John Nelson has been the CEO of Ames National Corporation (NASDAQ:ATLO) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also assess whether Ames National pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Ames National

Comparing Ames National Corporation's CEO Compensation With the industry

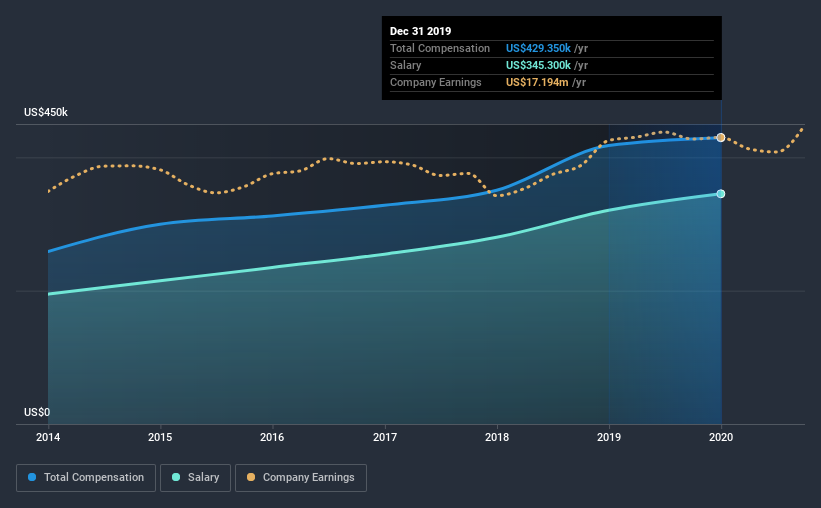

Our data indicates that Ames National Corporation has a market capitalization of US$196m, and total annual CEO compensation was reported as US$429k for the year to December 2019. That is, the compensation was roughly the same as last year. Notably, the salary which is US$345.3k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$832k. That is to say, John Nelson is paid under the industry median. Moreover, John Nelson also holds US$235k worth of Ames National stock directly under their own name.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$345k | US$321k | 80% |

| Other | US$84k | US$97k | 20% |

| Total Compensation | US$429k | US$418k | 100% |

Speaking on an industry level, nearly 43% of total compensation represents salary, while the remainder of 57% is other remuneration. Ames National pays out 80% of remuneration in the form of a salary, significantly higher than the industry average. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Ames National Corporation's Growth

Over the past three years, Ames National Corporation has seen its earnings per share (EPS) grow by 6.6% per year. It achieved revenue growth of 13% over the last year.

This revenue growth could really point to a brighter future. And, while modest, the EPS growth is noticeable. So while we'd stop just short of calling this a top performer, but we think it is well worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Ames National Corporation Been A Good Investment?

With a three year total loss of 15% for the shareholders, Ames National Corporation would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

As we touched on above, Ames National Corporation is currently paying its CEO below the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But then, EPS growth is lacking and so are the returns to shareholders. We're not critical of the remuneration John receives, but it would be good to see improved returns to shareholders before compensation grows too much.

Shareholders may want to check for free if Ames National insiders are buying or selling shares.

Switching gears from Ames National, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Ames National, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqCM:ATLO

Ames National

Operates as a multi-bank holding company that provides banking products and services primarily in Boone, Clarke, Hancock, Marshall, Polk, Story, and Union counties in central, north central, and south-central Iowa.

Flawless balance sheet second-rate dividend payer.