- United States

- /

- Banks

- /

- NasdaqGS:BANR

A Look at Banner (BANR) Valuation as Analyst Upgrades Fuel Investor Interest Ahead of Q3 2025 Earnings

Reviewed by Kshitija Bhandaru

Banner (BANR) is preparing to announce its Q3 2025 earnings, and investor interest is picking up as analysts have raised earnings estimates for both 2025 and 2026. This development comes as expectations grow for improvements in key financial metrics.

See our latest analysis for Banner.

Shares have seen renewed interest ahead of the earnings announcement, with a 3.78% one-day share price gain recently helping to offset a slower patch. However, total shareholder return over the past year remains just above break-even at 0.13%. Banner’s longer-term performance stands out more, with a 101.46% five-year total return reflecting solid historical momentum even as short-term moves stay muted.

If you’re watching how sentiment shifts around earnings, it’s also a smart time to broaden your outlook. Discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets and expectations building for improved performance, the question is whether Banner is undervalued at these levels or if the market is already reflecting all the upside ahead.

Most Popular Narrative: 12.8% Undervalued

Banner’s fair value is estimated at $73.40, comfortably above the latest close of $63.99. Analysts foresee more upside if projections play out as expected.

The company's investments in new deposit and loan origination systems, as well as ongoing digitization efforts, are expected to reduce branch and back-office costs. These initiatives could also expand its reach to new customer segments, potentially improving net margins and efficiency ratios.

How does a traditional bank justify a valuation typically associated with tech stocks? The answer lies in bold growth assumptions and ambitious future profit margins. Want the details that make this thesis compelling? Only the full narrative reveals the surprising numbers and rationale driving this target price.

Result: Fair Value of $73.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, exposure to commercial real estate loans and rising expenses from digital investments could put pressure on Banner’s margins and limit potential upside if conditions worsen.

Find out about the key risks to this Banner narrative.

Another View: How Do the Numbers Stack Up on Market Ratios?

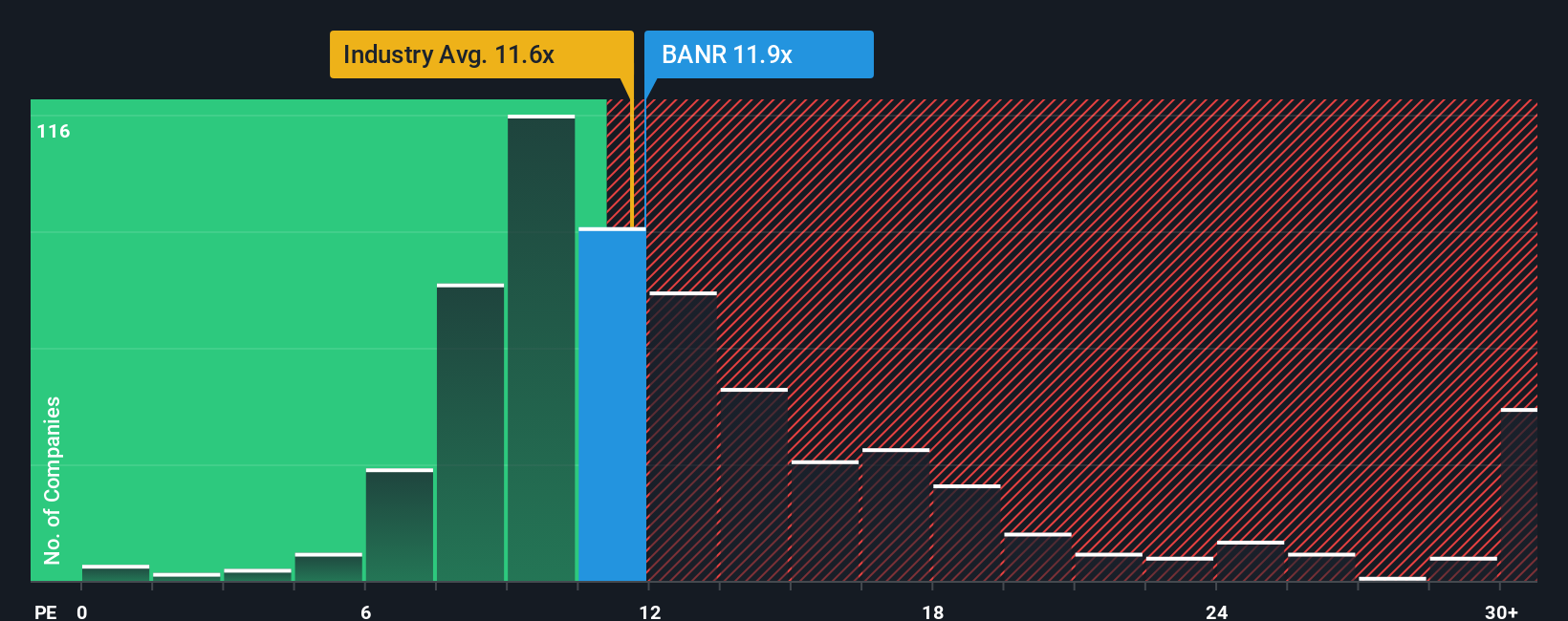

Looking at market ratios, Banner trades on a price-to-earnings of 12.1x, which is above the US Banks industry average of 11.5x but below the peer average of 16.3x and perfectly matches the estimated fair ratio of 12.1x. This suggests the stock is neither particularly cheap nor expensive by this metric, so is the market simply fair, or missing something fundamental?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Banner Narrative

If you have your own perspective or want to dig into the figures yourself, you can craft your own analysis and narrative in just a few minutes with Do it your way.

A great starting point for your Banner research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investors always keep an eye out for fresh opportunities. Don’t let others spot the next breakout or high-yield play before you do. Try these powerful screens today:

- Boost your portfolio’s income by targeting high-yield opportunities using these 18 dividend stocks with yields > 3% and capture stocks offering over 3% dividends.

- Join the AI revolution early and find promising potential by checking out these 25 AI penny stocks, a list of companies harnessing artificial intelligence for growth.

- Step ahead of the crowd with these 3564 penny stocks with strong financials, featuring under-the-radar picks that combine strong fundamentals with significant upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BANR

Banner

Operates as the bank holding company for Banner Bank that engages in the provision of commercial banking and financial products and services to individuals, businesses, and public sector entities in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives