- United States

- /

- Auto

- /

- NYSE:RACE

30%of this Ferrari N.V. (NYSE:RACE) insider's holdings were sold in the last year

Insiders were net sellers of Ferrari N.V.'s (NYSE:RACE ) stock during the past year. That is, insiders sold more stock than they bought.

While insider transactions are not the most important thing when it comes to long-term investing, we would consider it foolish to ignore insider transactions altogether.

See our latest analysis for Ferrari

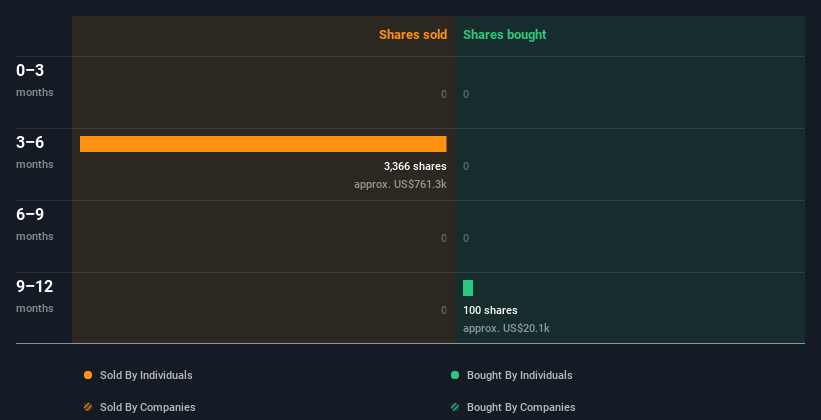

Ferrari Insider Transactions Over The Last Year

In the last twelve months, the biggest single sale by an insider was when the CEO & Executive Director, Benedetto Vigna, sold US$761k worth of shares at a price of US$226 per share. That means that an insider was selling shares at slightly below the current price (US$264). When an insider sells below the current price, it suggests that they considered that lower price to be fair. That makes us wonder what they think of the (higher) recent valuation. Please do note, however, that sellers may have a variety of reasons for selling, so we don't know for sure what they think of the stock price. This single sale was just 30% of Benedetto Vigna's stake. Benedetto Vigna was the only individual insider to sell shares in the last twelve months.

The chart below shows insider transactions (by companies and individuals) over the last year. By clicking on the graph below, you can see the precise details of each insider transaction!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Does Ferrari Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Ferrari insiders own about US$5.0b worth of shares (which is 10% of the company). I like to see this level of insider ownership, because it increases the chances that management are thinking about the best interests of shareholders.

So What Does This Data Suggest About Ferrari Insiders?

It doesn't really mean much that no insider has traded Ferrari shares in the last quarter. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Ferrari insider transactions don't fill us with confidence. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Ferrari. In terms of investment risks, we've identified 1 warning sign with Ferrari and understanding this should be part of your investment process.

But note: Ferrari may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RACE

Ferrari

Through its subsidiaries, engages in design, engineering, production, and sale of luxury performance sports cars worldwide.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives