- United States

- /

- Auto

- /

- NYSE:GM

General Motors (NYSE:GM) Appoints Duncan Aldred As New North America President

Reviewed by Simply Wall St

General Motors (NYSE:GM) experienced a 2.9% price increase over the past month, potentially buoyed by significant corporate events. The promotion of Duncan Aldred to Senior Vice President and President of North America marks a crucial leadership change, aligning with GM's strategic growth vision. Additionally, the company's Q1 earnings report disclosed increased revenue and basic EPS, coupled with a higher quarterly dividend, which may have contributed positively to investor sentiment. Concurrently, GM's recent debt financing activity via fixed-rate notes provides financial flexibility. These developments unfold amid mixed market trading, as investors focus on trade discussions and Fed rate decisions.

We've identified 3 weaknesses for General Motors (2 can't be ignored) that you should be aware of.

The recent advancements at General Motors, including the leadership change and enhanced financial flexibility through debt financing, are set to impact the company's growth narrative positively. With the expansion of GM's EV portfolio and Super Cruise technology, these changes support the firm's efforts to streamline operations and bolster profitability. Over the past five years, GM's total shareholder return, including share price appreciation and dividends, was 107.24%, highlighting substantial investor gains. However, over the last year, GM underperformed the US Auto industry, which returned 41.4%, indicating recent challenges despite longer-term gains.

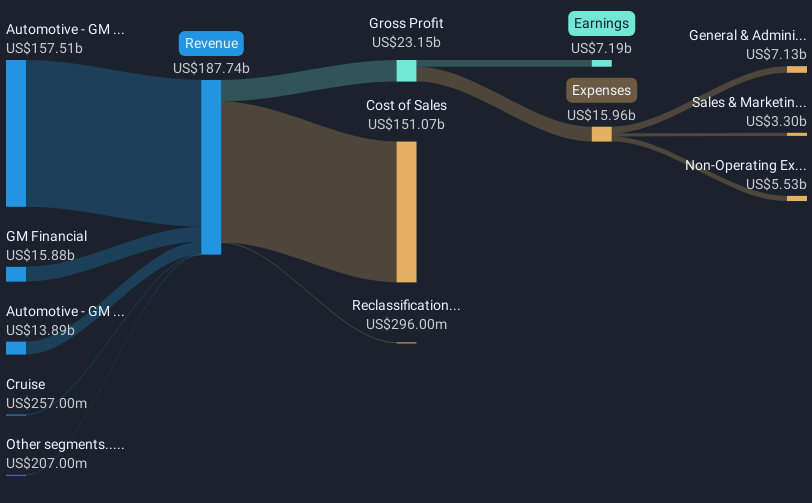

The company's strategic focus on electric vehicles and operational enhancements suggest potential improvements in future revenue streams and cost efficiencies, aiding earnings forecasts. The revenue, at US$188.45 billion, and earnings growth targets rely heavily on these initiatives taking effect. While GM has shown a 2.9% share price increase recently, the current price of US$46.94 remains an 15.8% discount from the analyst consensus price target of US$55.74. This suggests market optimism about GM's ability to enhance profitability and meet future targets, although investors should consider aligning these estimates with their own expectations.

Evaluate General Motors' historical performance by accessing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives