- United States

- /

- Auto

- /

- NYSE:XPEV

Are XPeng’s (XPEV) Rising November Deliveries Reinforcing Its Smart EV Scale‑Up Narrative?

Reviewed by Sasha Jovanovic

- XPeng Inc. has reported past delivery figures for November 2025, with 36,728 Smart EVs delivered for the month and year‑to‑date deliveries reaching 391,937 units, reflecting solid year‑over‑year growth in both metrics.

- This surge in monthly and cumulative deliveries highlights how XPeng’s current sales momentum may be interacting with its broader push into smart, software‑centric EVs.

- Next, we’ll examine how this strong November delivery performance shapes XPeng’s investment narrative around scaling smart EV volumes and profitability.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

XPeng Investment Narrative Recap

To own XPeng, you need to believe it can convert rapid Smart EV volume growth into a sustainable, profitable software‑centric business. November’s 36,728 deliveries and 156% year‑to‑date growth support the near term volume scaling catalyst but do not fully resolve the key risk that XPeng is still loss‑making, with negative net margins and ongoing heavy investment needs.

The most relevant recent announcement here is XPeng’s Q4 2025 delivery and revenue guidance, which points to continued high growth in unit volumes and sales. When set alongside November’s strong delivery data, this guidance reinforces the central catalyst of scaling Smart EV volumes, while also reminding investors that high capital requirements and price competition could still weigh on the path to break‑even.

However, investors should also be aware that XPeng’s pursuit of scale comes with ongoing dilution and profitability pressures that...

Read the full narrative on XPeng (it's free!)

XPeng's narrative projects CN¥137.4 billion revenue and CN¥6.4 billion earnings by 2028.

Uncover how XPeng's forecasts yield a $28.24 fair value, a 41% upside to its current price.

Exploring Other Perspectives

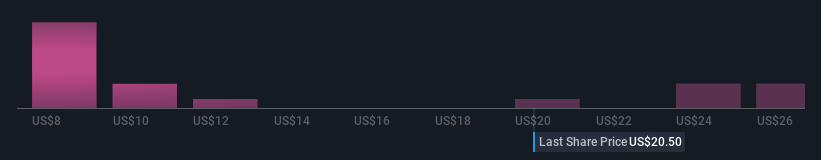

Simply Wall St Community members have 15 fair value estimates for XPeng, ranging from US$9.86 to US$33.26, underscoring how far opinions can diverge. Against this wide spread, the central question remains whether recent delivery momentum can offset persistent losses and intense EV price competition, so it is worth weighing several of these perspectives before forming your own view.

Explore 15 other fair value estimates on XPeng - why the stock might be worth as much as 66% more than the current price!

Build Your Own XPeng Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPeng research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free XPeng research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPeng's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:XPEV

XPeng

Designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People’s Republic of China.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026