- United States

- /

- Auto

- /

- NYSE:NIO

How GIC’s Lawsuit Over Revenue Recognition at NIO (NIO) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Earlier this week, Singapore’s sovereign wealth fund GIC filed a lawsuit against NIO, alleging the automaker unlawfully recognized battery lease revenue through a related party, raising concerns over financial transparency.

- This legal dispute comes as NIO reports two consecutive months of record electric vehicle deliveries and significantly ramps up production capacity with new models and factory expansions.

- We'll consider how the new legal risks surrounding revenue recognition could influence NIO's investment narrative and market outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

NIO Investment Narrative Recap

The core investment case for NIO rests on the belief that scale-driven delivery growth, ongoing new model launches, and innovation in EV technology can eventually tip the company toward profitability. The recent GIC lawsuit over alleged revenue misreporting introduces new uncertainty, bringing financial transparency and governance into sharper focus. For now, this legal action could be a material short-term risk if it affects investor confidence or impacts NIO's ability to raise capital, though near-term catalysts like record deliveries may remain firmly in play.

Among recent announcements, NIO's achievement of two consecutive months of record electric vehicle deliveries stands out, as it underscores the company's operational momentum despite intensifying scrutiny around its accounting. This milestone aligns with the company’s expansion of production capacity through multiple brands, which is central to its strategy of driving volume growth and broadening its market presence in the premium and mass-market segments.

However, while delivery numbers rise, investors should not overlook the very real risks emerging from growing legal and financial scrutiny...

Read the full narrative on NIO (it's free!)

NIO's narrative projects CN¥148.4 billion revenue and CN¥7.5 billion earnings by 2028. This requires 28.8% yearly revenue growth and a CN¥31.8 billion earnings increase from the current CN¥-24.3 billion.

Uncover how NIO's forecasts yield a $6.79 fair value, a 4% downside to its current price.

Exploring Other Perspectives

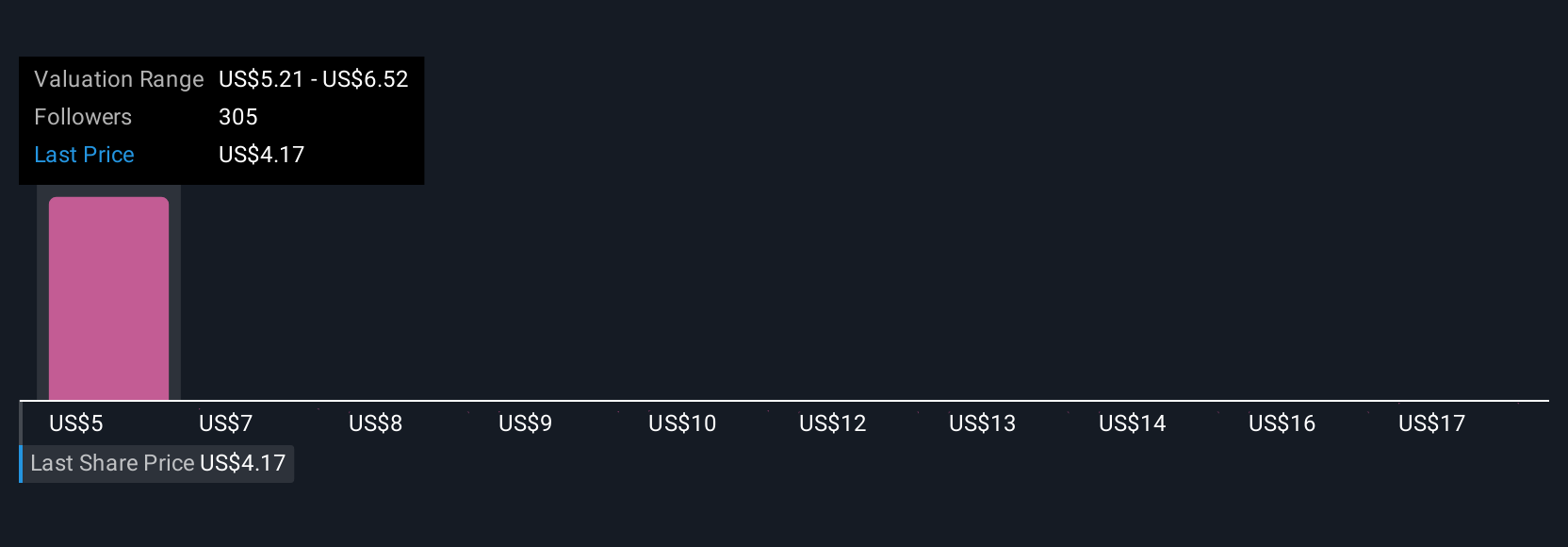

Twenty-one members of the Simply Wall St Community tagged NIO’s fair value from US$4.15 to US$18.27 per share. That breadth of expectation stands beside key risks to financial transparency that could have broad implications for future performance; consider how such diverse viewpoints could shape your own research.

Explore 21 other fair value estimates on NIO - why the stock might be worth 41% less than the current price!

Build Your Own NIO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NIO research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free NIO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NIO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if NIO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NIO

NIO

Designs, develops, manufactures, and sells smart electric vehicles in China, Europe, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion