- United States

- /

- Auto

- /

- NYSE:XPEV

XPeng (NYSE:XPEV): Assessing Valuation Following Record Q3 and September Vehicle Delivery Growth

Reviewed by Kshitija Bhandaru

XPeng (NYSE:XPEV) has reported record vehicle deliveries for September and the third quarter of 2025, achieving significant year-over-year growth and surpassing key delivery milestones in the electric vehicle sector.

See our latest analysis for XPeng.

XPeng’s latest record-setting deliveries have drawn attention, sparking renewed optimism in the company’s growth prospects. Over the past year, total shareholder returns have climbed 0.8%. Momentum has picked up meaningfully in recent months as XPeng continues to post sharp operational gains and enhance its technology offerings.

If you're keeping an eye on where innovation and growth are accelerating in the auto industry, don’t miss the opportunity to explore See the full list for free.

Yet with shares already boasting a near-doubling year-to-date and analyst targets only modestly higher, investors now face a crucial question: Is XPeng a bargain at current levels, or has the market already priced in all this explosive growth?

Most Popular Narrative: 12% Undervalued

With XPeng's last close at $23.07 and the most widely followed narrative estimating fair value at $26.29, the share price still trails the projected upside. This reflects ongoing investor bets on future transformation. This narrative channels optimism about XPeng moving beyond a pure EV maker as recurring software and partnership revenues begin to reshape the story.

Strategic collaborations, most notably with Volkswagen, are generating recurring IP/licensing revenue streams beyond vehicle sales and could be further monetized as XPeng's E/E architecture becomes foundational for more VW models (including ICE and PHEV). This may drive incremental high-margin revenue and support EPS growth.

Want to know how much recurring revenue these partnerships could unlock? The narrative’s future value hinges on software-driven margins, scale advantages, and a bold new profit profile. Don’t miss the financial projections that are surprising even industry insiders—see what’s fueling this ambitious target.

Result: Fair Value of $26.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing net losses and fierce domestic competition could curb XPeng’s profit momentum. This raises questions about the sustainability of its growth trajectory.

Find out about the key risks to this XPeng narrative.

Another View: Multiples vs. Market

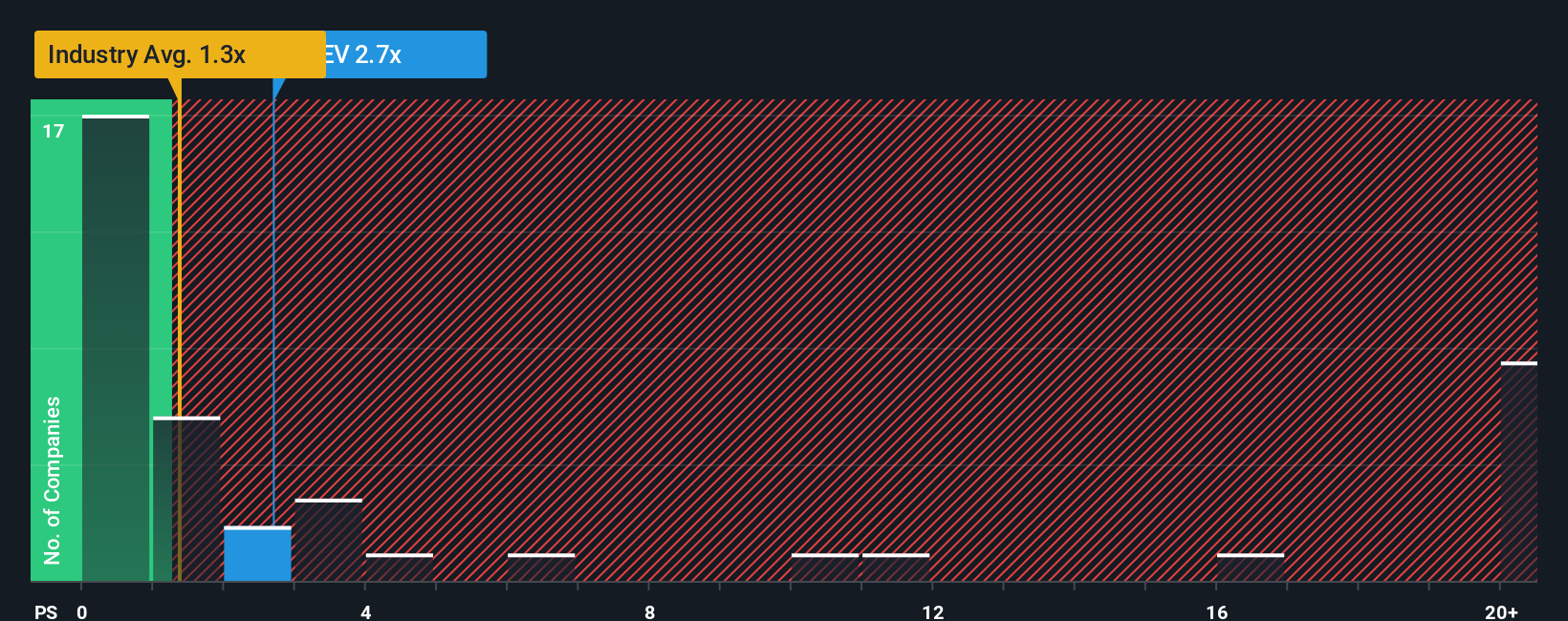

Looking through the lens of the price-to-sales ratio, XPeng is trading at 2.6 times sales, which is notably higher than the US Auto industry average of 1.4x and even above its fair ratio of 2.1x. Compared to peers, however, XPeng offers better value. Does this premium signal conviction in XPeng's growth, or does it add extra valuation risk if results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own XPeng Narrative

Keep in mind, if you see things differently or want to dive into the numbers firsthand, you can quickly craft your own perspective. Do it your way, Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding XPeng.

Looking for More Smart Investment Moves?

Don’t limit your search to just one company. If you want to catch the next breakout trend or uncover hidden gems, start using these powerful tools today. Miss them, and you could be missing the future of the market:

- Spot high-yield opportunities by scanning these 19 dividend stocks with yields > 3% that offer attractive returns and consistent payouts backed by solid fundamentals.

- Catch the wave of game-changing innovation by targeting companies at the forefront with these 24 AI penny stocks before the crowd catches on.

- Maximize your potential upside with these 896 undervalued stocks based on cash flows that analysts believe are trading well below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives