- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV) Sees 68% Price Surge Last Quarter on Promising Q4 Earnings

Reviewed by Simply Wall St

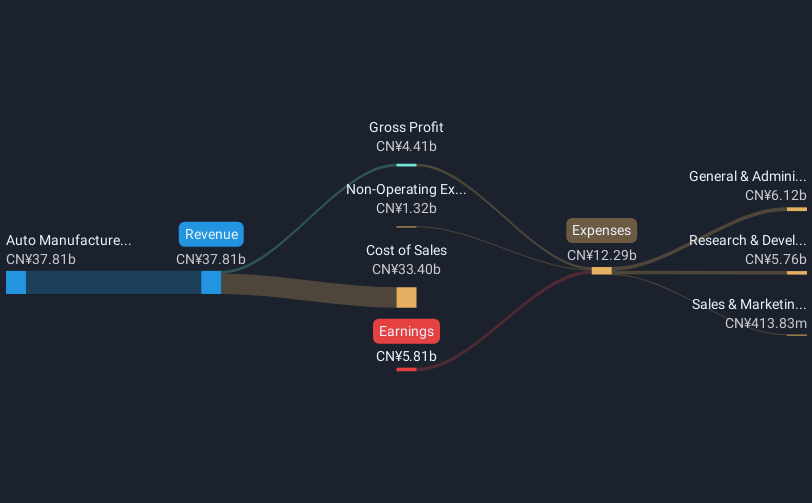

XPeng (NYSE:XPEV) recently revealed promising fourth-quarter earnings with revenues rising to CNY 16,105 million. The company has projected robust vehicle deliveries and revenue growth for the first quarter of 2025. February's delivery figures showed a significant increase, with 30,453 smart EVs delivered—a 570% growth year-over-year. Meanwhile, XPeng's expansion into European markets, including Switzerland and Poland, strengthens its international reach. These developments coincide with a broader rally in tech stocks, partially driven by easing concerns over U.S. tariffs. Collectively, these factors align with XPeng's impressive 68% price increase over the last quarter.

Buy, Hold or Sell XPeng? View our complete analysis and fair value estimate and you decide.

Over the past year, XPeng's total shareholder return, including share price appreciation and dividends, surged by an impressive 154.38%. This exceptional performance contrasts with the US Auto industry return of 33.4% and the broader market's 8.1%. Several factors have likely contributed to this success. Firstly, XPeng's aggressive international expansion, marked by entry into markets like Switzerland, the UK, and Poland, has enhanced global visibility and revenue streams. Significant vehicle delivery growth in early 2025 further amplified the company's appeal.

Additionally, advancements in XPeng's AI technologies and the development of the world's first AI-defined vehicle, the XPENG P7+, have positioned it at the forefront of technological innovation. This aligns with their strategy of frequent AI-driven product launches, underscoring their commitment to innovation. Despite a net loss last year, the surge in shareholder returns indicates strong investor confidence in XPeng's long-term growth trajectory amidst its rapid expansion and technological advancements.

Explore historical data to track XPeng's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives