- United States

- /

- Banks

- /

- NasdaqGS:VLY

Three Dividend Stocks To Enhance Your Investment Portfolio

Reviewed by Simply Wall St

As U.S. markets experience a notable upswing, with major indexes on track for their best week since June, investors are keenly observing opportunities to bolster their portfolios amid the positive momentum. In such a dynamic environment, dividend stocks can offer stability and income potential, making them an attractive option for those looking to enhance their investment strategies in a thriving market landscape.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.99% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.51% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.78% | ★★★★★★ |

| Interpublic Group of Companies (IPG) | 5.37% | ★★★★★★ |

| Heritage Commerce (HTBK) | 4.73% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.73% | ★★★★★★ |

| Farmers National Banc (FMNB) | 5.00% | ★★★★★★ |

| Ennis (EBF) | 5.79% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.08% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.55% | ★★★★★★ |

Click here to see the full list of 124 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Burke & Herbert Financial Services (BHRB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Burke & Herbert Financial Services Corp., with a market cap of $979.86 million, operates as the bank holding company for Burke & Herbert Bank & Trust Company, offering a range of community banking products and services in Virginia and Maryland.

Operations: Burke & Herbert Financial Services Corp. generates its revenue primarily through its Community Banking segment, which accounted for $331.64 million.

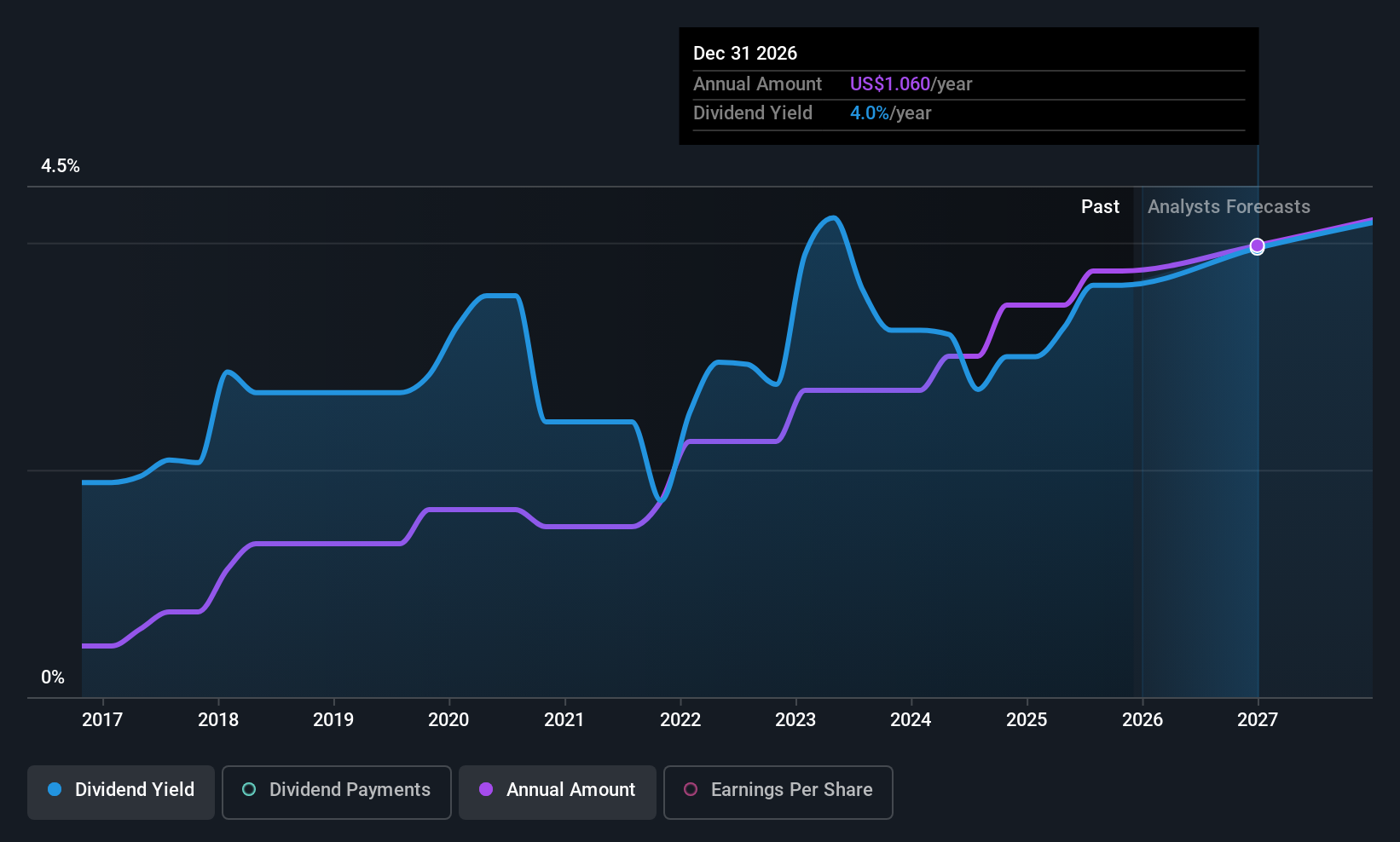

Dividend Yield: 3.4%

Burke & Herbert Financial Services offers a stable dividend yield of 3.39%, supported by a low payout ratio of 31.4%, indicating sustainability. The company's dividends have been reliable and growing over the past decade, although they are lower than the top quartile in the US market. Despite trading below its estimated fair value, recent earnings growth is significant, with net income rising to US$87.06 million for nine months ended September 2025 from US$15.92 million previously.

- Unlock comprehensive insights into our analysis of Burke & Herbert Financial Services stock in this dividend report.

- Our expertly prepared valuation report Burke & Herbert Financial Services implies its share price may be lower than expected.

MetroCity Bankshares (MCBS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MetroCity Bankshares, Inc. is the bank holding company for Metro City Bank, offering a range of banking products and services in the United States, with a market cap of $685.17 million.

Operations: MetroCity Bankshares, Inc. generates its revenue primarily through its Community Banking segment, which accounted for $147.35 million.

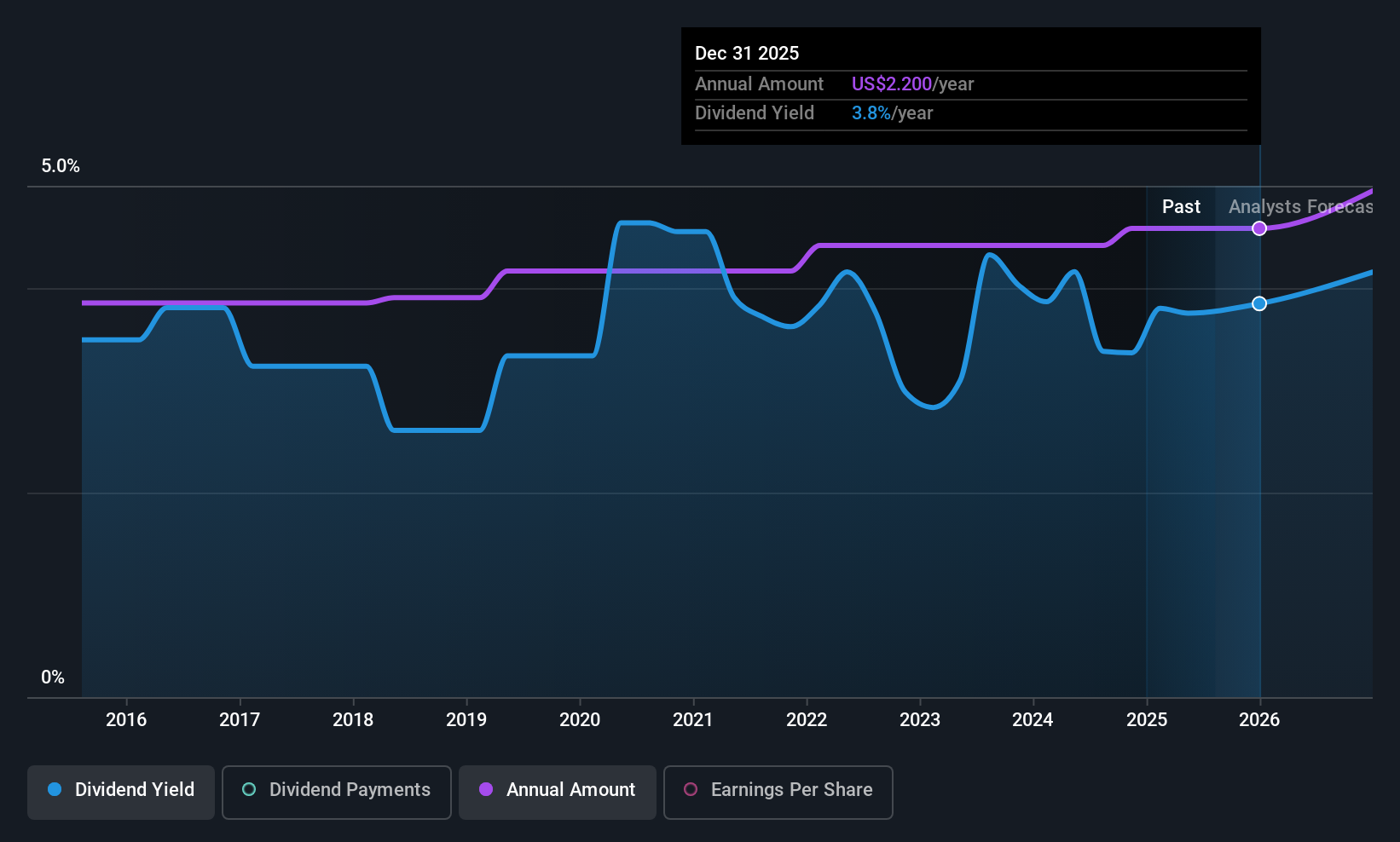

Dividend Yield: 3.8%

MetroCity Bankshares provides a stable dividend yield of 3.75%, with dividends consistently growing and remaining reliable over the past decade. The payout ratio is a sustainable 35.9%, ensuring dividends are well covered by earnings, and future payouts are projected to remain covered at 34.9%. Despite trading below its estimated fair value, recent earnings show modest growth, with net income reaching US$50.39 million for the nine months ended September 2025 from US$48.27 million previously.

- Click to explore a detailed breakdown of our findings in MetroCity Bankshares' dividend report.

- According our valuation report, there's an indication that MetroCity Bankshares' share price might be on the cheaper side.

Valley National Bancorp (VLY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Valley National Bancorp, with a market cap of $6.31 billion, operates as the holding company for Valley National Bank, offering a range of commercial, private banking, retail, insurance, and wealth management financial services.

Operations: Valley National Bancorp's revenue segments include Consumer Banking at $367.09 million and Commercial Banking at $1.24 billion.

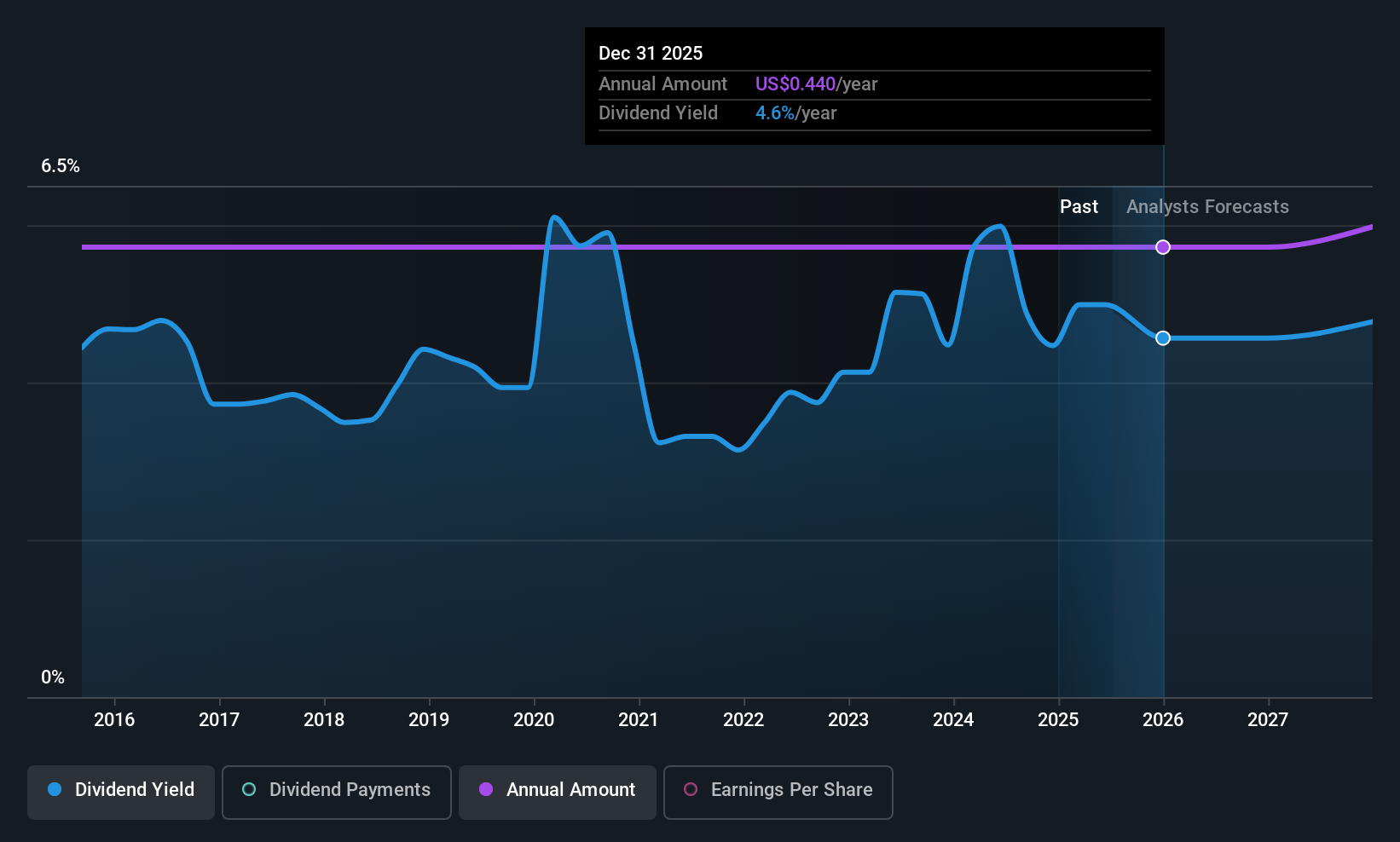

Dividend Yield: 3.9%

Valley National Bancorp offers a dividend yield of 3.88%, with dividends well-covered by earnings at a payout ratio of 49.8%. However, the dividends have been unreliable over the past decade, lacking growth and stability. Recent executive appointments aim to bolster commercial banking growth across key markets like New Jersey and California, aligning with their strategic expansion efforts. The company reported strong earnings for Q3 2025, with net income rising to US$163.36 million from US$97.86 million a year ago.

- Navigate through the intricacies of Valley National Bancorp with our comprehensive dividend report here.

- The analysis detailed in our Valley National Bancorp valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Click through to start exploring the rest of the 121 Top US Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VLY

Valley National Bancorp

Operates as the holding company for Valley National Bank that provides various commercial, private banking, retail, insurance, and wealth management financial services products.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success