- United States

- /

- Auto

- /

- NYSE:RACE

Ferrari (NYSE:RACE): Has the Recent Share Price Pullback Opened a Valuation Opportunity?

Reviewed by Simply Wall St

Ferrari (RACE) has quietly drifted lower over the past 3 months, even as revenue and net income keep growing at mid single digit rates. That disconnect is where the current opportunity debate starts.

See our latest analysis for Ferrari.

Over the past year, Ferrari’s share price return has cooled as investors reassess how much to pay for its premium growth, even though the stock still boasts a strong multi year total shareholder return that reflects its enduring brand power.

If this kind of rerating has you thinking about what else might be interesting in autos, it is worth scanning other auto manufacturers to see how Ferrari’s peers are priced and growing.

With shares down double digits over the past year despite steady mid single digit growth and a sizeable gap to analyst targets, is Ferrari quietly slipping into undervalued territory, or is the market already pricing in every lap of future expansion?

Most Popular Narrative: 13.7% Undervalued

Based on the most followed narrative, Ferrari’s fair value sits above the last close of $393.84, suggesting the recent share price pullback may be overstating near term worries.

Ferrari's expansion of infrastructure and product offerings, including the new e-building and paint shop for enhanced personalization, is expected to increase production flexibility, supporting revenue growth and improved net margins through operational efficiencies.

Want to see why steady revenue gains, rising margins and shrinking share count still justify a rich future earnings multiple? The full narrative reveals the exact growth, profitability and valuation assumptions behind that premium fair value call.

Result: Fair Value of $456.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup could unravel if new model launches dilute Ferrari’s exclusivity, or if supply and macro headwinds squeeze margins more than expected.

Find out about the key risks to this Ferrari narrative.

Another View: Rich Multiples Signal Caution

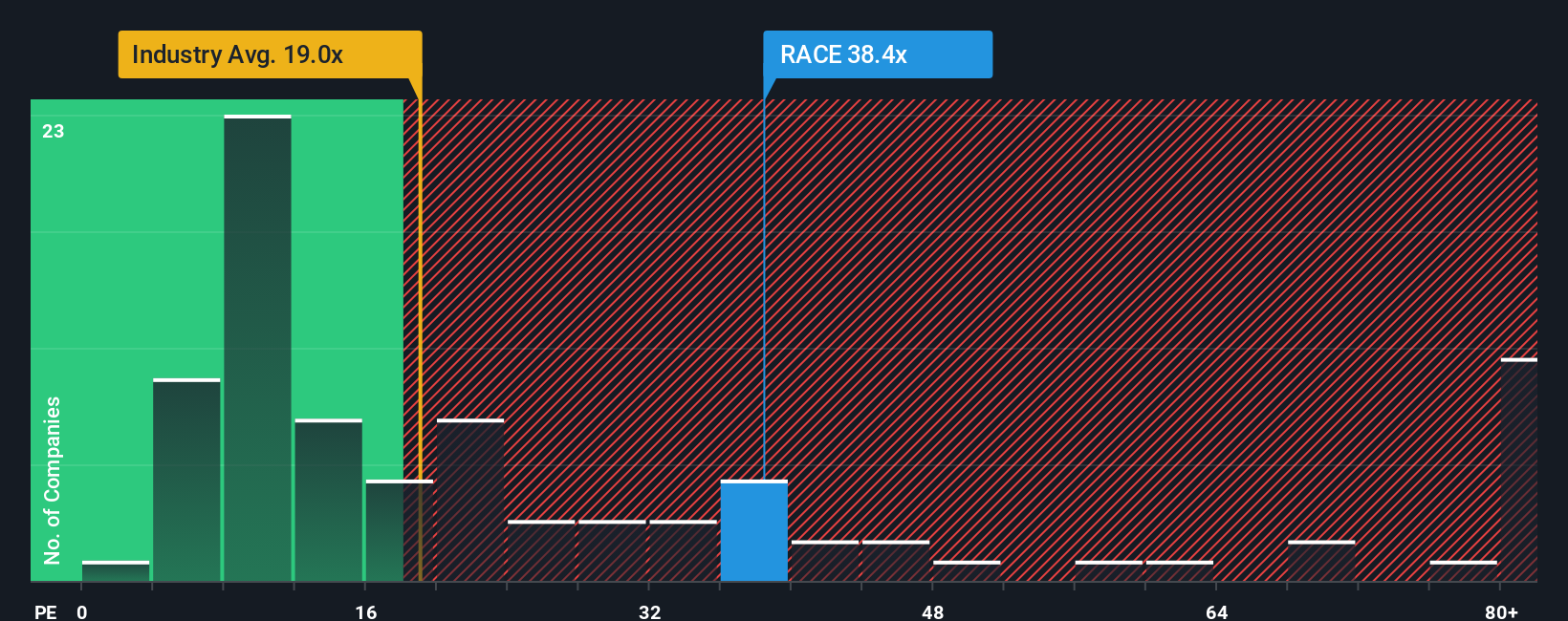

Step away from narratives and Ferrari looks pricey on simple earnings math. The stock trades on a 37.7x P/E versus 18.2x for both the global Auto industry and peers, while our fair ratio sits at just 17.1x. Is this a moat, or just multiple risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ferrari Narrative

If you see things differently or would rather dive into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Ferrari.

Ready for more investment ideas?

Do not stop at Ferrari. Line up your next move with ideas tailored to different strategies, before other investors get there first.

- Explore potential mispricing by scanning these 912 undervalued stocks based on cash flows that combine solid fundamentals with valuations the market may be overlooking.

- Look for structural growth by targeting these 30 healthcare AI stocks that use data, automation, and innovation to reshape patient outcomes and healthcare efficiency.

- Follow cutting edge trends by tracking these 81 cryptocurrency and blockchain stocks focused on digital assets, blockchain infrastructure, and next generation payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026