- United States

- /

- Auto

- /

- NYSE:THO

THOR Industries (THO): Assessing Valuation After Strong Q4 Earnings, 2026 Outlook, and New Electric RV Launch

Reviewed by Kshitija Bhandaru

THOR Industries reported quarterly results that caught the market’s attention, as net income and earnings per share increased compared to last year. The company also shared its 2026 sales and earnings outlook.

See our latest analysis for THOR Industries.

THOR Industries' stronger-than-anticipated fourth quarter earnings, fresh 2026 guidance, and ongoing buybacks have all kept the spotlight on the stock. The recent launch of its innovative electric motorhome has also drawn attention. This run of activity has contributed to building positive momentum: the latest 1-year total shareholder return came in at 0.6%, while the stock has delivered an impressive 56% total return over three years.

If you’re tracking momentum in the auto sector or hunting for the next breakthrough, now’s a great moment to discover See the full list for free.

With shares delivering solid multi-year returns and investor enthusiasm running high after THOR Industries’ latest results and product innovations, the pressing question is whether the current price reflects all future upside or if a genuine buying opportunity remains.

Price-to-Earnings of 21.5x: Is it justified?

THOR Industries is currently trading at a price-to-earnings (P/E) ratio of 21.5x. This places it well above both its peer group average and the broader global auto sector. The current share price of $105.72 outpaces the valuation that peers and historical benchmarks suggest should apply.

The price-to-earnings (P/E) ratio reveals how much investors are paying for $1 of a company's earnings. For an automaker like THOR Industries, it is a key metric, given the sector’s cyclical nature and focus on steady, reliable profit streams.

Right now, the market is pricing THOR Industries at a premium. Its P/E is significantly higher than the peer average of 15.3x and also surpasses the global auto industry average of 17.9x. This suggests investors expect relatively stronger growth or more resilient profitability. However, compared to our estimated fair P/E of 15.4x, THOR still appears overvalued, as the current multiple outpaces what historical and sector models would typically support.

Explore the SWS fair ratio for THOR Industries

Result: Price-to-Earnings of 21.5x (OVERVALUED)

However, ongoing market volatility, or a slowdown in revenue and net income growth, could quickly challenge the upbeat outlook that is currently driving investor enthusiasm.

Find out about the key risks to this THOR Industries narrative.

Another View: Discounted Cash Flow

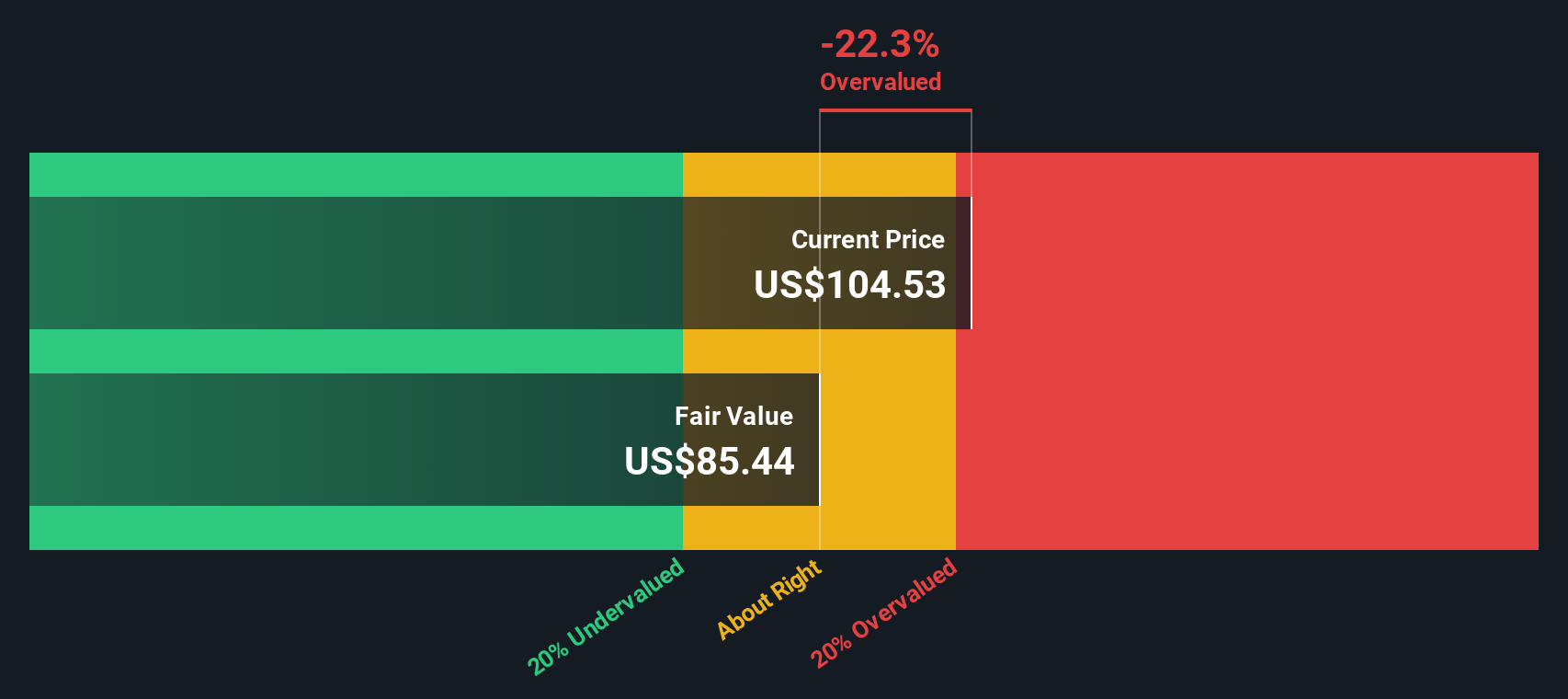

Looking from another angle, the SWS DCF model suggests that THOR Industries is trading at a premium to its estimated intrinsic value. Shares are at $105.72, while the calculated fair value stands at $85.22. This DCF approach points to the stock being overvalued right now. Is the market optimism outpacing the company’s fundamentals, or could growth expectations still prove DCF models too conservative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out THOR Industries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own THOR Industries Narrative

If you have your own perspective or want to dig into the numbers yourself, you can shape your story in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding THOR Industries.

Looking for more investment ideas?

Unlock fresh opportunities and stay ahead by targeting fast-moving trends and top-performing stocks. Don’t wait until everyone else catches on.

- Capture the potential of market newcomers by scanning these 3569 penny stocks with strong financials, which have strong financials that set them apart from the rest.

- Tap into the future of medicine and technology through these 31 healthcare AI stocks, where breakthroughs are happening at the intersection of health and artificial intelligence.

- Grow your passive income by selecting from these 19 dividend stocks with yields > 3%, which reliably deliver yields greater than 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if THOR Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:THO

THOR Industries

Designs, manufactures, and sells recreational vehicles (RVs), and related parts and accessories in the United States, Germany, rest of Europe, Canada, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives