- United States

- /

- Auto

- /

- NYSE:XPEV

Why XPeng (XPEV) Is Up 7.0% After Record-Breaking Q3 Electric Vehicle Deliveries

Reviewed by Sasha Jovanovic

- XPeng Inc. announced it delivered a record 41,581 Smart Electric Vehicles in September 2025, a 95% year-over-year increase, with third-quarter deliveries reaching 116,007 units for a 149% annual rise.

- This surge positions XPeng as a leading force in the smart EV market, underlining both accelerating demand and the company’s ability to consistently scale production.

- We’ll explore how XPeng’s rapid delivery growth and milestone achievements may influence its investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

XPeng Investment Narrative Recap

For XPeng shareholders, the thesis centers on rapidly scaling EV deliveries, advancing proprietary AI technology, and capturing share both domestically and in new global markets. The record September and Q3 delivery figures reinforce strong top-line growth, a key near-term catalyst, but the impact on XPeng's path to profitability remains uncertain as persistent net losses and ambitious R&D spend continue to weigh on margins. Intense price competition still poses the largest risk, as higher sales alone may not guarantee better bottom-line results if cost pressures remain unrelieved.

Among XPeng's recent updates, the sustained expansion across European markets stands out. This aligns directly with one of the company's primary growth catalysts: diversifying revenue streams via international exposure, helping to mitigate reliance on the competitive Chinese market and supporting volume growth necessary for achieving future profitability milestones.

On the flip side, investors should be aware that record deliveries and overseas expansion do not fully address the ongoing challenge of...

Read the full narrative on XPeng (it's free!)

XPeng's outlook indicates revenues of CN¥137.4 billion and earnings of CN¥6.4 billion by 2028. This is based on an annual revenue growth rate of 31.6% and represents a CN¥10.7 billion increase in earnings from the current level of CN¥-4.3 billion.

Uncover how XPeng's forecasts yield a $26.29 fair value, a 10% upside to its current price.

Exploring Other Perspectives

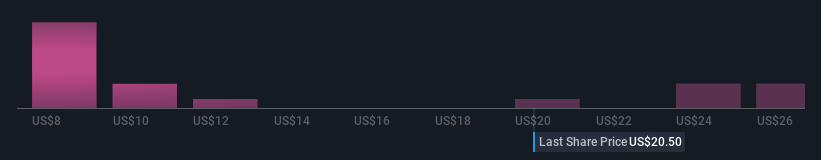

Fifteen estimates from the Simply Wall St Community place XPeng's fair value between US$9.23 and US$33.26 per share, highlighting pronounced disagreement. Even as global expansion gathers pace, the persistent risk of earnings losses could keep future returns uncertain, make sure to consider a range of perspectives before drawing conclusions.

Explore 15 other fair value estimates on XPeng - why the stock might be worth as much as 40% more than the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives