- United States

- /

- Banks

- /

- NasdaqCM:ATLO

I Built A List Of Growing Companies And Ames National (NASDAQ:ATLO) Made The Cut

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Ames National (NASDAQ:ATLO). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Ames National

How Fast Is Ames National Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Over the last three years, Ames National has grown EPS by 12% per year. That's a pretty good rate, if the company can sustain it.

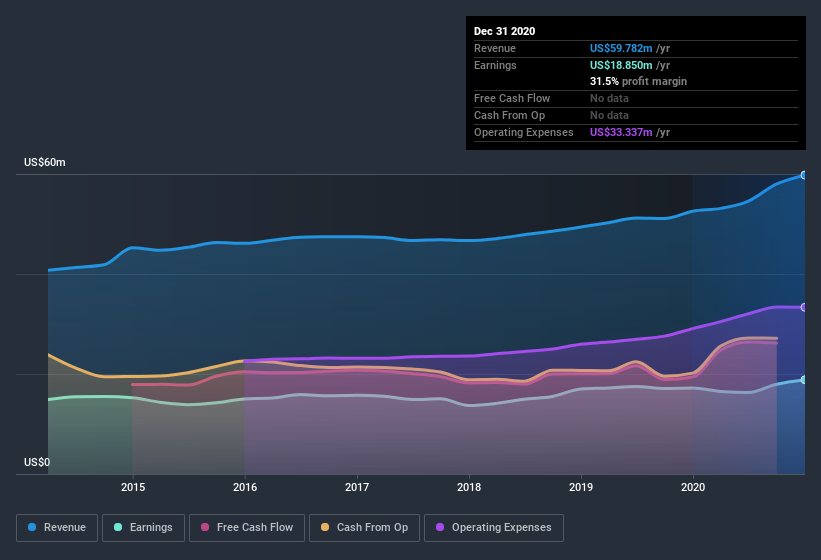

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Ames National's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers I've used might not be the best representation of the underlying business. While we note Ames National's EBIT margins were flat over the last year, revenue grew by a solid 14% to US$60m. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Ames National isn't a huge company, given its market capitalization of US$244m. That makes it extra important to check on its balance sheet strength.

Are Ames National Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's good to see Ames National insiders walking the walk, by spending US$409k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to brim with joyful expectancy. Zooming in, we can see that the biggest insider purchase was by Kevin Deardorff for US$50k worth of shares, at about US$21.81 per share.

It's reassuring that Ames National insiders are buying the stock, but that's not the only reason to think management are fair to shareholders. Specifically, the CEO is paid quite reasonably for a company of this size. I discovered that the median total compensation for the CEOs of companies like Ames National with market caps between US$100m and US$400m is about US$939k.

The Ames National CEO received total compensation of just US$429k in the year to . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add Ames National To Your Watchlist?

One important encouraging feature of Ames National is that it is growing profits. And that's not all, folks. We've also seen insiders buying stock, and noted modest executive pay. The sum of all that, for me, points to a quality business, and a genuine prospect for further research. Of course, identifying quality businesses is only half the battle; investors need to know whether the stock is undervalued. So you might want to consider this free discounted cashflow valuation of Ames National.

As a growth investor I do like to see insider buying. But Ames National isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Ames National or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Ames National, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:ATLO

Ames National

Operates as a multi-bank holding company that provides banking products and services primarily in Boone, Clarke, Hancock, Marshall, Polk, Story, Taylor, and Union Counties in central, north-central, and south-central Iowa.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives