- United States

- /

- Building

- /

- NYSE:MOD

Modine Manufacturing (MOD): Assessing Valuation After Launch of EdgeDX and EdgeAire for Data Center Growth

Reviewed by Simply Wall St

Most Popular Narrative: 13.3% Undervalued

According to the most widely followed narrative, Modine Manufacturing's current share price is seen as undervalued by 13.3% relative to a consensus fair value. The latest projections suggest there is meaningful upside potential, based on assumptions about revenue growth, profit margins, and sector positioning.

The accelerating build-out of data centers and the need for next-generation cooling solutions are driving extraordinary demand for Modine's products. Management is forecasting the potential to double data center revenues from approximately $1 billion in fiscal '26 to $2 billion by fiscal '28. This structural demand from digital infrastructure is set to materially boost revenue growth and deliver significant operating leverage over time.

Want to see what is fueling these bold projections? The fair value here hinges on expected growth rates and margin leaps that could turn industry heads. Wonder how fast Modine’s numbers might climb, and what future multiple is being penciled in? Find out why this valuation is turning analyst heads and what surprises might be baked into their forecasts.

Result: Fair Value of $160 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, execution risks from integrating acquisitions or a slowdown in data center demand could interrupt Modine's high-growth outlook and could also moderate its future returns.

Find out about the key risks to this Modine Manufacturing narrative.Another Perspective: Is the Market Missing Something?

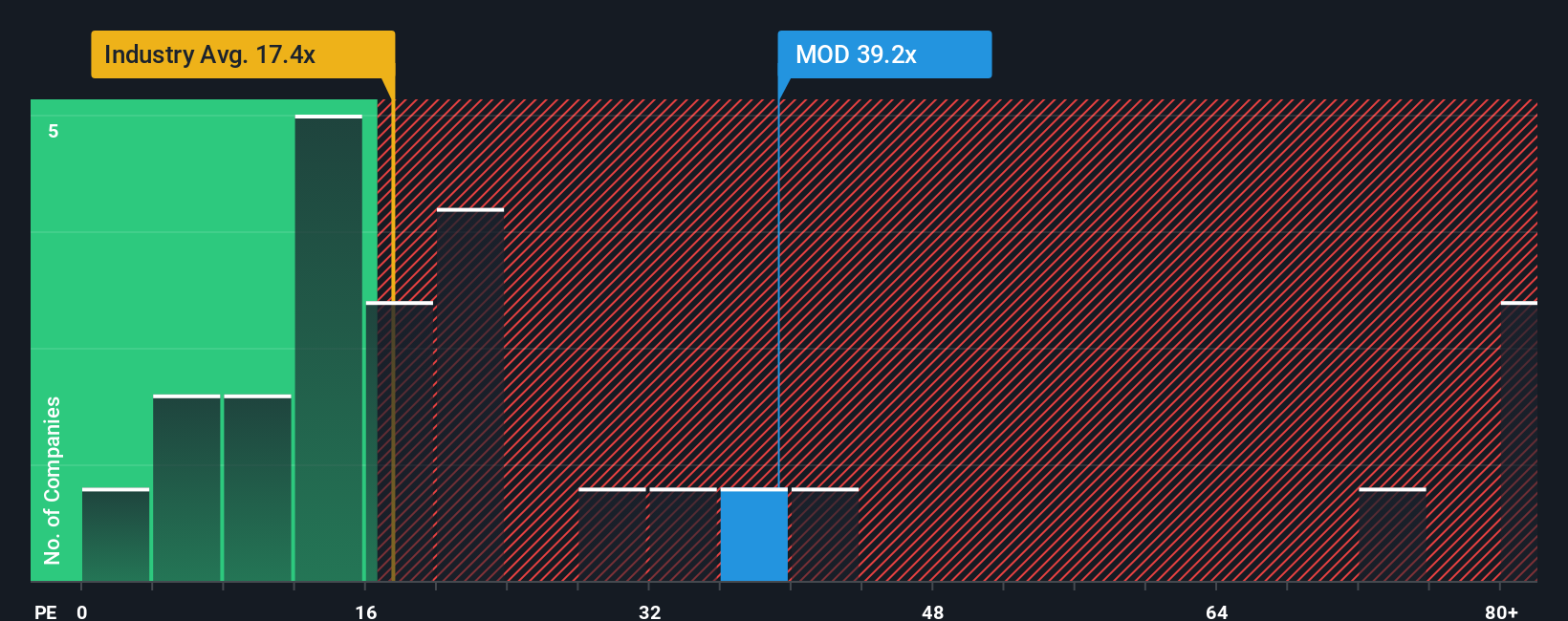

A second look using the earnings multiple points to Modine Manufacturing trading at a higher level than the wider auto components sector. This finding stands in contrast to the earlier undervalued view. Could the growth story justify this premium? Alternatively, are investors overlooking real risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Modine Manufacturing Narrative

If your viewpoint differs or you want to dig into the numbers on your own terms, there’s nothing stopping you from sketching out a custom narrative in just a few minutes: Do it your way.

A great starting point for your Modine Manufacturing research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait for the market to pass you by. Find high-potential stocks that fit your goals using our hand-picked screens. These are the opportunities savvy investors won't want to overlook.

- Uncover stocks trading well below their fair value by using our list of undervalued stocks based on cash flows for the chance to spot tomorrow’s winners today.

- Catch the next breakout in artificial intelligence as you review companies shaking up the industry with AI penny stocks and leading the charge in machine learning innovation.

- Secure your portfolio’s income with our top picks of dividend stocks with yields > 3% that boast yields above 3% and reliable payout histories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:MOD

Modine Manufacturing

Designs, engineers, tests, manufactures, and sells mission-critical thermal solutions in the United States, Canada, Italy, Hungary, the United Kingdom, China, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion