- United States

- /

- Auto

- /

- NYSE:ZK

ZEEKR (NYSE:ZK) Valuation in Focus as Investors Revisit Long-Term Growth Prospects

Reviewed by Simply Wall St

Most Popular Narrative: 23.6% Undervalued

According to the most widely followed narrative, ZEEKR Intelligent Technology Holding is considered substantially undervalued based on future growth prospects and operational progress.

The company’s strong innovation pipeline, specifically upcoming launches of premium models such as the Zeekr 9X and 8X with proprietary super electric hybrid technology and 900V fast charging, positions ZEEKR to capture increased demand as consumers globally shift towards high-tech, intelligent electric mobility. This trend is likely to drive revenue growth and improved vehicle margins in the coming quarters.

What is driving this eye-catching discount? There is a bold vision built into these numbers, with a significant bet on rapid expansion, improved margins, and a major pivot to profitability that few automakers attempt. Want to know what outsized forecasts and ambitious leaps underpin this unusually low fair value? Find out which surprisingly optimistic financial assumptions are fueling this undervaluation.

Result: Fair Value of $37.52 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rapid expansion and fierce competition worldwide could limit ZEEKR’s margins or slow international growth. This may challenge even the most optimistic forecasts.

Find out about the key risks to this ZEEKR Intelligent Technology Holding narrative.Another View: DCF Model Raises Questions

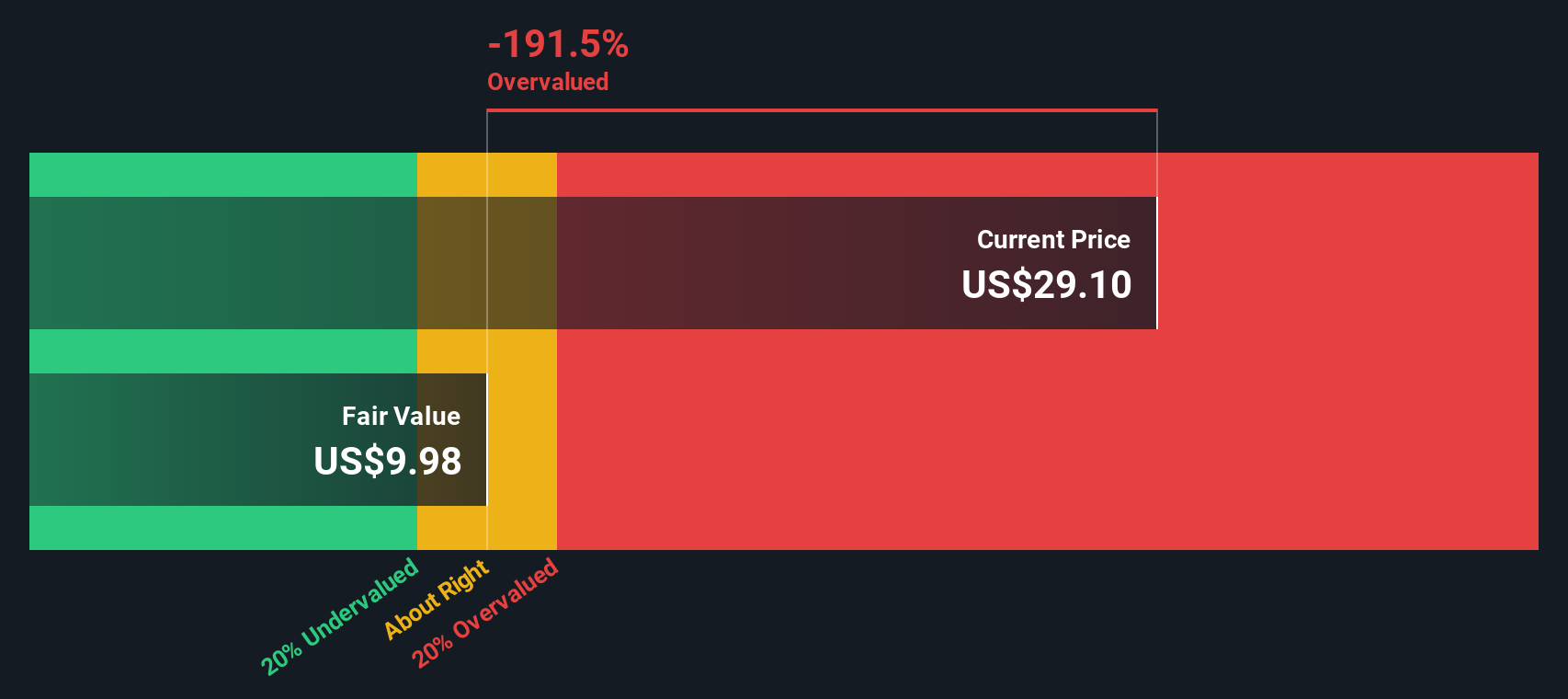

While analysts see strong upside based on future growth and market expansion, our SWS DCF model tells a very different story and suggests ZEEKR could be trading above its estimated fair value. Which approach lines up best with reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own ZEEKR Intelligent Technology Holding Narrative

If this perspective does not quite fit your view, or if you prefer digging into the figures yourself, you can build your own case for ZEEKR in just a few minutes with our tools, and Do it your way.

A great starting point for your ZEEKR Intelligent Technology Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let your research stop here. The best opportunities often hide just outside the spotlight, and with the right tools, you could spot them first.

- Seize the potential in fast-growing healthcare innovators shaking up medical technology, and get the inside track with healthcare AI stocks.

- Tap into undervalued companies whose share prices lag behind their true worth. Unlock new financial opportunities using undervalued stocks based on cash flows.

- Catch early trends among AI-focused trailblazers powering tomorrow’s smart industries. Start with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZEEKR Intelligent Technology Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ZK

ZEEKR Intelligent Technology Holding

An investment holding company, engages in the research and development, production, commercialization, and sale of the electric vehicles and batteries.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives