- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (XPEV) Is Up 7.0% After Record Q3 EV Deliveries and New Smart Tech Features

Reviewed by Sasha Jovanovic

- In September 2025, XPeng Inc. announced record deliveries of 41,581 Smart Electric Vehicles, a 95% year-over-year increase that pushed its third-quarter total to 116,007 units and first nine months' cumulative deliveries to 313,196.

- XPeng also unveiled new driver-assistance features, achieved a very high urban adoption rate for its ADAS technology, and maintained a top AAA ESG rating for the third straight year, highlighting progress in technology and sustainability.

- We'll examine how XPeng's record-breaking delivery growth and advanced smart features influence its investment narrative going forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

XPeng Investment Narrative Recap

To be an XPeng shareholder, one needs conviction in the company's ability to convert rapid delivery and revenue growth into sustainable profitability despite a fiercely competitive Chinese EV sector. The recent record deliveries reinforce XPeng's near-term momentum, benefitting the key catalyst of volume-driven margin improvement, but do not immediately resolve the largest risk, persistent net losses and uncertain path to profitability. Overall, while headline delivery growth is positive, it is not a material shift to the profit challenge that bears most on the stock’s investment case.

A particularly relevant announcement is XPeng’s August guidance projecting third-quarter revenues between CNY 19.6 billion and CNY 21.0 billion, closely matching the scale implied by the latest delivery results. This alignment signals operational follow-through, but investors should remain attentive to whether scale enables margin progression, given the risk from ongoing high costs and competitive pricing pressures.

By contrast, it’s important for shareholders to be aware that XPeng’s rapid growth comes alongside persistent operating losses and...

Read the full narrative on XPeng (it's free!)

XPeng's outlook anticipates CN¥137.4 billion in revenue and CN¥6.4 billion in earnings by 2028. This is based on an annual revenue growth rate of 31.6% and represents a CN¥10.7 billion increase in earnings from the current level of CN¥-4.3 billion.

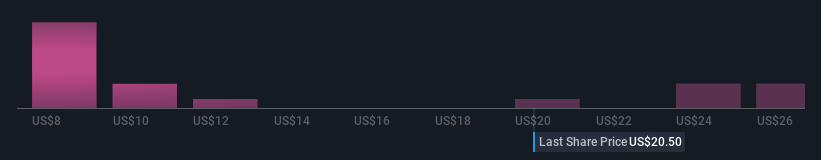

Uncover how XPeng's forecasts yield a $26.29 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Fifteen members of the Simply Wall St Community estimated XPeng’s fair value from CNY 9.23 to CNY 33.26 per share. While revenue is surging, sustained profitability remains a key debate for future performance, explore several viewpoints and decide where you stand.

Explore 15 other fair value estimates on XPeng - why the stock might be worth as much as 40% more than the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026