- United States

- /

- Auto

- /

- NYSE:GM

General Motors (NYSE:GM) Announces US$2 Billion Fixed-Income Offering With New Co-Lead Underwriters

Reviewed by Simply Wall St

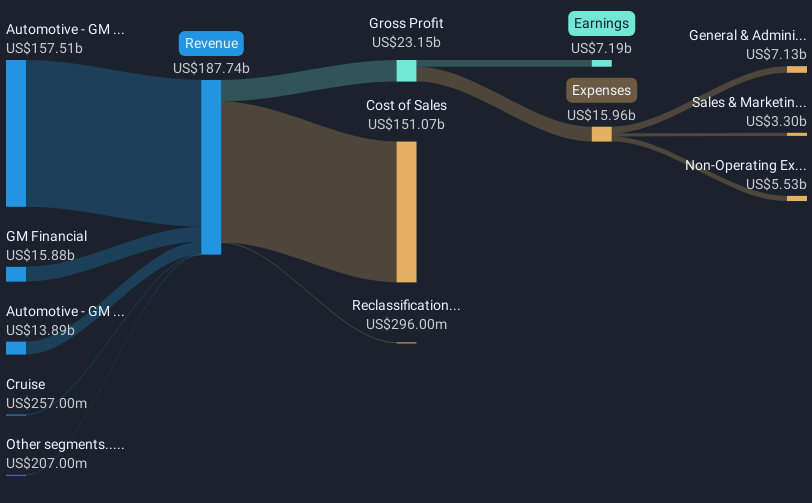

General Motors (NYSE:GM) recently expanded the co-lead underwriters for its $750 million fixed-income offering, a move aligned with its ongoing debt strategy. The company also raised $2 billion in senior unsecured fixed-rate notes to refinance existing debt and fund its venture with Ultium Cells LLC. Despite the market's mixed performance amid tariff concerns and awaiting Fed decisions, GM's shares rose 2.7% over the last month. This growth aligns with market trends, where the Dow Jones declined slightly, yet the news of strengthened debt structures may have provided added confidence to investors.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

The recent expansion by General Motors in its debt strategy, including the $750 million fixed-income offering, aligns with its ongoing focus on enhancing financial flexibility. This move is integral to the company's narrative of optimizing its operations, particularly in the face of profit margin pressures and restructuring efforts in international markets like China. Shareholders have seen a substantial total return of 104.70% over five years, a significant performance when evaluating long-term shareholder value despite recent underperformance against the US Auto industry and market over the past year.

In light of these developments, the latest initiatives could bolster GM's revenue and earnings forecasts. The decision to refinance debt and redirect funds towards joint ventures signals a commitment to strengthening future cash flows and profitability, potentially improving the current forecasted earnings of $7.8 billion by April 2028. With a consensus price target of $55.74, current price movements reflecting a 15.8% discount indicate potential for upside, assuming the company's execution aligns with market expectations on cost reductions and EV portfolio expansion. The price target suggests room for further appreciation in share value should the company meet or exceed its strategic and financial objectives.

Dive into the specifics of General Motors here with our thorough balance sheet health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GM

General Motors

Designs, builds, and sells trucks, crossovers, cars, and automobile parts worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives