with a market capitalization of $755.76 million.

Operations: Ituran generates revenue primarily from telematics services, contributing $255.03 million, and telematics products, adding $93.38 million. The company's net profit margin is a key indicator of its profitability.

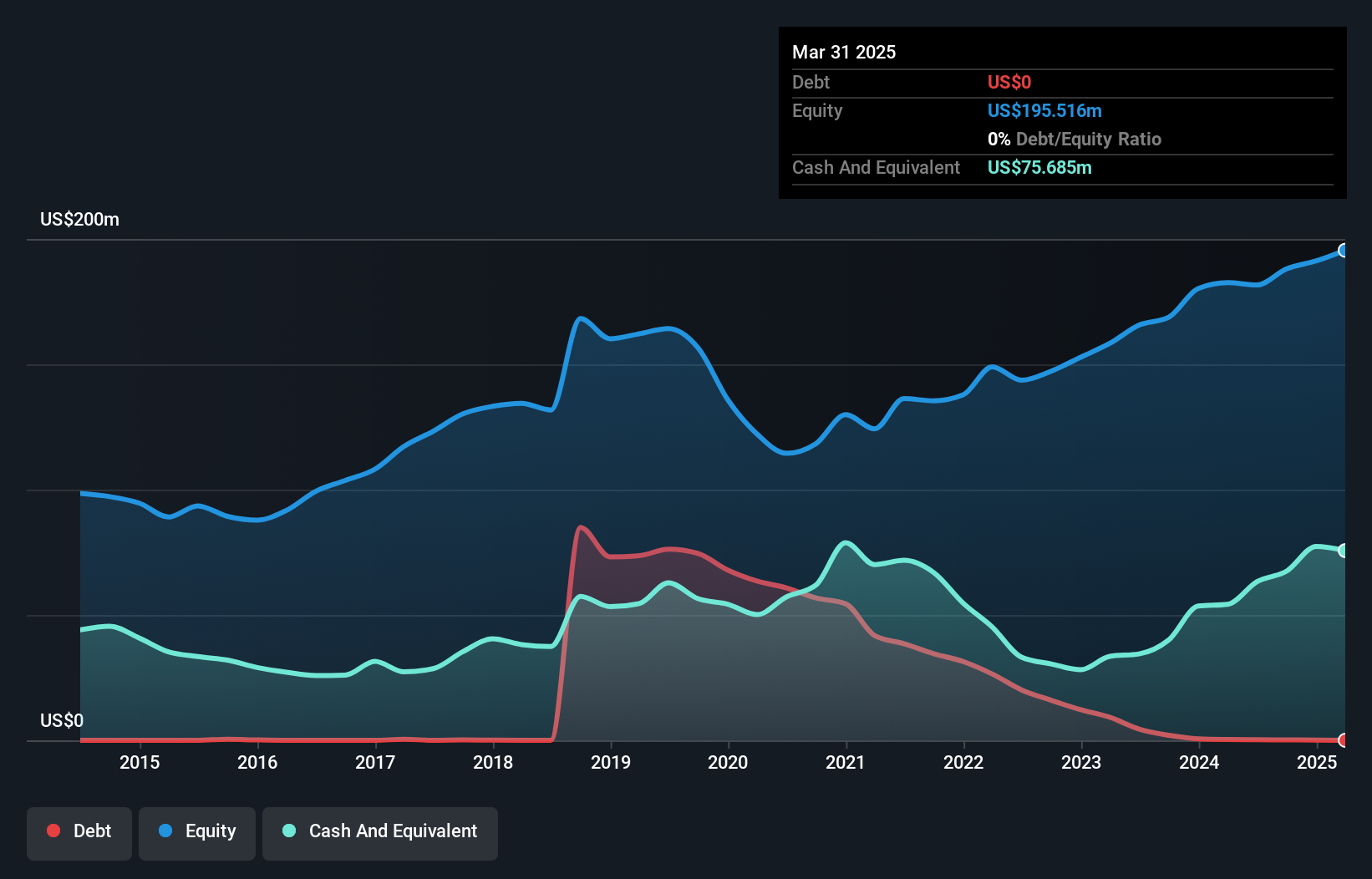

Ituran Location and Control, a nimble player in the tech space, showcases robust financial health with no debt compared to five years ago when its debt-to-equity ratio was 48%. The company has consistently delivered high-quality earnings, boasting a 22.9% annual growth over the past five years. Trading at 25% below its estimated fair value, it presents an attractive proposition for investors. Recent developments include securing a three-year service agreement with Renault across Latin America and announcing a $0.50 per share dividend. Earnings for Q3 2025 reached US$92 million with net income of US$14 million, reflecting steady performance improvements.

Make It Happen

- Discover the full array of 296 US Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITRN

Ituran Location and Control

Provides location-based telematics services and machine-to-machine telematics products in Israel, Brazil, and internationally.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success