- United States

- /

- Banks

- /

- NasdaqGS:LKFN

June 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

As the United States stock market experiences a slight uptick with major indices like the S&P 500 and Nasdaq Composite reaching their highest levels since February, investors are keenly watching developments in U.S.-China trade talks. In this context, dividend stocks continue to attract attention for their potential to provide steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Valley National Bancorp (VLY) | 4.92% | ★★★★★☆ |

| Universal (UVV) | 5.39% | ★★★★★★ |

| Southside Bancshares (SBSI) | 5.05% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.75% | ★★★★★★ |

| Ennis (EBF) | 5.36% | ★★★★★★ |

| Dillard's (DDS) | 6.45% | ★★★★★★ |

| CompX International (CIX) | 5.01% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.00% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.97% | ★★★★★☆ |

| Chevron (CVX) | 4.86% | ★★★★★★ |

Click here to see the full list of 143 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

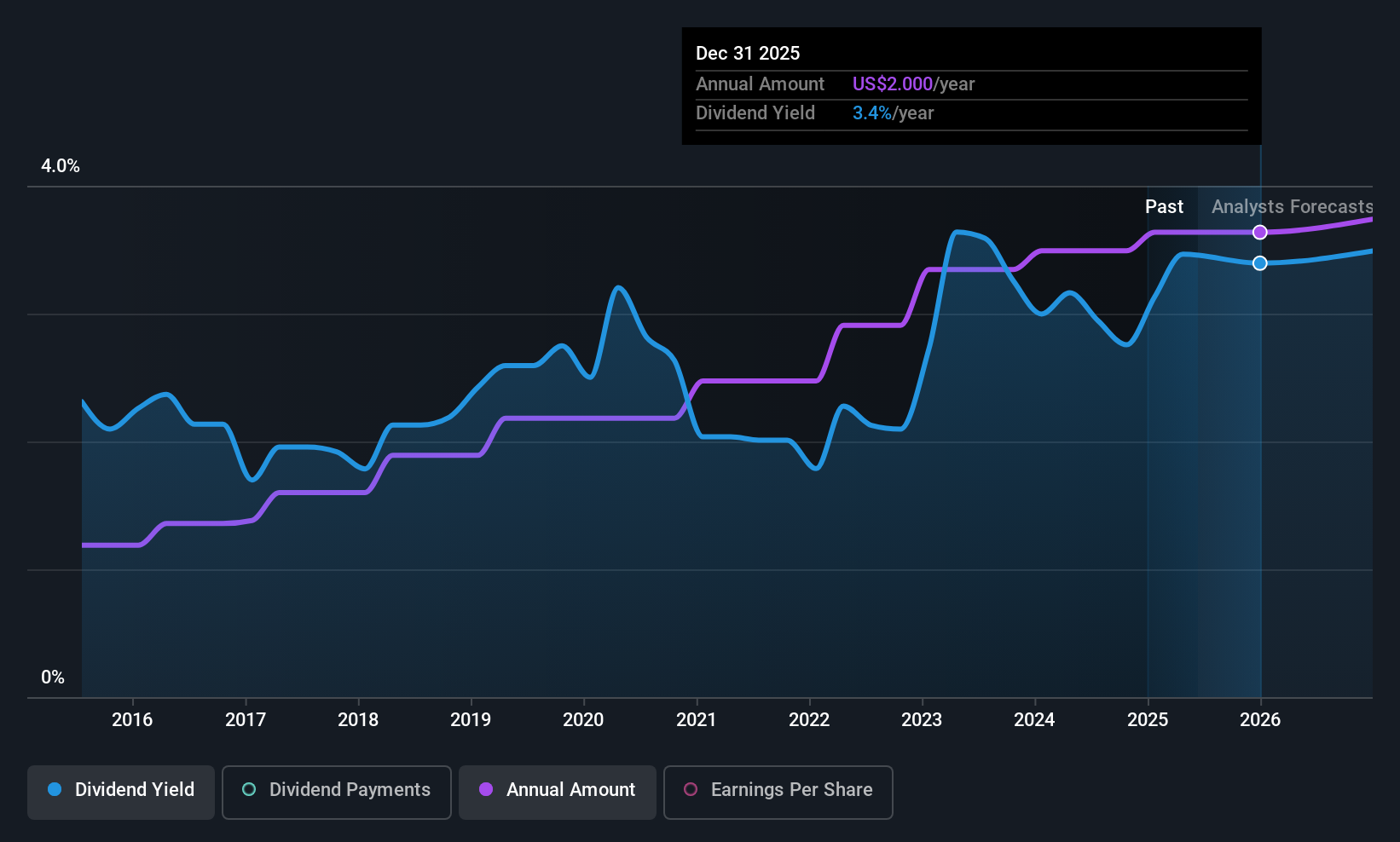

Lakeland Financial (LKFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lakeland Financial Corporation is the bank holding company for Lake City Bank, offering a range of banking products and services in the United States with a market cap of $1.54 billion.

Operations: Lakeland Financial Corporation generates revenue primarily through its Financial Services segment, which amounts to $236.27 million.

Dividend Yield: 3.3%

Lakeland Financial offers a stable dividend history with consistent growth over the past decade, supported by a reasonable payout ratio of 55.8%. Despite its reliability, the current dividend yield of 3.28% is below the top quartile of US market payers. Recent earnings showed a decline in net income to US$20.09 million for Q1 2025, which may impact future payouts if trends persist. Board appointments could influence strategic directions affecting dividends long-term.

- Delve into the full analysis dividend report here for a deeper understanding of Lakeland Financial.

- Our comprehensive valuation report raises the possibility that Lakeland Financial is priced higher than what may be justified by its financials.

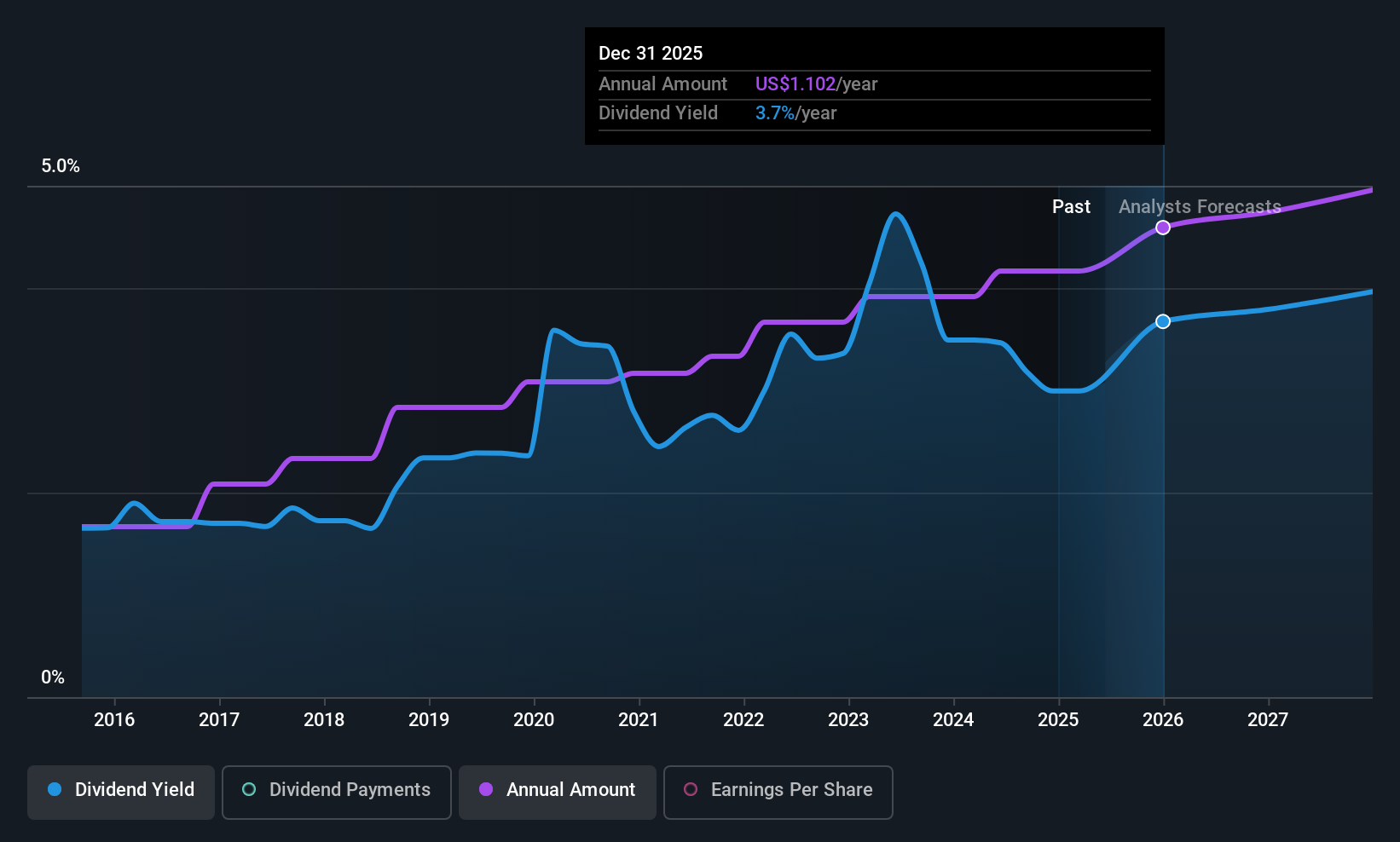

Cadence Bank (CADE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cadence Bank offers commercial banking and financial services across the United States, with a market capitalization of approximately $5.75 billion.

Operations: Cadence Bank's revenue is primarily derived from its Community Banking segment at $1.19 billion, followed by Corporate Banking at $488.84 million, Banking Services at $143.76 million, and Mortgage services contributing $104.39 million.

Dividend Yield: 3.5%

Cadence Bank maintains a stable dividend history with consistent growth over the past decade, supported by a low payout ratio of 35.4%, indicating sustainability. The current yield of 3.54% falls short compared to top-tier US dividend payers. Recent earnings show net income rising to US$133.22 million in Q1 2025, suggesting robust financial health. A share repurchase program announced in April may enhance shareholder value but requires regulatory approval before proceeding.

- Take a closer look at Cadence Bank's potential here in our dividend report.

- The valuation report we've compiled suggests that Cadence Bank's current price could be quite moderate.

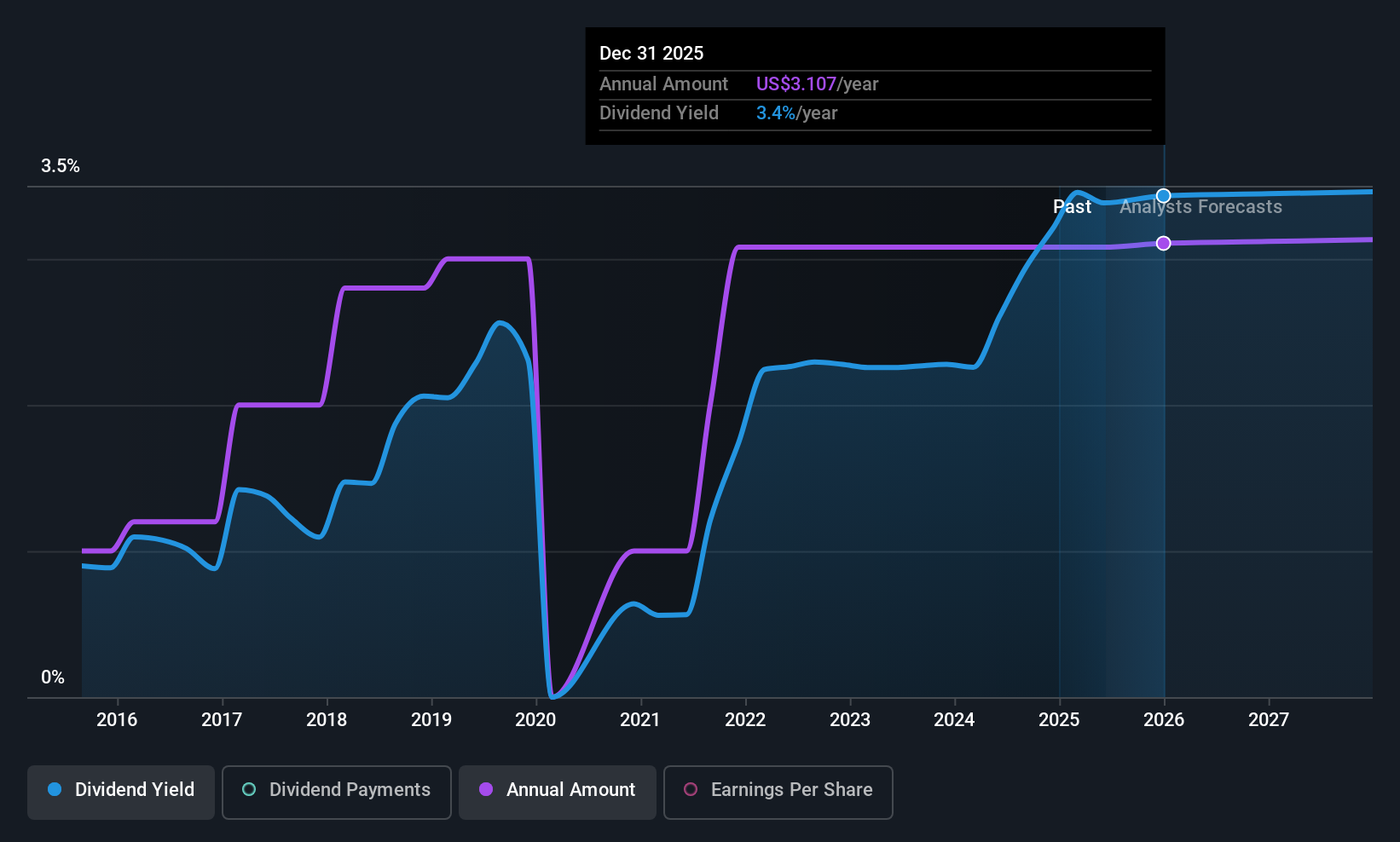

Lear (LEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Lear Corporation designs, develops, engineers, manufactures, assembles, and supplies automotive seating and electrical distribution systems for original equipment manufacturers across multiple continents with a market cap of approximately $4.73 billion.

Operations: Lear Corporation's revenue is primarily derived from its Seating segment, which generated $16.90 billion, and its e-Systems segment, which contributed $5.98 billion.

Dividend Yield: 3.4%

Lear Corporation's dividend payments have been volatile over the past decade, though recent affirmations maintain a quarterly payout of $0.77 per share. Despite a low payout ratio of 35.7%, indicating earnings and cash flow coverage, the dividend yield of 3.41% lags behind top-tier US payers. Recent Q1 2025 results show declining sales and net income, while significant share buybacks totaling $4.11 billion may bolster shareholder value amidst financial challenges and high debt levels.

- Get an in-depth perspective on Lear's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Lear is priced lower than what may be justified by its financials.

Seize The Opportunity

- Access the full spectrum of 143 Top US Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LKFN

Lakeland Financial

Operates as the bank holding company for Lake City Bank that provides various banking products and services in the United States.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives